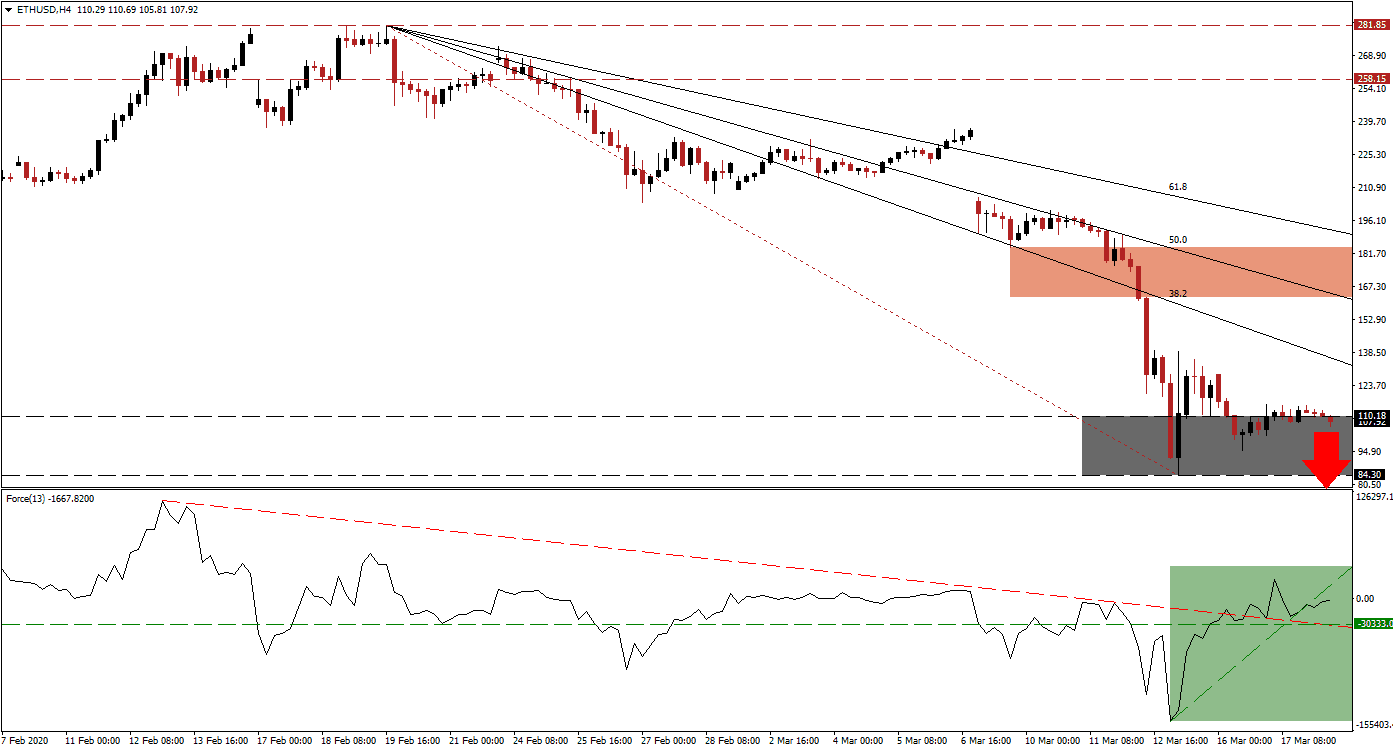

While financial markets are faced with the most significant stress since the global financial crisis of 2008, the cryptocurrency sector is trapped in the middle of capital outflows. Many initial adopters inaccurately praised the sector as disconnected from traditional finance. The introduction of institutional capital resulted in the sector crash of 2017, followed by the Crypto Winter of 2018, and the 2019 recovery. Institutional outflows have now collapsed the market once again. The ETH/USD failed to maintain the breakout above its support zone, and bearish pressures are mounting.

The Force Index, a next-generation technical indicator, was able to recover off of a new 2020 low, which allowed for the conversion of its horizontal resistance level into support. It additionally elevated the Force Index above its descending resistance level, now turned into temporary support, as marked by the green rectangle. Bears remain in control of the ETH/USD with this technical indicator in negative territory and below its ascending support level. You can learn more about the Force Index here.

This cryptocurrency pair experienced a minor technical recovery but has since reversed its breakout. The descending Fibonacci Retracement Fan sequence is adding to downside pressures on the ETH/USD. More institutional selling is anticipated as fund managers rush to raise capital by exiting non-core holdings to meet margin calls, adding to the downward spiral across the cryptocurrency sector. The short-term resistance zone, located between 162.68 and 184.66, as marked by the red rectangle, will continue to be lowered to reflect fundamental developments.

Price action retreated into its support zone located between 84.30 and 110.18, as marked by the grey rectangle. Ethereum miners, who ensure the network is operational and secure, are now operating at a financial loss. It will result in a hashrate contraction, dragging price action down with it. A breakdown is expected to extend the correction with a new wave of sell orders. The next support zone awaits the ETH/USD between 53.60 and 70.24, dating back to March 2017 before the cryptocurrency bubble formed. You can learn more about a breakdown here.

ETH/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 107.00

Take Profit @ 65.00

Stop Loss @ 120.50

Downside Potential: 4,200 pips

Upside Risk: 1,350 pips

Risk/Reward Ratio: 3.11

In the event of a sustained breakout in the Force Index above its ascending support level, the ETH/USD could experience a short-covering rally. The upside potential is limited to its descending 50.0 Fibonacci Retracement Fan Resistance Level, which crossed below its short-term resistance zone. With a global recession looming and more selling across equity markets, any spike in price action should be considered an outstanding selling opportunity.

ETH/USD Technical Trading Set-Up - Limited Short-Covering Scenario

Long Entry @ 140.00

Take Profit @ 162.00

Stop Loss @ 129.00

Upside Potential: 2,200 pips

Downside Risk: 1,100 pips

Risk/Reward Ratio: 2.00