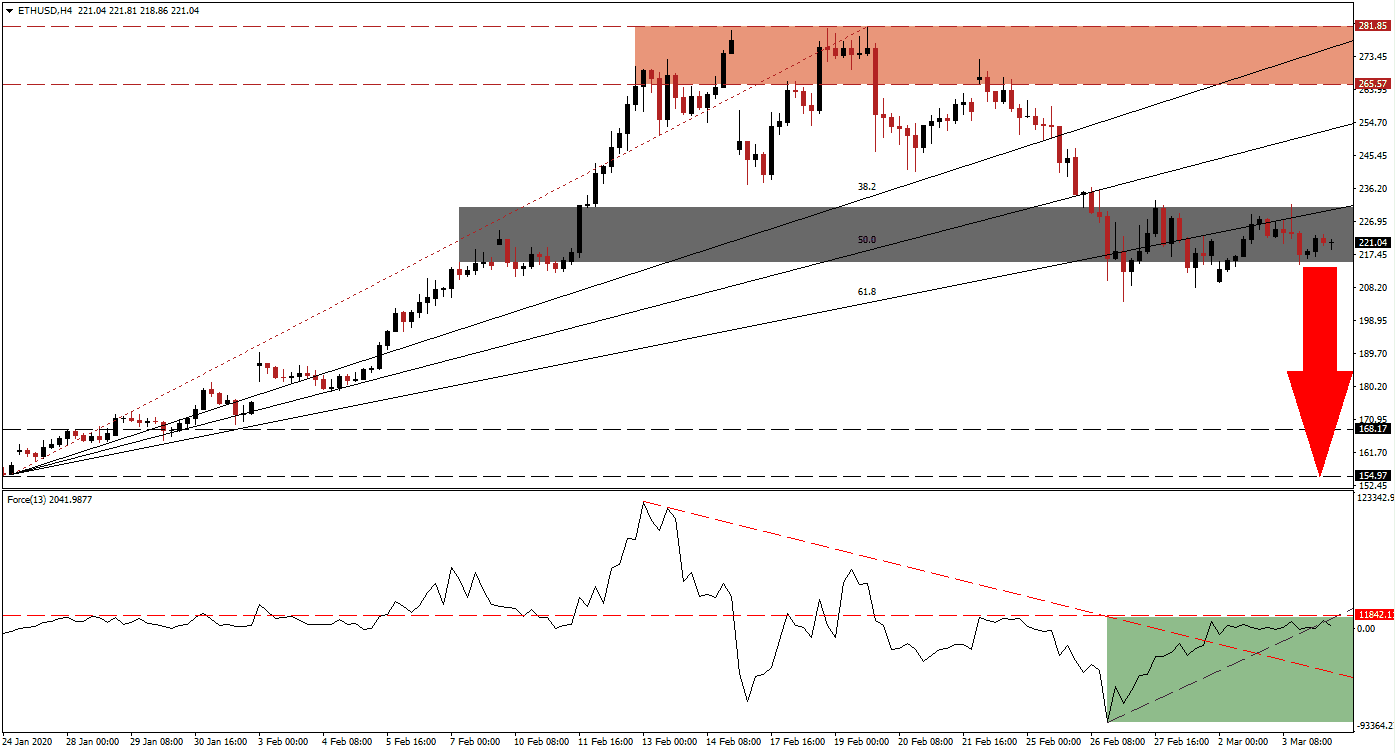

Following the breakdown in the ETH/USD below its ascending 61.8 Fibonacci Retracement Fan Resistance Level, the uptrend has ended. Bitcoin cooled the entire cryptocurrency sector, with few exceptions, and the rising bearish sentiment is evident in price action. Bitcoin and the Ethereum network share one compelling connection. The deployment of wrapped Bitcoin (WBTC) on the Ethereum network is one attempt to combine Ethereum’s smart contracts with Bitcoin’s secure blockchain database. It doesn’t change the bearish bias in this cryptocurrency pair, vulnerable for a more massive correction.

The Force Index, a next-generation technical indicator, recovered from a new 2020 low but has now pushed below its ascending support level, adding to significant bearish developments. It failed to eclipse its horizontal resistance level, as marked by the green rectangle. Bulls are temporarily in charge of the ETH/USD following the move above the 0 center-line. This technical indicator is now favored to contract below its descending resistance level, acting as support, ceding control of price action to bears.

After this cryptocurrency pair was rejected by its resistance zone located between 265.57 and 281.85, as marked by the red rectangle, a failed recovery resulted in a lower high. Bearish momentum continued to increase, resulting in a breakdown below its entire Fibonacci Retracement Fan sequence. The subsequent reversal was limited to its converted 61.8 Fibonacci Retracement Fan Resistance Level, adding to breakdown pressures in the ETH/USD. You can learn more about a resistance zone here.

Traders are recommended to monitor the intra-day low of 204.31, the current low of the corrective phase. It is positioned below its short-term support zone located between 215.23 and 230.73, as marked by the grey rectangle. A push below this level is anticipated to force the ETH/USD farther to the downside. Price action will face its next long-term support zone between 154.97 and 168.17 from where a breakdown cannot be ruled out. The cryptocurrency market is interconnected to the global financial system and exposed to Covid-19 related portfolio adjustments, primarily by institutional investors.

ETH/USD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 221.00

Take Profit @ 155.00

Stop Loss @ 236.75

Downside Potential: 6,600 pips

Upside Risk: 1,575 pips

Risk/Reward Ratio: 4.19

In case of a push higher in the Force Index, initiated by its ascending support level, the ETH/USD is likely to attempt a revival. Given the emerging bearish fundamental outlook, coupled with technical developments, the upside potential remains limited to the top range of its resistance zone. Any recovery should be considered as an outstanding long-term selling opportunity in this cryptocurrency pair.

ETH/USD Technical Trading Set-Up - Limited Recovery Scenario

Long Entry @ 248.00

Take Profit @ 272.50

Stop Loss @ 237.00

Upside Potential: 2,450 pips

Downside Risk: 1,100 pips

Risk/Reward Ratio: 2.23