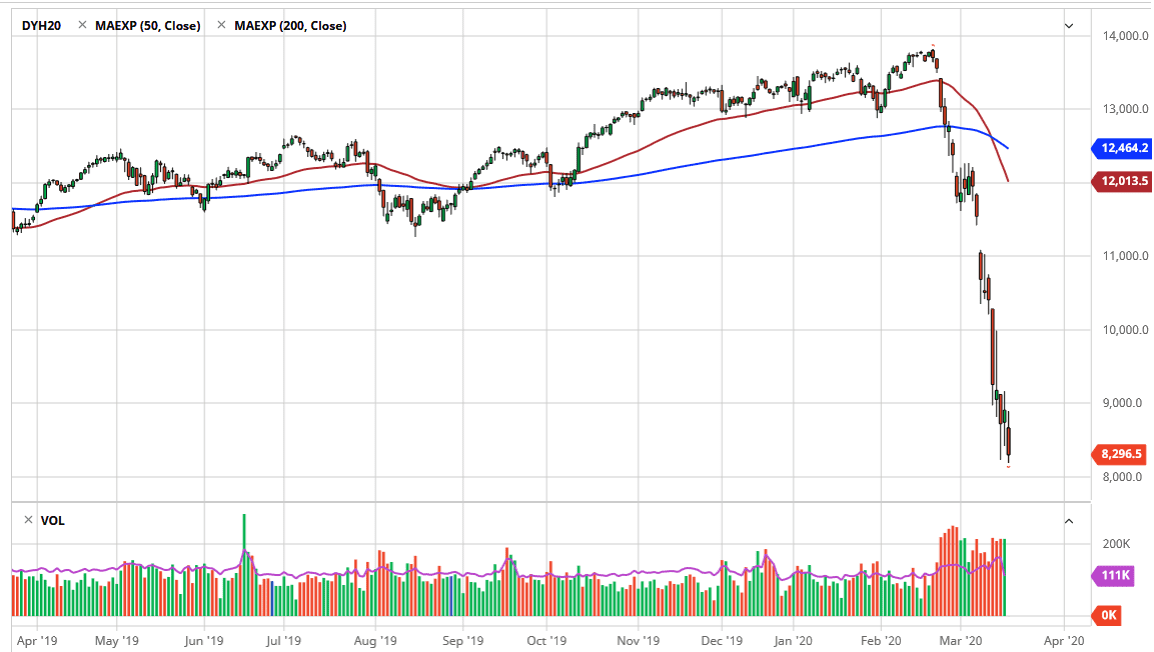

The German index has plunged again during trading on Wednesday as global equities continue to shed massive amounts of gains. At this point, the market has given up so much of the gains that it is difficult to jump in and start buying. That being said, the market is oversold to say the least. At this point, the market is likely to see a certain amount of value hunting, but I do not think that is reason enough to get involved. After all, the European Union is in dire straits and it’s very likely that the bulk of traders will look at the DAX as an opportunity to sell.

At this point, it’s very likely that if we break down below the €8000 level, we will go looking toward the next major level which would be near the €7000 level. However, if the market were to break above the €9000 level, then it could push this market towards the €10,000 level next. That would test the top of the inverted hammer that was recently broken, which would signify a major breach of selling pressure. I don’t expect that to happen, but it is always a possibility. Furthermore, you should keep in mind that there is a gap above that has yet to be filled, although I think that is going to be a longer-term deal, not necessarily something that we see anytime soon.

Alternately, if we do break down below that 8000 level, we could get a bit of a flush lower, but I think a lot of the massive selling pressure is already gone. The German ZEW was miserable this month, and force even more selling. Christine Largarde has recently suggested that the European GDP could drop 5%, which of course will lose a lot of the bullish traders even further. However, there are a lot of stimulus measures coming, and as a general rule it’s typically when leaders panic that market start to settle down. I don’t think we are quite there yet, but longer-term I do believe that we will get a nice buying opportunity. In the meantime, it’s not until we break above €9000 that I would even entertain that scenario. Rallies are to be faded, specifically on short-term charts more than anything else. The DAX will be just as volatile as everywhere else, but there does come a point where we start to run out of sellers. We aren’t there yet, but we are definitely closer than we were just a week ago.