Switzerland announced CHF10 billion in assistance to small businesses and employees as Covid-19 has crippled the supply chain, depressed confidence, and sparked global recession fears. The bulk of state aid, CHF8 billion, is earmarked for companies to claim funds to avoid laying off employees. CHF580 million in emergence bank loans and up to CHF1 billion in assistance to hard-hit companies are additionally available. The Swiss Franc, the second most popular safe-haven currency after the Japanese Yen, has increased and adds to economic stress to the export-dependent Swiss economy. Bullish momentum in the CHF/SGD is fading, positioning this currency pair for a temporary breakdown.

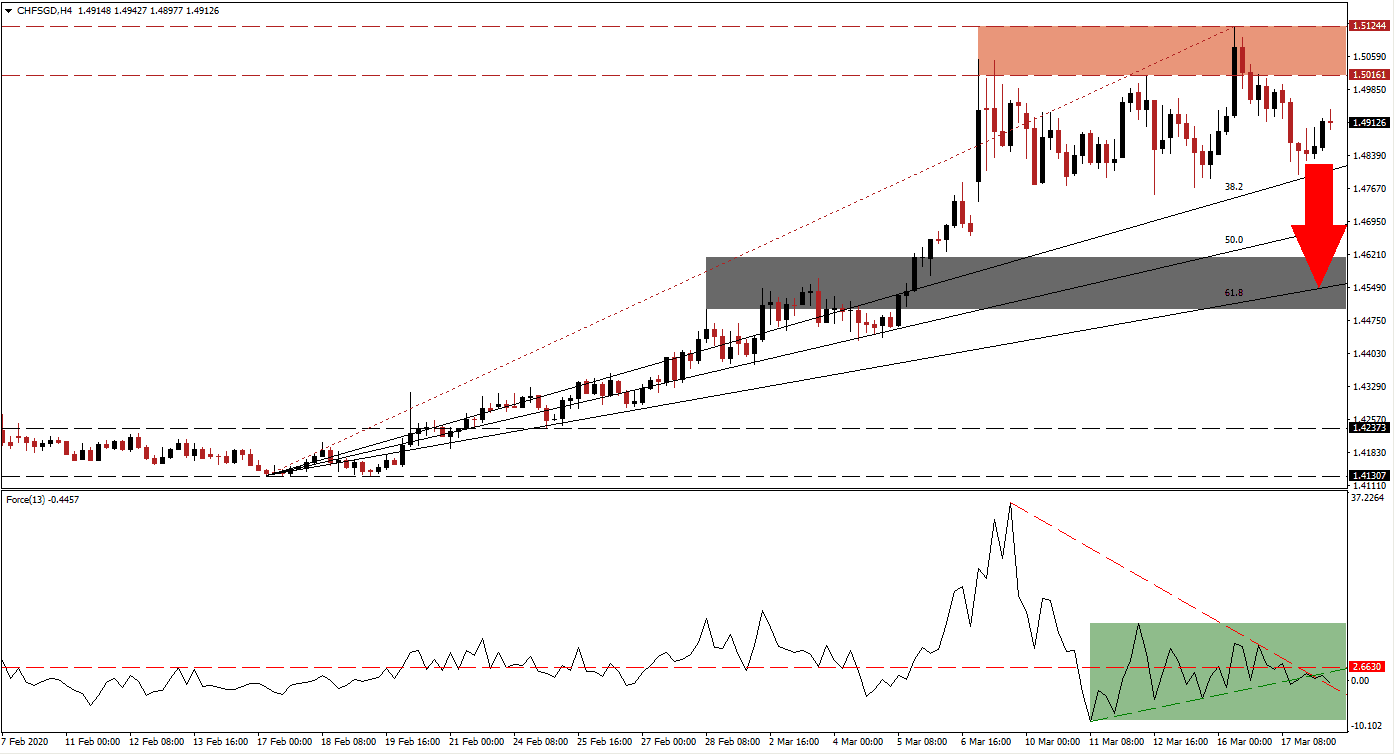

The Force Index, a next-generation technical indicator, presented an initial warning that the rally is vulnerable to a corrective phase. While the CHF/SGD extended its advance to a higher high, the Force Index collapsed below its horizontal support level, converting it into resistance. An ascending support level emerged, as marked by the green rectangle, but downside pressure enforced by its descending resistance level keeps this technical indicator below its horizontal resistance level. A move into negative territory is anticipated to spark a reversal in price action.

Following the initial breakdown in the CHF/SGD below its resistance zone, the bullish trend significantly weakened. This zone is located between 1.50161 and 1.51244, as marked by the red rectangle. Price action rebounded after reaching its ascending 38.2 Fibonacci Retracement Fan Support Level, but momentum remains depressed. The Swiss National Bank is favored to increase direct interference in the Forex market in an attempt to prevent uncontrolled appreciation in the Swiss Franc. Singapore’s Prime Minister warned the economic impact from Covid-19 on its economy will be more severe than during the last global financial crisis.

One essential level to monitor is the intra-day low of 1.47970, the low of the breakdown in price action below its resistance zone. A sustained push lower is expected to result in the addition of new net short positions in the CHF/SGD, accelerating the pending reversal. The next short-term support zone is located between 1.44988 and 1.46155, as marked by the grey rectangle, enforced by its 61.8 Fibonacci Retracement Fan Support Level. More downside will require a new catalyst. You can learn more about a support zone here.

CHF/SGD Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 1.49100

Take Profit @ 1.45500

Stop Loss @ 1.50200

Downside Potential: 360 pips

Upside Risk: 110 pips

Risk/Reward Ratio: 3.27

Should the Force Index eclipse its ascending support level, which currently acts as resistance, the CHF/SGD is likely to attempt a breakout. The upside potential appears limited to its next resistance zone located between 1.52430 and 1.53280, dating back to July 2011. Forex traders are advised to proceed with caution with the Swiss and Singaporean economies heavily dependent on exports, while the former is home to an active central bank.

CHF/SGD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.50750

Take Profit @ 1.52750

Stop Loss @ 1.49850

Upside Potential: 200 pips

Downside Risk: 90 pips

Risk/Reward Ratio: 2.22