Volatility across the global financial system remains elevated. After the Covid-19 outbreak sparked a global sell-off, the oil price collapse accelerated the flight to safe-have haven assets. The Japanese Yen and the Swiss Franc remain the two primary ones in the Forex market, with the former more prominent. Economic data out of Japan has been depressed, but massive demand for its currency due to the de-risking of portfolios continues to strengthen it. A short-covering rally took the CHF/JPY into its short-term resistance zone from where a more massive correction is pending.

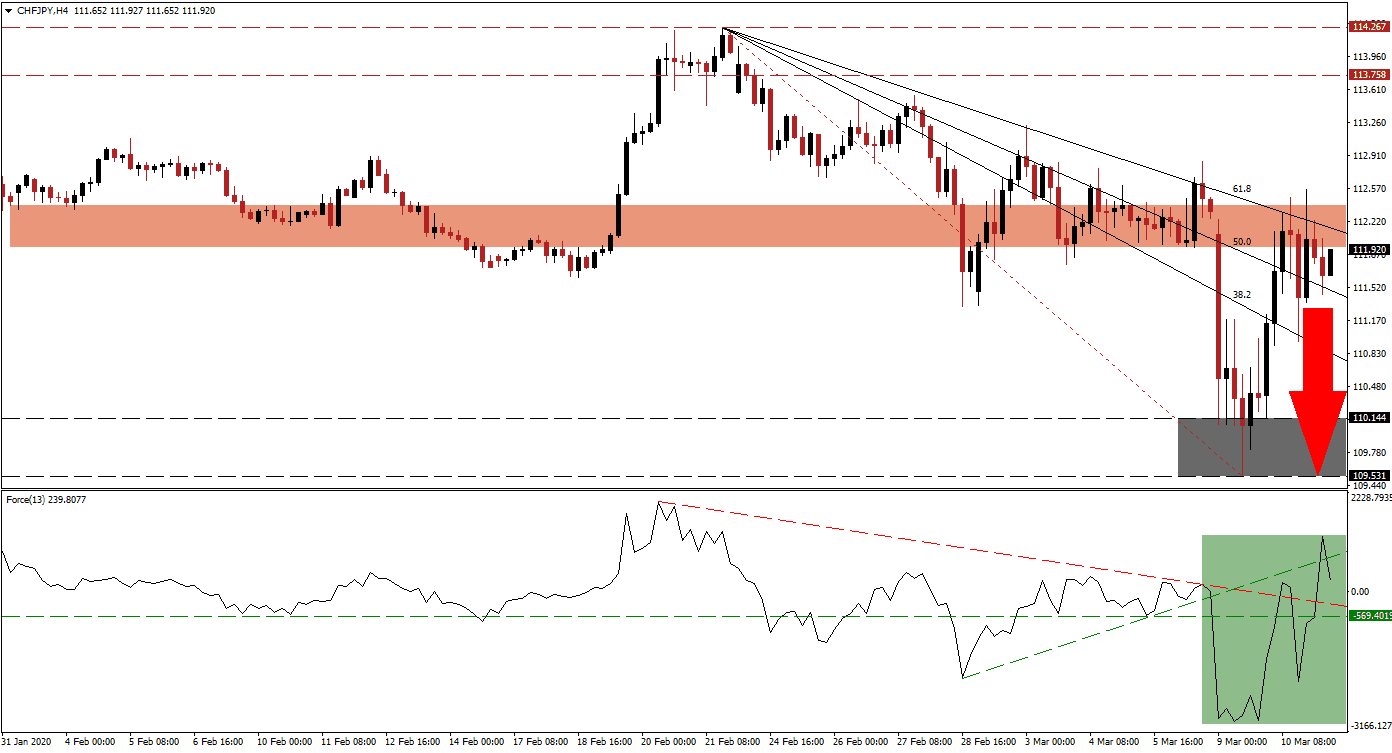

The Force Index, a next-generation technical indicator, confirms the increase in volatile price movements. After collapsing to a new 2020 low, a quick reversal took the Force Index above its horizontal resistance level, converting it into support. Bullish momentum sufficed to further elevate it above its descending resistance level, which currently acts as support. A brief spike above its ascending support level has been reversed, as marked by the green rectangle. This technical indicator is now positioned to correct into negative territory, placing bears in control of the CHF/JPY, and initiating a new breakdown sequence.

Following the rejection in this currency pair by its short-term resistance zone, bearish pressures are expanding. This zone is located between 111.945 and 112.392, as marked by the red rectangle. The Bank of Japan is strictly evaluating the strength of its currency and is know to conduct what many refer to as stealth intervention. One of the preferred indicators the Japanese central bank utilizes is the exchange rate of the USD/JPY. A breakdown below 100 is anticipated to trigger an intervention, which will have a ripple effect on the CHF/JPY.

Adding downside pressures on price action is its descending Fibonacci Retracement Fan sequence. The 50.0 and 38.2 Fibonacci Retracement Fan Support Levels already crossed below the short-term resistance zone. Forex traders are recommended to monitor the intra-day low of 111.321, the low of a previously reversed breakdown. A contraction below this level is expected to result in the addition of new net short positions in this currency pair. It will provide the catalyst to drop the CHF/JPY into its support zone located between 109.531 and 110.144, as marked by the grey rectangle. You can learn more about the support and resistance zone here.

CHF/JPY Technical Trading Set-Up - Correction Scenario

Short Entry @ 111.900

Take Profit @ 109.550

Stop Loss @ 112.600

Downside Potential: 235 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.36

A sustained breakout in the Force Index above its ascending support level, currently converted into temporary resistance, is likely to inspire the CHF/JPY into a price spike. Without a significant fundamental catalyst, the upside potential remains limited to the long-term resistance zone located between 113.758 and 114.267. Forex traders may view this as a short-selling opportunity.

CHF/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 112.850

Take Profit @ 113.950

Stop Loss @ 112.350

Upside Potential: 110 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 2.20