Hopes that economic stimulus packages and corporate bailouts will spark an economic recovery in the second half of 2020 are premature. Underestimating the ongoing disruptions caused by Covid-19 has resulted in initially slow response times by many countries. Swiss cases have surpassed 9,000, and Japan may have to postpone this year’s Summer Olympics. Early estimates indicate a loss of ¥700 billion to the economy. The Swiss Franc and the Japanese Yen are considered safe-haven currencies. Price action in the CHF/JPY advanced into the bottom range of its resistance zone, but a bullish momentum breakdown is likely to force a correction.

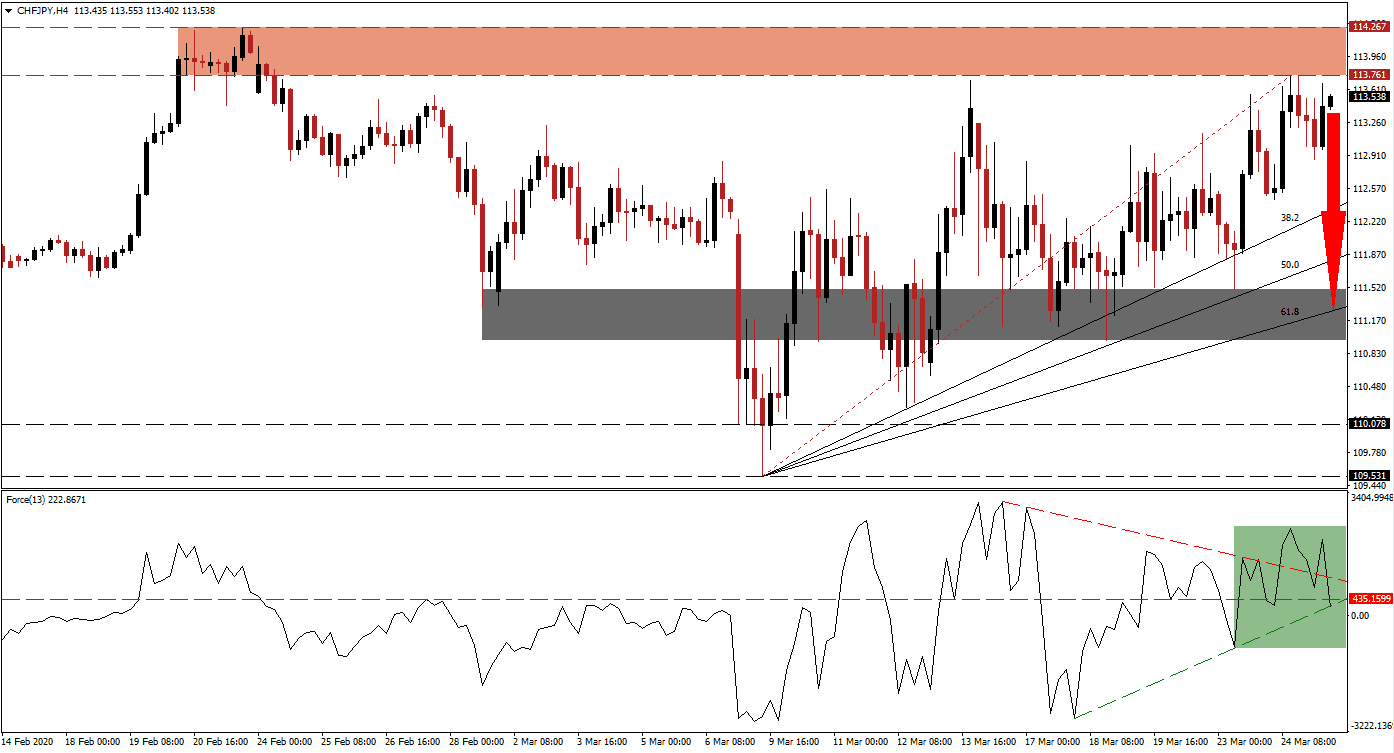

The Force Index, a next-generation technical indicator, failed to confirm the marginally higher high in the CHF/JPY, creating two lower highs. It led to the reversal of the breakout above its descending resistance level. The Force Index is now converting its horizontal support level into resistance, as marked by the green rectangle. A breakdown below its ascending support level is pending, from where bears are favored to take control of price action once this technical indicator contracts into negative territory.

This currency pair was previously rejected by its resistance zone located between 113.761 and 114.267, as marked by the red rectangle. The subsequent price action reversal emerged with weaker momentum, creating conditions for a corrective phase in the CHF/JPY. Japan’s economy continues its deterioration with business confidence at an all-time low. Despite data pointing towards more hardship, safe-haven demand for the Japanese Yen keeps pressure on price action. You can learn more about a resistance zone here.

Adding to breakdown pressures in the CHF/JPY are mounting problems in the export-oriented Swiss economy. Price action is positioned to correct through its ascending 50.0 Fibonacci Retracement Fan Support Level and into its short-term support zone. This zone is located between 110.968 and 111.502, as identified by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is crossing through it, marking a potential end to the pending sell-off in this currency pair.

CHF/JPY Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 113.500

Take Profit @ 111.300

Stop Loss @ 114.200

Downside Potential: 220 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.14

A sustained breakout in the Force Index above its descending resistance level may inspire more upside in the CHF/JPY. Both economies are home to active central banks, and market manipulation, especially by the Swiss National Bank, is not uncommon. The next resistance zone is located between 115.286 and 116.094. Forex traders are recommended to remain cautious with price action in the event of a breakout.

CHF/JPY Technical Trading Set-Up - Breakout Scenario

Long Entry @ 114.750

Take Profit @ 116.000

Stop Loss @ 114.200

Upside Potential: 125 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 2.27