Canada’s economy began the Covid-19 pandemic and collapse in oil prices on a vulnerable foundation. Prime Minister Trudeau oversaw an economy suffering from a decrease in exports, weak private sector investment, and rail blockades. While the CAD/JPY was able to recover from a contraction into its support zone, safe-haven demand for the Japanese Yen is on the rise. The US announced a $2 trillion stimulus, and the Canadian economy relies heavily on the US supply-chain and consumers. Early indicators point towards a global recession, placing downside pressure on this currency pair.

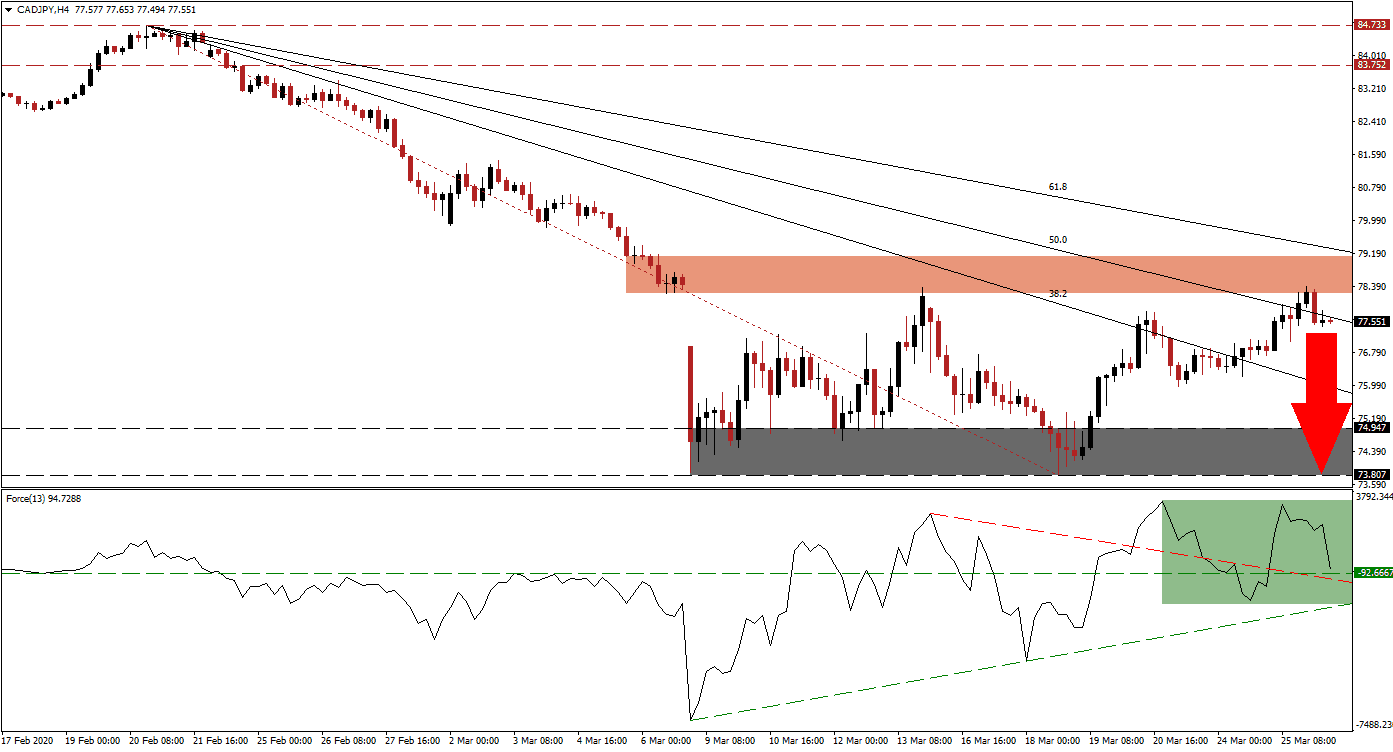

The Force Index, a next-generation technical indicator, recorded a marginally lower high before retreating. It is on the verge of converting its horizontal support level into resistance, as marked by the green rectangle. The Force Index is then expected to contract below its descending resistance level, acting as temporary support, followed by a collapse below its ascending support level. Bears will take control of the CAD/JPY once this technical indicator moves below the 0 center-line, adding to downside pressures.

This currency pair was previously rejected by its short-term resistance zone located between 78.226 and 79.126, as marked by the red rectangle. The bottom range marks the top of a price gap to the downside, while the descending 61.8 Fibonacci Retracement Fan Resistance Level is enforcing the uppermost range. Price action briefly entered this zone before retreating below its 50.0 Fibonacci Retracement Fan Resistance Level, from where more selling in the CAD/JPY is anticipated. You can learn more about a price gap here.

Japan decided to delay the Summer Olympic games amid concerns over the Covid-19 spread in Africa. The market reaction to the US stimulus was muted, and the Japanese Yen is positioned for new capital inflows. Fundamental developments combined with the loss in bullish momentum are likely to extend the sell-off in the CAD/JPY into its support zone. This zone awaits price action between 73.807 and 74.947, as identified by the grey rectangle. A breakdown cannot be ruled out, dependent on emerging economic data.

CAD/JPY Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 77.550

Take Profit @ 73.800

Stop Loss @ 78.400

Downside Potential: 375 pips

Upside Risk: 85 pips

Risk/Reward Ratio: 4.41

Should the Force Index bounce higher off of its descending resistance level, the CAD/JPY is favored to attempt a breakout above its 61.8 Fibonacci Retracement Fan Resistance Level. Given multiple economic challenges to the Canadian economy, any such move is expected to be temporary and limited to the intra-day high of 80.642, the peak from where the most recent collapse originated. Forex traders are recommended to take advantage of a breakout attempt with new sell orders.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 79.200

Take Profit @ 80.600

Stop Loss @ 78.600

Upside Potential: 140 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.33