After the World Health Organization officially declared Covid-19 a global pandemic, demand for safe-haven assets accelerated. Gold and the Japanese Yen are two of the most widely bought assets across portfolios during uncertain times. Recession fears for the Japanese economy increased following the downward revision to fourth-quarter GDP to an annualized contraction of 7.1%. Business spending and private consumption are expected to remain depressed in the first quarter, but the currency continues to attract capital inflows. Breakdown pressure on the CAD/JPY is likely to extend the correction in this currency pair.

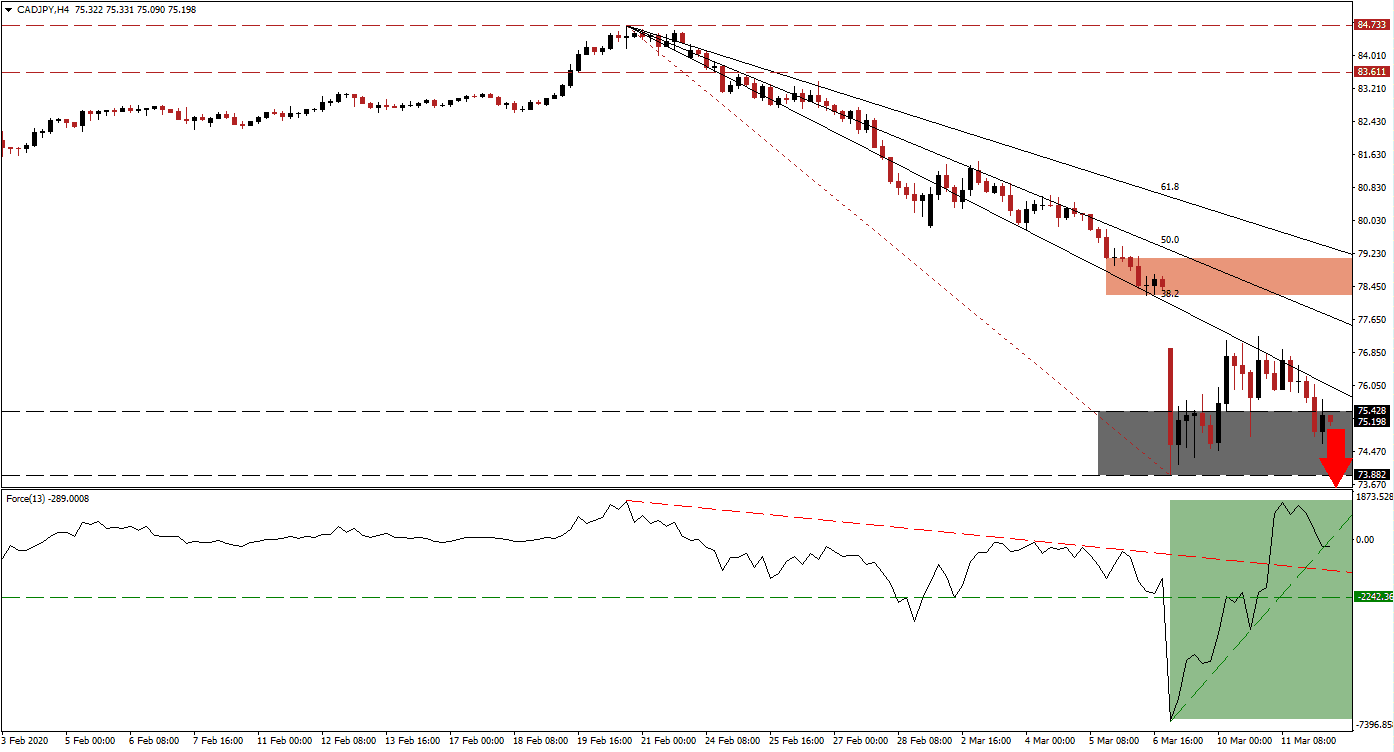

The Force Index, a next-generation technical indicator, started to retreat from a brief spike, failing to elevate it into positive territory. It is now favored to accelerate to the downside following the conversion of its ascending support level into resistance, as marked by the green rectangle. This technical indicator is on track to push below its descending resistance level, which acts as short-term support and slide below its horizontal support level, deeper into negative conditions. The pending result is more downside in the CAD/JPY. You can learn more about the Force Index here.

Bearish pressures mounted after price action opened with a price gap to the downside, below its short-term resistance zone located between 78.226 and 79.126, as marked by the red rectangle. Weakness out of the Canadian economy, increased by the collapse in oil prices this week, is expanding breakdown pressures in the CAD/JPY. The 50 basis point interest rate cut by the Bank of Canada is further adding to structural weakness in the Canadian Dollar. You can learn more about a price gap here.

This currency pair attempted a reversal after reaching its support zone but failed to maintain it. The CAD/JPY is now faced with its descending 38.2 Fibonacci Retracement Fan Resistance Level, anticipated to force a breakdown below its support zone located between 73.882 and 75.428, as marked by the grey rectangle. Price action will face its next support zone between 70.960 and 71.450, dating back to October 2008. More downside will require a new catalyst, which cannot be ruled out.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 75.200

Take Profit @ 71.200

Stop Loss @ 76.300

Downside Potential: 400 pips

Upside Risk: 110 pips

Risk/Reward Ratio: 3.64

A breakout in the Force Index above its ascending support level is expected to inspire a short-term recovery in the CAD/JPY. Due to bearish fundamentals in the Canadian Dollar, Forex traders are advised to take advantage of any price spike with new short-positions. Japan announced a stimulus package for its economy, and safe-haven demand for the Japanese Yen remains stable. The upside potential for a reversal is limited to its short-term resistance zone, enforced by its 61.8 Fibonacci Retracement Fan Resistance Level.

CAD/JPY Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 77.200

Take Profit @ 79.000

Stop Loss @ 76.300

Upside Potential: 180 pips

Downside Risk: 90 pips

Risk/Reward Ratio: 2.00