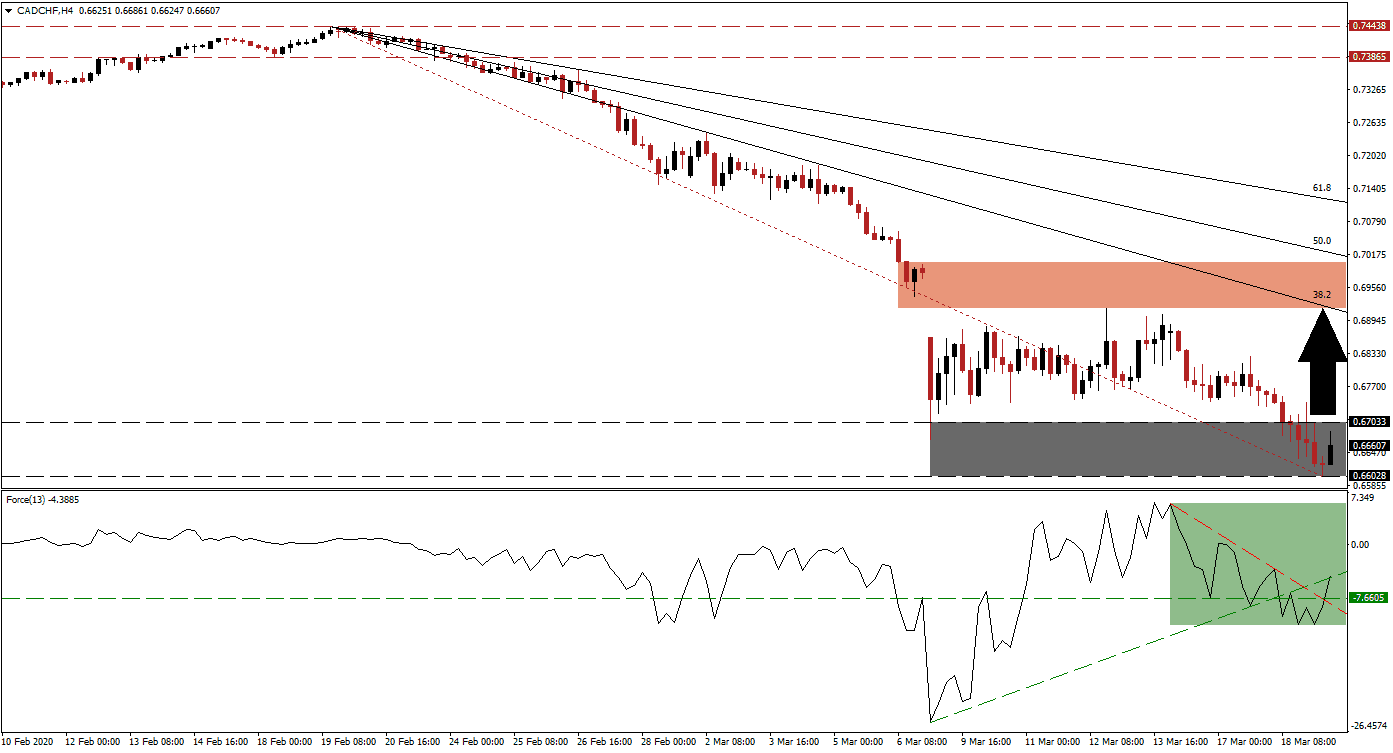

Canada announced an C$82 billion economic aid package, or 3% of GDP, in response to Covid-19. It consists of C$55 billion in tax deferrals for businesses and families plus C$27 billion in direct support to impacted companies and individuals. Canada is especially hard hit as it faced economic disruptions from railroad blockades before Covid-19 added economy-wide shut-downs. The plunge in oil prices further strains the budget, while some estimates call for the unemployment rate to surge above 20% unless the situation will successfully be contained. Price action in the CAD/CHF collapsed to lows not seen since January 2015, but a recovery in bullish momentum is materializing inside of its support zone.

The Force Index, a next-generation technical indicator, shows the existence of a positive divergence. After this currency pair extended its sell-off, the Force Index started to recover. Following a brief collapse, it has now converted its horizontal resistance level back into support. This technical indicator additionally pushed through its descending resistance level, as marked by the green rectangle, and is now challenging its ascending support level, which presently acts as resistance. A push into positive territory is favored to place bulls in charge of the CAD/CHF. You can learn more about the Force Index here.

A breakout in this currency pair above its support zone located between 0.66028 and 0.67033, as marked by the grey rectangle, is anticipated to spark a short-covering rally. It will close the gap between the CAD/CHF and its descending 38.2 Fibonacci Retracement Fan Resistance Level. Switzerland, home to an active central bank, announced its CHF10 billion stimulus. The Swiss National Bank is known for direct market manipulation, assisting its export-dependent economy. The Swiss currency is the second most purchased safe-haven currency after the Japanese Yen, and demand remains elevated.

While conditions for a short-covering rally exist, the pending advance is expected to precede more selling in the CAD/CHF. The 38.2 Fibonacci Retracement Fan Resistance Level is likely to enforce the dominant bearish trend, which will stop price action from challenge its short-term resistance zone. This zone is located between 0.69160 and 0.70025, as marked by the red rectangle, including a price gap to the downside. It will be lowered following rejection in this currency pair from where an extension of the breakdown sequence should follow. You can learn more about a price gap here.

CAD/CHF Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.66600

Take Profit @ 0.69100

Stop Loss @ 0.65900

Upside Potential: 250 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 3.57

In the event of rejection in the Force Index by its ascending support level, currently acting as resistance, the CAD/CHF is anticipated to extend its corrective phase. The next support zone is identified between 0.65070 and 0.65580, but Forex traders are advised to remain cautious. The Swiss National Bank tends to act once price action approaches essential levels. A material deterioration of existing conditions is required to warrant more downside.

CAD/CHF Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.65700

Take Profit @ 0.65200

Stop Loss @ 0.65900

Downside Potential: 50 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.50