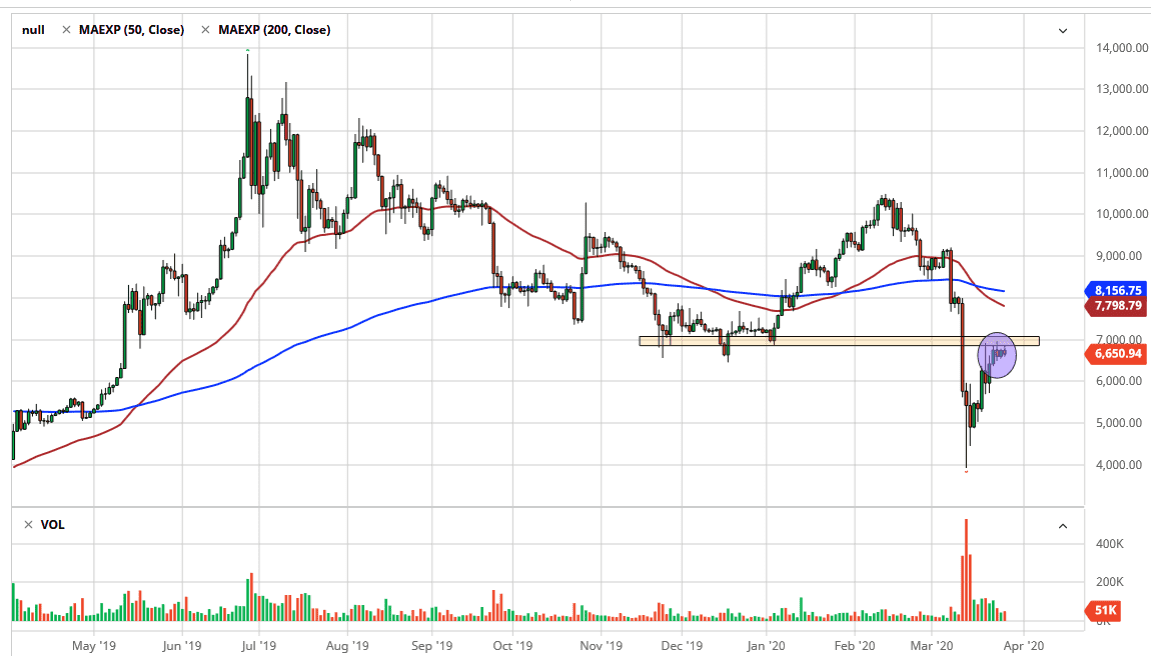

The Bitcoin market has initially tried to rally during the trading session on Friday but continues to find a lot of trouble in the area of $7000, an area that I have had marked on the chart for several days. As you can see, the momentum has fallen apart, and this tells me that we are more likely to see a bit of a fall from here then to break out suddenly. In this current environment, it’s obvious that the buyers continue to try to break higher, but simply do not have the momentum to do so.

That being said, if we were to close above $7000 on a daily candlestick, then it would be a reasonably bullish sign. That could send the pair looking towards the 50 day EMA above, closer to the $7800 level. Because of this, markets will be more likely than not to have a bit of a short squeeze at this happens. This of course is the bullish argument for Bitcoin. I recognize that we could even try to take out the 200 day EMA above if this happens. However, I don’t think this is very likely due to the fact that we simply could not do much over the last couple of sessions.

Looking at this chart, I believe that the $6000 level is the next target. Furthermore, they also believe that the market could go below there, perhaps looking towards the psychologically significant round figure of $5000. That’s an area that I think will continue to cause a certain amount of psychological support, as well as structural support based upon the recent bounce. I don’t know that we break down below there anytime soon, but ultimately I think that is the area that the market is going to try to revisit due to the fact that it was such a sharp selloff that it’s difficult to imagine that traders won’t try to find out whether or not that was some type of bottom.

The one thing I think you can count on is that Bitcoin won’t simply sit here and do nothing forever. That being said though, volume in Bitcoin is extraordinarily thin so we can have several days in a row where nothing happens followed by a very impulsive candlestick. That’s probably how this breaks out or breaks down, in a sudden and sharp move. I still favor shorting more than anything else.