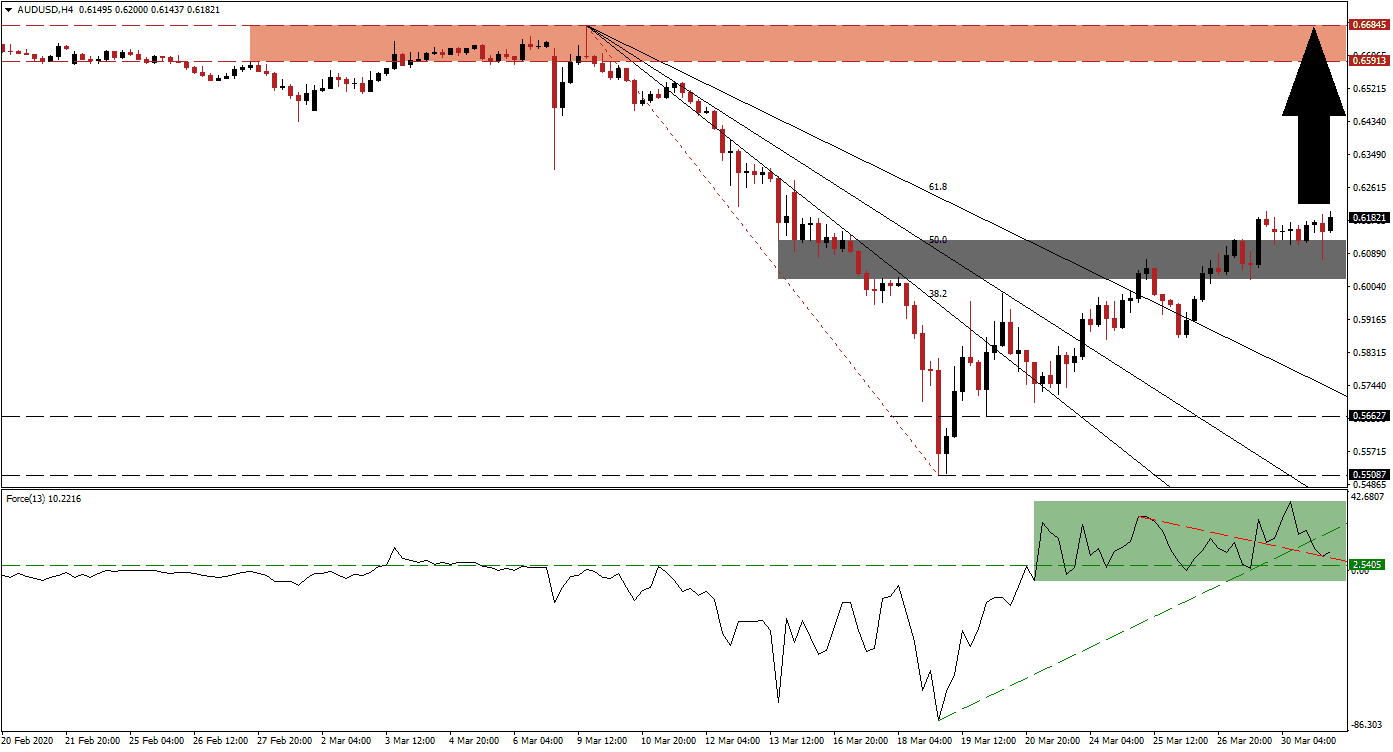

Panic-selling initially plunged this currency pair below the essential 0.60000 level before a massive price action reversal unfolded. Australia is heavily dependent on the Chinese economy, and the Australian Dollar remains the primary Chinese Yuan proxy currency. PMI data out of China for March posted a surprise expansion with readings above 50.0 in all three sub-components. Australia announced a third stimulus, boosting the total economic rescue package to A$189 billion or 10% of GDP. The AUD/USD converted its short-term horizontal resistance zone into support from where a breakout extension is anticipated.

The Force Index, a next-generation technical indicator, shows the recovery off of a lower low that confirmed the preceding sell-off in this currency pair. The Force Index then accelerated to the upside, turning its horizontal resistance level into support. After recording a new monthly peak, it retreated below its ascending support level, as marked by the green rectangle. This technical indicator is now expected to bounce higher, off of its descending resistance level, acting as a temporary support. Bulls remain in control of the AUD/USD, favored to lead more gains in price action.

Australian consumer confidence plunged, and the country is enforcing coronavirus restrictions, moving closer to a full lockdown, as pleaded by a group of doctors. The recovery in the AUD/USD gathered momentum after its pushed through its descending 61.8 Fibonacci Retracement Fan Resistance Level. It resulted in the breakout above its short-term resistance zone, now turned support. This zone is located between 0.60220 and 0.61221, as identified by the grey rectangle.

While a minor retreat to the bottom range of this support zone cannot be ruled, price action is well-positioned to extend its breakout. Forex traders are recommended to monitor the intra-day low of 0.63095. It represents the low of the initial breakdown below its long-term resistance zone located between 0.65913 and 0.66845, as marked by the red rectangle. A sustained pushed higher is likely to result in the addition of new net buy orders, providing the required volume to extend the rally in the AUD/USD into its resistance zone.

AUD/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.61800

Take Profit @ 0.66800

Stop Loss @ 0.60200

Upside Potential: 500 pips

Downside Risk: 160 pips

Risk/Reward Ratio: 3.13

In the event the Force Index sustains a breakdown below its descending resistance level, the AUD/USD is likely to be pressured into a correction. With the fundamental outlook for the Australian economy more bullish than the US economy, any contraction in this currency pair should be considered a buying opportunity. The downside potential appears limited to its 61.8 Fibonacci Retracement Fan Support Level, which is approaching the top range of its support zone located between 0.55087 and 0.56627.

AUD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.59500

Take Profit @ 0.57000

Stop Loss @ 0.60500

Downside Potential: 250 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 2.50