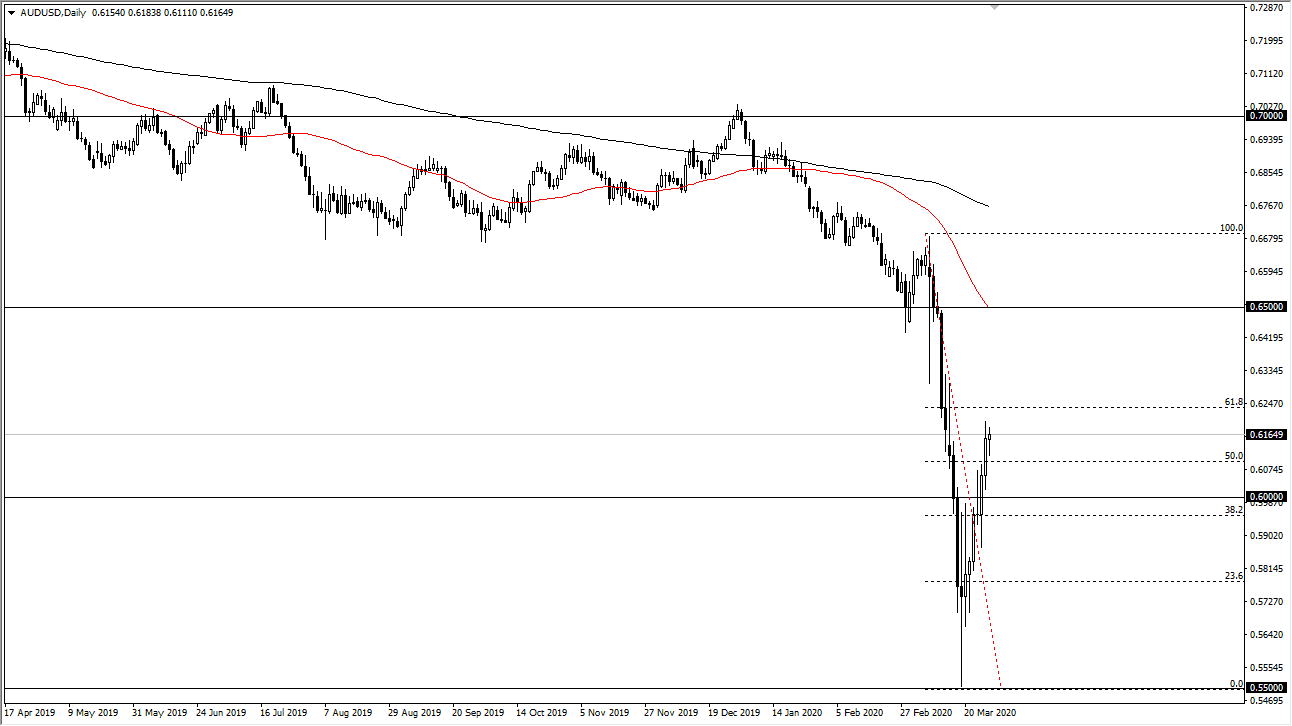

The Australian dollar has gone back and forth during the trading session on Monday, as traders came back from the weekend. We are hanging around an area that was a major gap previously, and even though it’s already been filled a couple of times there seems to be a lot of interest in the 0.6150 region. With that being the case I like the idea of waiting to see the next impulsive candlestick and simply following it. In other words, I believe that the market is going to try to make a decision rather soon, and it’s our job as traders to follow.

Looking at the chart, I do believe that there is a lot of resistance above, and you should keep in mind that the Australian dollar depends on global growth as it is a major commodity currency. The candlestick looks as if it is trying to push higher but the fact that the range is so much smaller than the previous one and the fact that we have several wicks just above suggests to me that we could run into trouble. If we break down below the bottom of the range for Monday, then I think we probably go looking towards the 0.60 level underneath, the large, round, psychologically significant figure underneath that had been previous resistance and should now be support.

To the upside, if we were to break above the highs of the Friday session, then we could go looking towards the 0.6325, possibly even as high as the 0.65 level after that. That level should be massive resistance and I would be very interested in shorting the Aussie in that region. All that being said, the 0.6235 level is basically where the 61.8% Fibonacci retracement level since, so that’s an area that I think will attract quite a bit of selling.

I believe it is very difficult to think that the Aussie is going to take off to the upside for a longer-term move, at least at the moment considering there is so little in the way of global growth. That being said, if we do pull back and make a “higher low”, that could be a good sign as the Australian dollar may start to react positively against the greenback due to the Federal Reserve flooding the market with cheap money. However, it’s going to take some time to build a base that is stable enough to rely on.