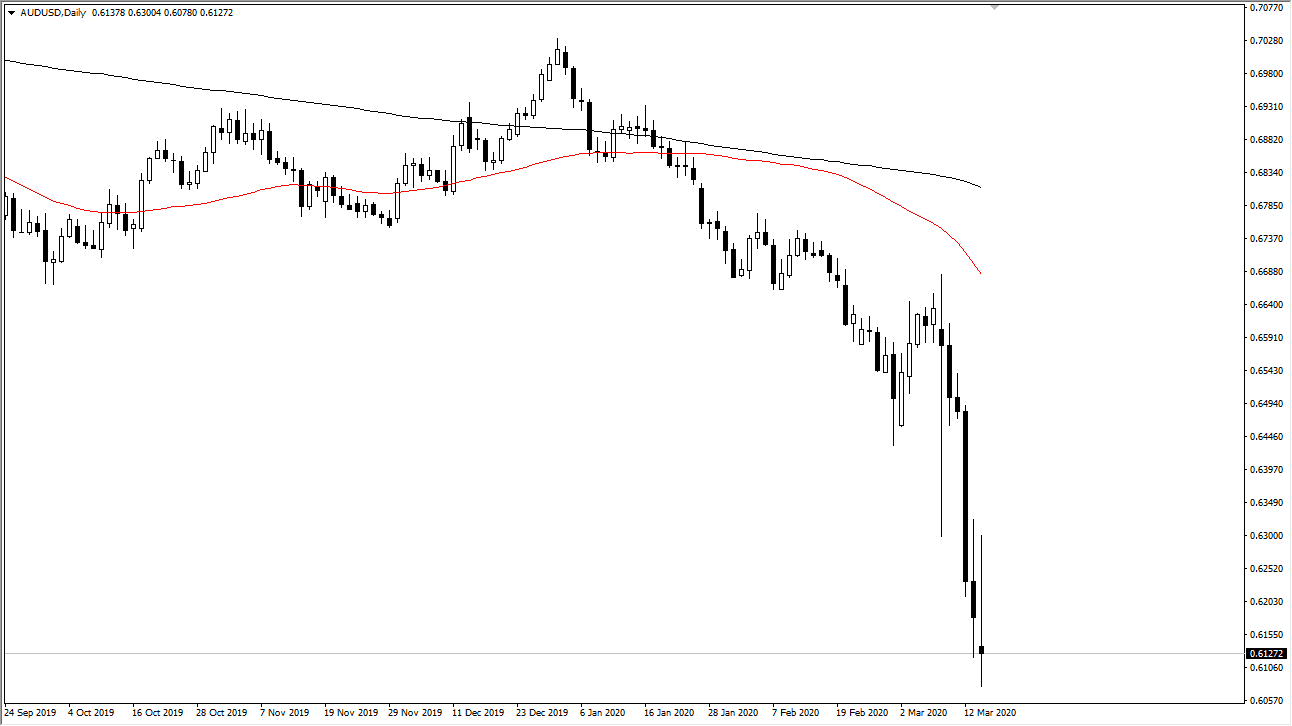

The Australian dollar initially gapped lower but then shot straight through the air as people traded the surprise announcement that the Federal Reserve was cutting interest rates by 100 basis points. However, the 0.63 level Browning for sellers, as people continue to worry about the overall global economy. Remember, Australia is highly sensitive to China, and therefore very sensitive to the overall global transaction and flow of goods.

Australia provides a lot of commodities in the form of iron, copper, aluminum, and gold just to name a few. I believe that the candlestick that I am looking at signals that we are going to go lower because it is a significant “inverted hammer.” That of course is a very negative set up, as it shows that not only did the sellers fail to push the market to the upside, but the sellers came back in and pushed it back down on the slight attempt that was made. This shows a lot of negativity, and therefore we should see a continuation.

The US dollar will continue to be looked at as a potential safety currency, especially against currencies such as the Australian dollar. Don’t get me wrong, we are at historic low pricing right now, getting awfully close to the 0.60 level. That level was the bottom of the financial crisis so I certainly think that could be a bit of support in that area. In fact, if the coronavirus numbers start to drop a bit, that could also be the bottom. In the short term though, it’s very likely that rallies that show signs of exhaustion are nice selling opportunities.

As far as buying is concerned, I need to see some type of stabilization when it comes to the stock markets and global risk appetite in general. However, if we can break above the 0.63 level it would break the back of a couple of long wicks, and that could send this market looking towards the 0.65 handle above which of course is a large, round, psychologically significant figure and the scene of the latest breakdown. That might be a nice place to start selling as well, unless of course something changes from the longer-term standpoint. While we are starting to reach peak panic, I don’t know that we are quite there yet and therefore the Australian dollar probably will continue to struggle in the short term as the headlines will continue to rattle markets.