The Australian dollar has gone back and forth during volatile trading on Thursday, as the world tries to understand the impact of the coronavirus on global growth. Remember, the Australian economy is highly levered to the situation in China, most specifically the fact that Australia provides of any of the commodities of the Chinese use in order to build their export machine, and construction in that rapidly growing society. At this point, it’s obvious that the growth globally is going to slow down, and therefore it should have a significant effect on Chinese movement economically.

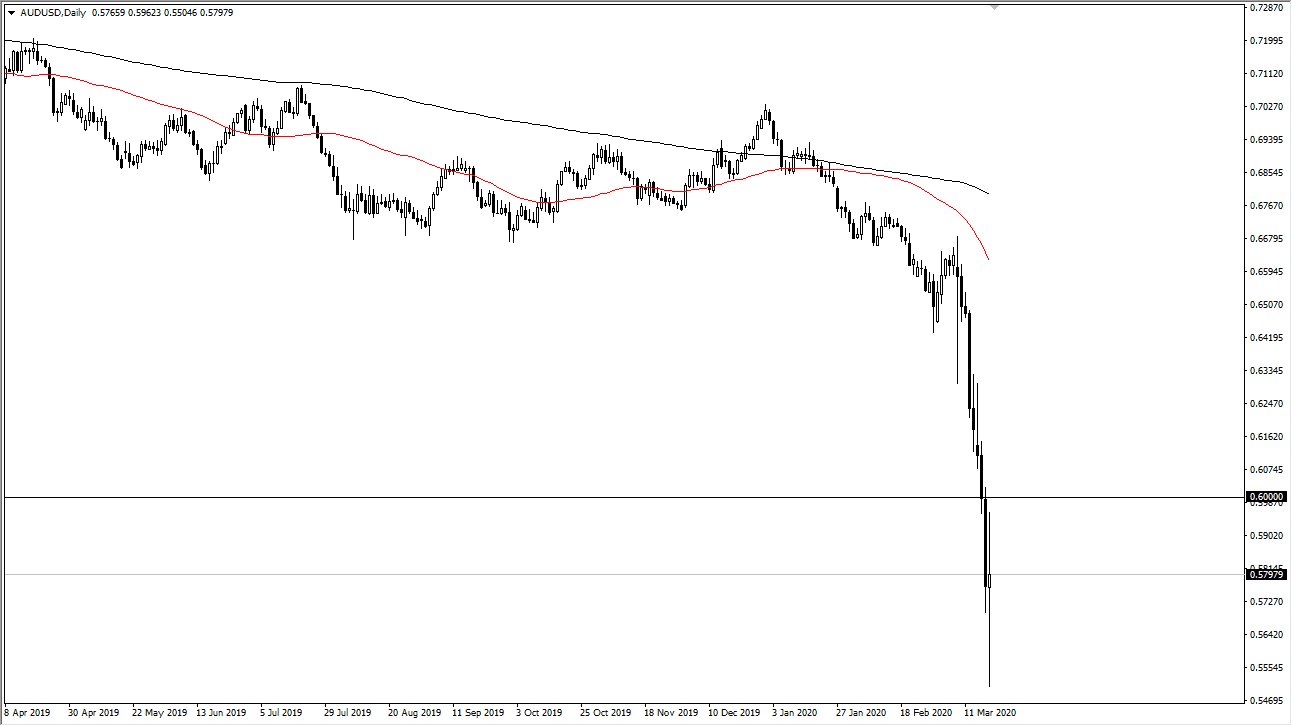

That being said, the 0.60 level is an area that was significant support previously, so the fact that it offered resistance during the day should not be that big of a surprise. By the end of the session, we have formed a very wide range, showing just how volatile this market is. I think we are getting closer to a bottom but quite frankly I think we still have selling to go. Rallies at this point will probably continue to see the 0.60 level as resistance, perhaps even all the way to the 0.62 level after that. If we break down below the lows of the session, then it’s likely that we go ahead and complete that move down to the 0.50 level which started earlier in the day, before being interrupted. Obviously, the 0.50 level would be a large, round, psychologically significant figure that will attract a lot of attention.

The US dollar continues to see plenty of strength, mainly because of fear out there in of course the entire shortage of US dollars when it comes to global debt. If the market does rally, it’s going to continue to offer selling opportunities until something changes substantially. That being said, it should not be a huge surprise that we occasionally get the relief rally like we saw during the day on Thursday. Heading into the weekend, it could get rather noisy, so therefore I would anticipate that Friday will be just as volatile as Thursday was as everything is considered to be up in the air at the moment, which generally means that the US dollar strengthens longer term. Ultimately, you should keep your position size relatively small, especially if you’re trying to play a bounce. The Aussie will continue to be one of the major epicenters of volatility.