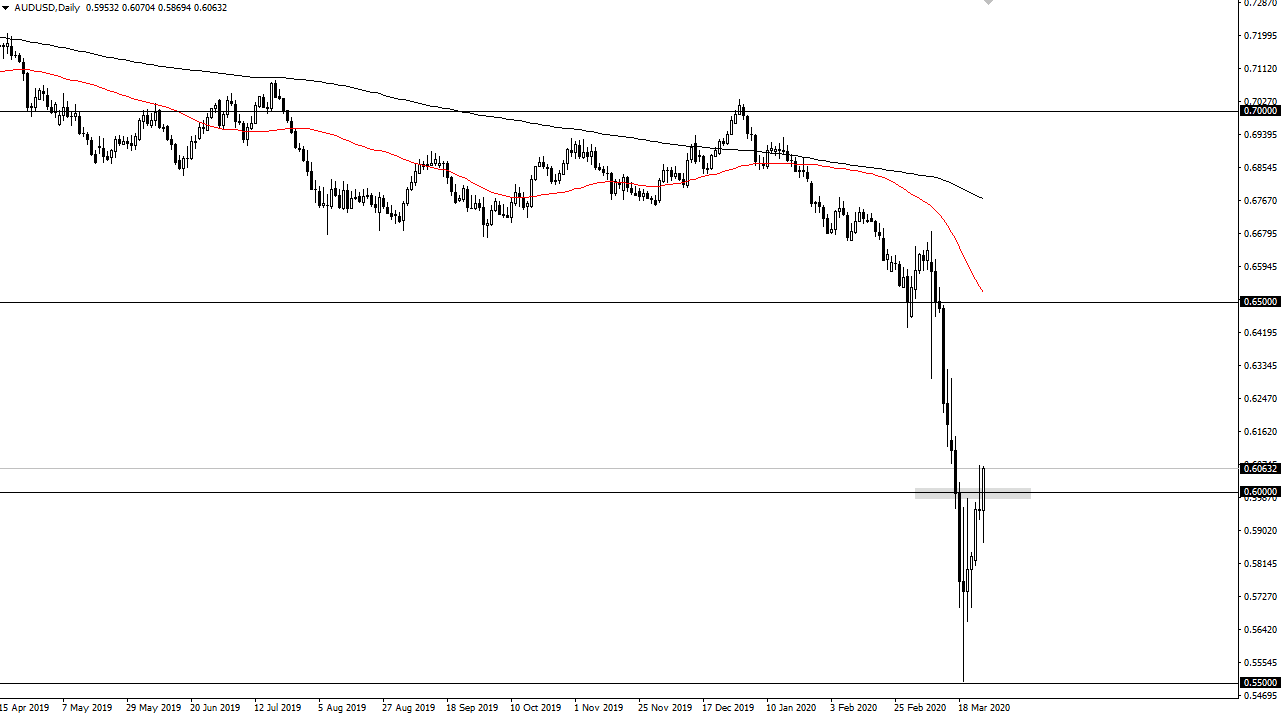

The Australian dollar has shot higher during the trading session on Thursday after initially falling. The once the candlestick was a shooting star right at an area that should cause quite a bit of resistance. Because of this, it showed that there was a real potential for the market to fall apart and breakdown. However, as the market fell, buyers came in just below the 0.59 level to pick up the Australian dollar “on the cheap”, and then has since turned around and broke above the 0.60 level, a psychologically important figure.

As the day is winding out in New York City, the market is currently sitting at the very top of the previous candlestick and therefore it looks like the Australian dollar is trying to make a major move to the upside.

The Australian dollar is a bit unique in the sense that it is highly levered to global growth. This is because Australia provides China with so many of its raw materials, thereby tying itself to manufacturing. The Chinese economy is going back to work, so that in theory should at least have commodities going higher. In Australia, the biggest commodity will probably be copper that you should be following, as China starts producing goods for the rest of the world. Unfortunately, the rest of the world is still under lockdown for the most part, and therefore a bit of concern when it comes to the idea of the overall demand.

Looking at the candlestick, it is positive, but I think that there is a bit of a “ceiling” above at the 0.65 level. That still opens up a nice short-term buying opportunity, but I do believe that more than likely we will see a retest of lower levels in order to form some type of solid footing for the market longer term. Because of this, I think that you are going to need to be extraordinarily cautious as far as buying is concerned, and perhaps a bit quicker to take profits on the downside which still should be attractive for a lot of concern traders out there. At this point, market participants will continue to pay attention to the latest headline but that of course is essentially a guess as to how things play when it comes to things like infection rates going down and demand picking back up. It’s very rare you see this type of destruction and then simply a complete turnaround at the drop of a hat.