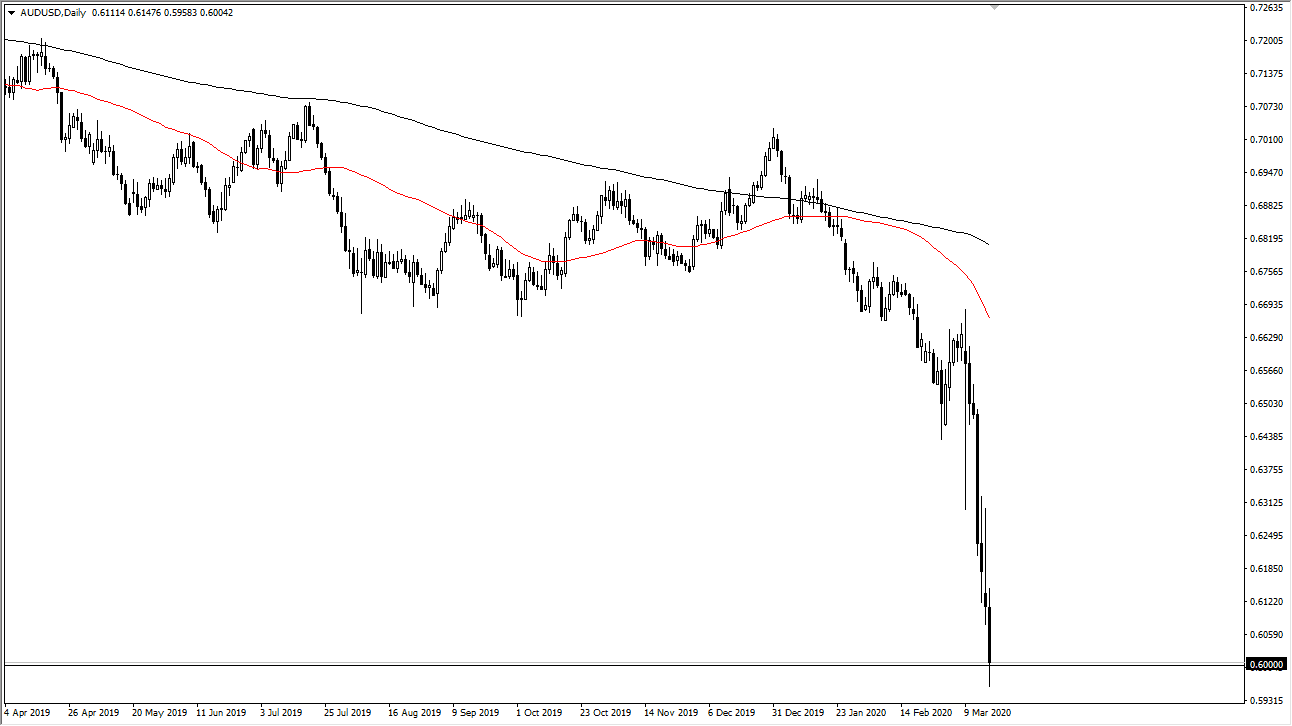

The Australian dollar has plummeted during the trading session on Tuesday, slicing below the 0.60 level during the day. This is a crucial area to pay attention to, as it is the bottom of the financial crisis. This is where the Australian dollar was trading at the very height of the Great Recession, and at this point one would have to think there are a lot of people paying attention to this in trying to figure out whether or not it should in fact go lower.

If we do break down below here on a daily close, and I mean significantly not just a few pairs, it opens up the door to the 0.58 level underneath, perhaps even as low as the 0.55 level after that. In general, this is a pair that tends to move with risk appetite and right now one has to wonder what kind of risk appetite there truly is. The one thing that has helped it beyond the obvious technical interest at this level, is the fact that the Federal Reserve is cut interest rates twice in the last couple of weeks, and then of course the US government is starting to jump into the market with both feet when it comes to fiscal stimulus. At this point, it should weigh upon the strength of the US dollar eventually, but clearly the Australian dollar is paying more attention to China and global trade than anything else.

With the global trade situation slowing down, it makes sense that the Australian dollar would suffer a bit due to the fact that Australia provides China with so much of its raw materials. Furthermore, market participants will continue to see a lot of Asian related assets as being difficult to deal with considering that the virus started there, and Asia is so sensitive to the lack of demand coming from other parts of the world. Furthermore, the Australian dollar is a bit of a proxy for the Chinese economy, so I do think that we are getting closer to the bottom than selling further, but the next couple of days will probably be very difficult. If we do get good news though, the Australian dollar might be one of the first places that money goes looking to as it is so undervalued at the moment and could lead to a longer-term “buy-and-hold” type of scenario. Regardless of what you do, small position sizing is probably crucial.