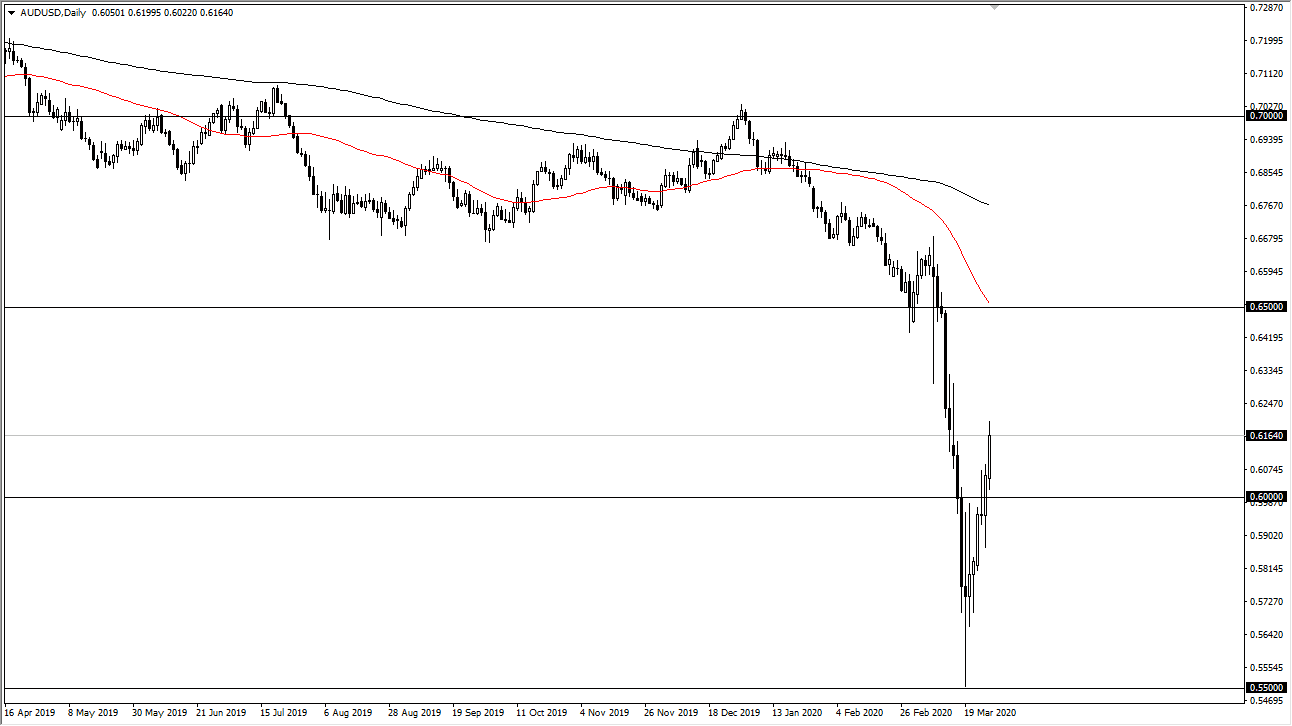

The Australian dollar rallied a bit during the trading session on Friday to reach out towards the 0.62 handle, the scene of a gap that had obviously been filled previously, but it has a certain amount of psychological influence on the market. Furthermore, one thing that we need to pay attention to is that risk appetite seems to be dropping off, so the question isn’t so much as to whether or not this is about buying the Australian dollar, whether it is a reaction to the stock markets in the United States. They sold off late the day and it should be noted that at that time on Friday the US dollar selling off makes quite a bit of sense due to the fact it is in focus.

Looking at this chart, I believe it is only a matter of time before we start shorting, especially near the 0.65 level. That’s assuming that we even take off to the upside. I don’t have any interest in trying to guess where we go next, but I recognize that if we try to break above the top of the candlestick for the day there are long wicks that were trying to get through from the last 10 days or so in order to reach towards the 0.65 handle. That’s an area that I think continues to be very crucial, if we can break above the level, that would be an extraordinarily bullish sign. At this point, I think it comes down to how the US dollar is doing in general, if you see it selling off against other currencies than it’s very likely that the market goes looking towards that handle.

Having said that, if we break down at this point, I will anticipate the 0.60 level being a target, but if we break down through their it’s likely that the market could go down towards the 0.59 level, where we might see a little bit of support. This could end up being a nice buying opportunity though, especially if the Australian dollar is actually in the process of bottoming out. A lot of this is going to come down to the Federal Reserve pumping the markets fully US dollars. However, if we were to turn around a break down below the lows again, then the 0.50 level underneath would be an extraordinarily supportive based upon longer-term charts. At this point, it really comes down to the US dollar strength. Pay attention to the US Dollar Index, as it could give you a heads up here.