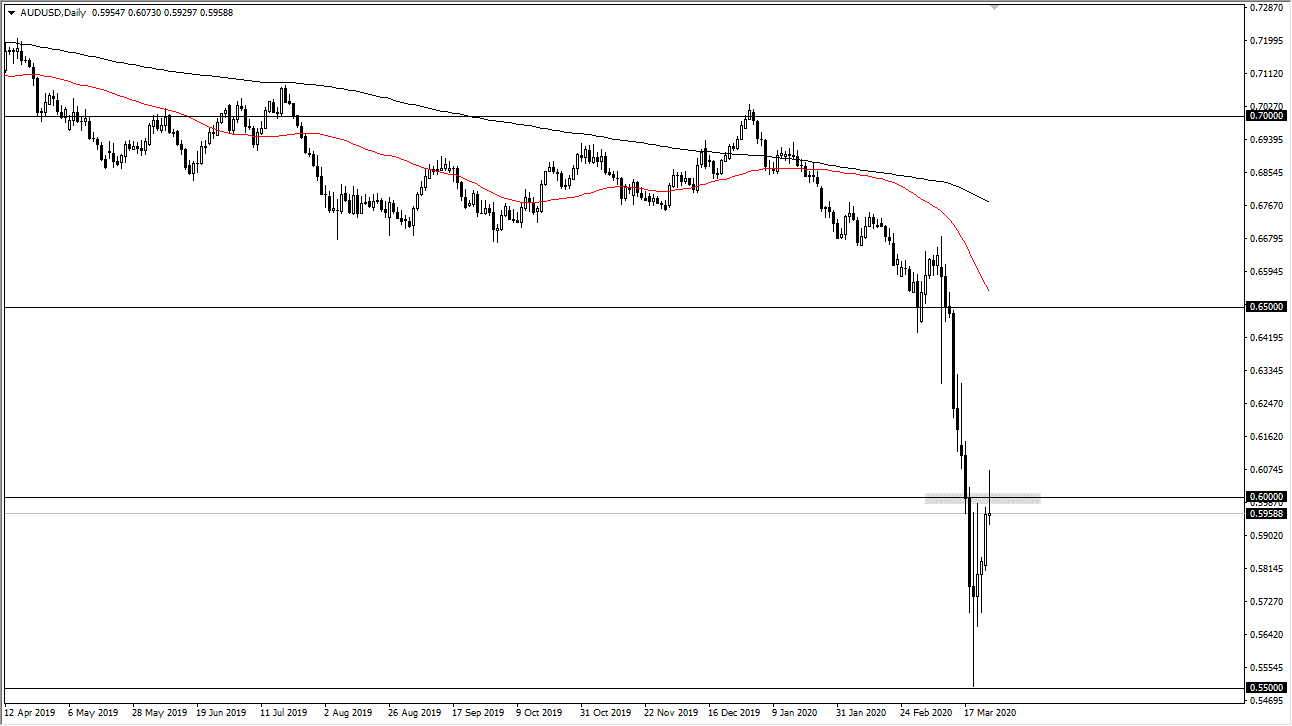

The Australian dollar initially tried to rally during the trading session on Wednesday, but as you can see struggled above the 0.60 level II pullback and form a bit of a shooting star. This is of course a very negative candlestick and it does suggest that perhaps we are going to pull back even further. I would not be surprised at that, mainly due to the fact that the Australian dollar is so highly risk sensitive, and of course the connection that the Aussie has to the Chinese economy.

While China is starting to get back to work and that of course will have traders looking at Australia is an area where we will see money flow into in order to pick up commodities. However, that’s not what’s actually happening. Because of this, and the fact that the 0.60 level, a significant round number, has held tells us that the Australian dollar is still pressured to the downside. The Australian economy is going to be especially sensitive to global growth or perhaps even a lack of, and therefore this is an important chart to watch regardless.

If we break down below the bottom of the candlestick for the trading session on Wednesday, then in theory we should go looking towards the bottom of the range. Alternately, if we break the top of the shooting star, that’s a very bullish sign and could send this market towards the 0.62 handle, maybe even the 0.6250 level after that. Ultimately, I believe that it is only a matter of time before the sellers return, because if nothing else we will need to retest the bottom in order to get a bullish trend going. The 0.55 level has offered significant support, but there’s even more support below at the round 0.50 level based upon monthly charts. While I do think that we are closer to the bottom than the time, the reality is that typically the bottoming process is just that: a process. It doesn’t happen in one shot. If we do pull back it makes quite a bit of sense, because there are a lot of people out there that are still concerned about the global growth story, or the lack of story perhaps is how it should be stated. Watch the copper markets, they will give you a “heads up” as to how people are viewing the potential demand for Australian hard commodities.