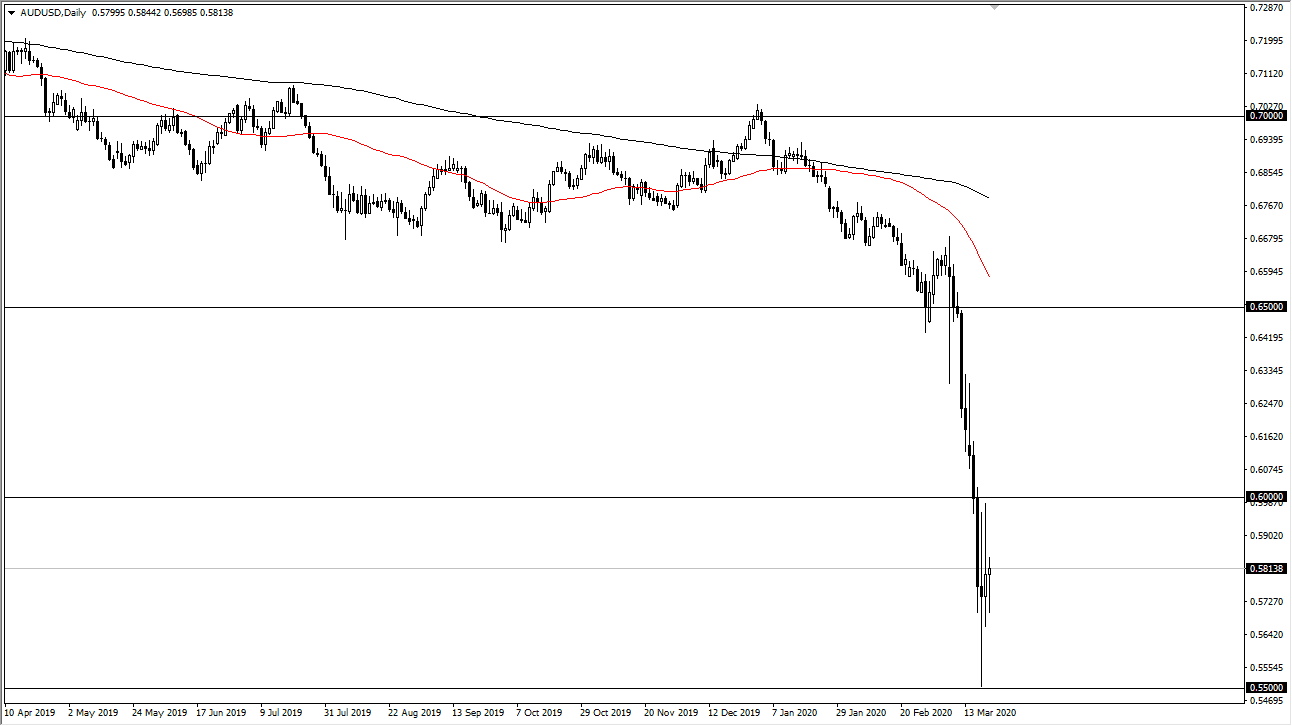

The Australian dollar has gone back and forth during the trading session on Monday to kick off the week, as we continue to hover around the 0.58 level. When you look at the chart, you can see that we have fallen as much as 300 pips from here down to the 0.55 handle, but we have also rallied all the way up to the 0.60 level during the Friday session. This being the case, it’s likely that we are going to continue to see this market try to figure out some type of range in order to stabilize after the massive price reduction in the value of the Aussie itself.

Typically, you get some type of sideways action after some massive drop like we have seen, and that leads to either forming some type of base, or a continuation pattern. Whether or not it is one or the other it will be far too early to discern, but it certainly has to be in the back of your mind right now. I believe at this point we are likely to see more back-and-forth trading than anything else, and therefore it’s crucial to look at this as a market that you should be making sideways trades on unless of course we get some type of daily close outside of this 500 point range.

The candlestick for the trading session on Monday was a bit neutral, and it is actually a good sign considering the previous two candlesticks. While they were both somewhat neutral and indecisive, the range of the candlestick for the Monday session was much smaller, so that in and of itself is a bit of a victory considering how the markets have all played out recently. Not only with the Australian dollar has it been the case, but just about anything that you can trade.

If we do break above the 0.60 level it’s likely that the market goes looking towards the 0.6250 handle, possibly even the 0.65 level after that. This of course needs some type of good news to lift the market like that, so while it is a possibility it’s not something, I’m holding my breath for. Alternately, if we break down below the 0.55 level, then it’s possible that the market goes looking towards the 0.5250 level after that. Furthermore, the Australian dollar has a huge support barrier near the 0.50 level, but that is an entirely different conversation in and of itself.