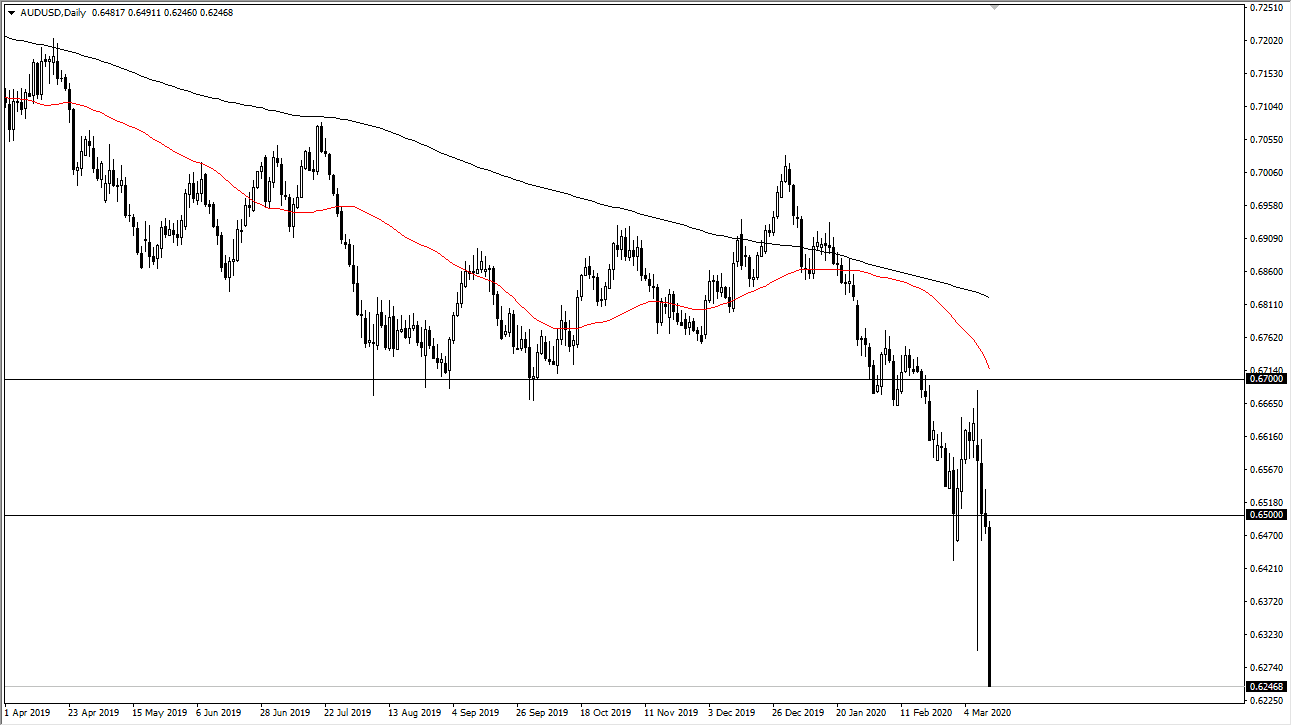

The Australian dollar broke down significantly during the trading session on Thursday, breaking the back of the massive hammer that had formed earlier this week. This is the scene of panic, and therefore I think that the best way to trade this market is going to be fading rallies. Quite frankly, there’s nothing to keep this market afloat at this point, as panic is clearly the word of the day. The Australian dollar is highly sensitive to the Chinese economy and of course the slowing down of the overall world economy due to the coronavirus, so keep that in mind as well.

I believe that we will get the occasional relief rally and that relief rally will be extraordinarily violent. However, it’s obvious that the Aussie cannot be trusted right now, meaning as every time we try to rally it only causes more economic pain for those who try to go long. The 0.65 level above is massive resistance, so I think breaking above there would be an interesting turn of events, perhaps enough to start sticking your toe in the water for long positions. We are quite a ways from there though, but when we do get some type of risk appetite relief rally, it’s going to be something massive. With that in mind I am paying close attention to what’s going on in this market, but clearly the negative candlestick shows that there is still a lot of panic out there.

That being said, I do believe that we are trying to form some type of base still, extending between the 0.65 in the 0.60 level. This is an area that has been crucial more than once, not the least of which was during the financial crisis. If we can get some type of major fiscal stimulus package out the United States, it is possible that perhaps we could get a bit of a turnaround, but I think that is going to be more of a process than a trade. One thing is for sure, you should keep your position size small but that can be said of just about any currency pair or financial market that you are involved in at the moment. Furthermore, we will probably get a lot of volatility towards the end of the day, as the market will be heading into the weekend fully aware that headlines could cross the wire to cause all kinds of chaos.