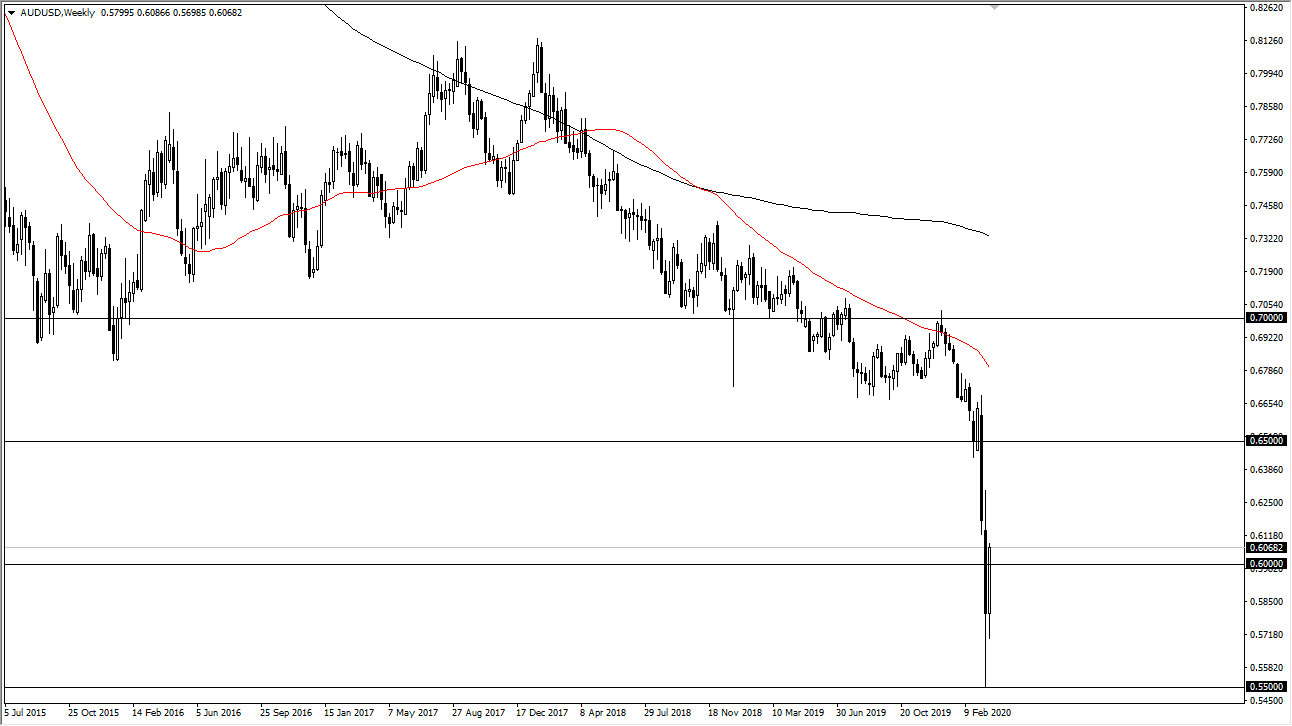

The Australian dollar has been very bearish for a while, dropping all the way down to the 0.55 level. However, we have seen the market bounce from there and even clear the 0.60 level heading into the month of April. That being said, the market is most certainly going to continue to pay attention to the longer-term trend, mainly due to the fact that there are a lot of crosswinds out there that will continue to work against the global growth, as the Chinese economy had been shut down for quite some time.

The market had a very rough month of March, as the coronavirus continues to cause major issues, as the Chinese started to get past it, but the rest of the world now finds itself in trouble. There are huge sections in the European Union, the United Kingdom, and the United States that are shut down. That of course has a major effect on global growth and with the Australian dollar being a commodity currency, it has a knock on effect over here. At this point, copper markets of course have taken a beating and that is a bit of a proxy for the Aussie itself. Furthermore, there are a lot of questions as to when the rest of the world catches up to the Chinese recovery, so therefore it’s a situation where the global growth situation is still going to be very tenuous at best. With that being the case, it’s very likely that the market will see selling pressure at one point or another during the month. The think that everything is fine, and this is all over with is a real stretch.

I believe that the real barrier is going to be the 0.65 handle, an area that is a large, round, psychologically significant figure, which by the time we get there it’s very possible that we may see the 50 week EMA reached down to that level. Any signs of exhaustion will probably be sold into, but the question now is whether or not this is a real rally and at this point I do not think so. Most of the time you will see markets retest these major bottoms before turning around. It’s very likely that happen sometime either during the month of April or May. It is because of this that I’m extraordinarily cautious when it comes to the Aussie, but it should be noted that the Federal Reserve is throwing as much money as they possibly can at markets.