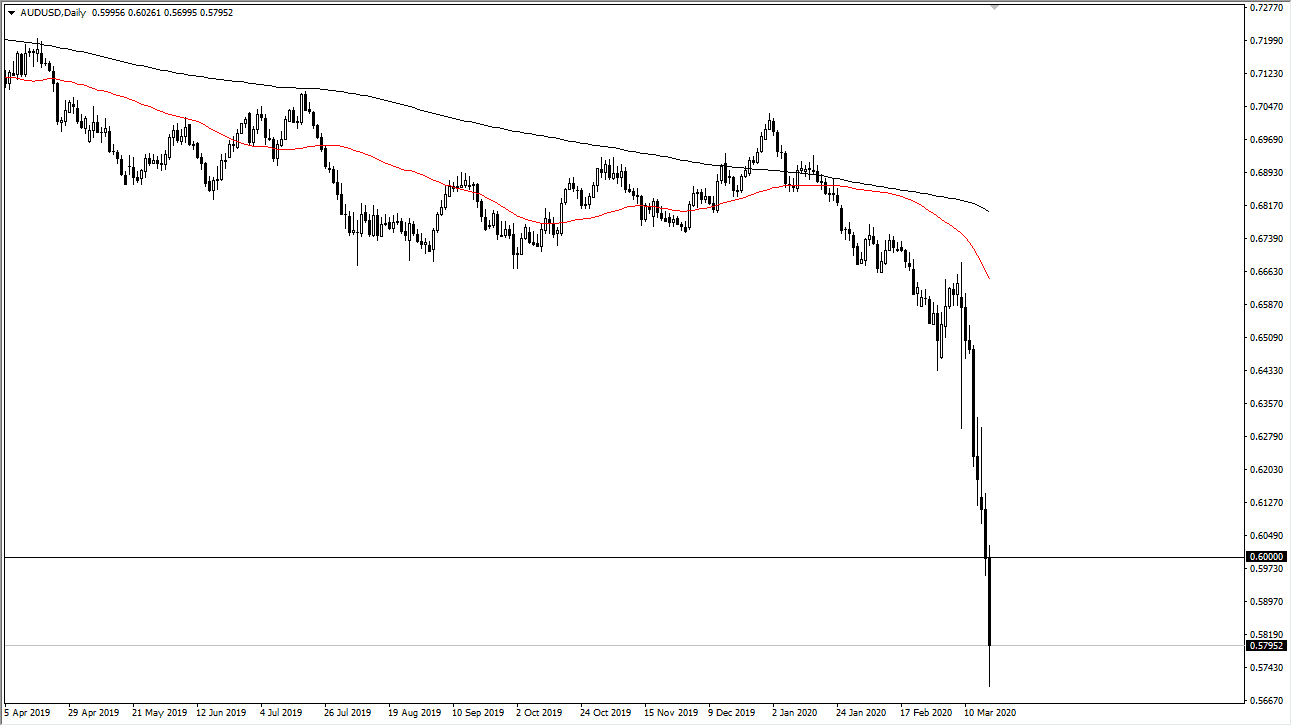

The Australian dollar has broken down significantly during trading on Wednesday, slicing through the 0.60 level in what can only be described as a major meltdown. Ultimately, the Australian dollar has suffered at the hands of the global slowdown, and it should be noted that we are now below the financial crisis lows. This is an overextension by any measure, but clearly you can’t be a buyer here. Granted, one day this will be a major “buy-and-hold” scenario, but not right now.

Ultimately, the market should show signs of relief rally is going forward but I think the 0.60 level above is the first area that I will be looking for selling opportunities. Even if we rally from there, I anticipate that the 0.61 level will also offer a potential selling opportunity as well. Granted, I do think that a longer-term “buy-and-hold” signal will appear sooner or later, but we need to see the coronavirus slowdown in places like America. This is because it will drive up demand for the goods that China produces, thereby driving up the demand for the commodities that Australian producers supply China with. If that’s going to be the case, the market should run in and look at the Aussie dollar with favor. We are not anywhere near that, so until that changes, I think it’s a matter of selling rallies.

In a sense, this was yet another “shot across the bow” for Australia, as the market is punishing the fact that Australia will certainly be hurt by global conditions, as there is no need for commodities. We have seen most of them completely rollover, and that will continue to be one of the major drivers of the Aussie dollar. Rallies at this point are not to be trusted, but if we were to break above the 0.63 level, then you could take a better look at going long but I believe that the most likely trade set up to the upside will be based upon a weekly candlestick, something that you simply buy and forget. It will be once everything recovers but, in the meantime, the latest fear driven headlines will continue to push this market to the downside as there is a huge demand for US dollars. The US dollar has been the favored currency around the world, and in an environment where there is almost no global growth, it makes sense that the Aussie is a major loser.