The Australian dollar continues to go back and forth in general as we are hanging about the 0.65 handle. Currently, the market is waiting to see whether or not the United States does some type of fiscal stimulus, and that of course will have a massive influence on risk appetite in general. Markets around the world have been struggling with the idea of the coronavirus slowing down commerce, something that is almost certain to be a major headwind. Keep in mind that the Australian dollar is commodity currency and therefore it moves right along with the idea of global growth. In order to see exactly what kind of trouble could be coming, one of the great charts to look at is copper. Copper comes from Australia, so it of course can give us a bit of a “heads up” when it comes to movement of the Aussie itself.

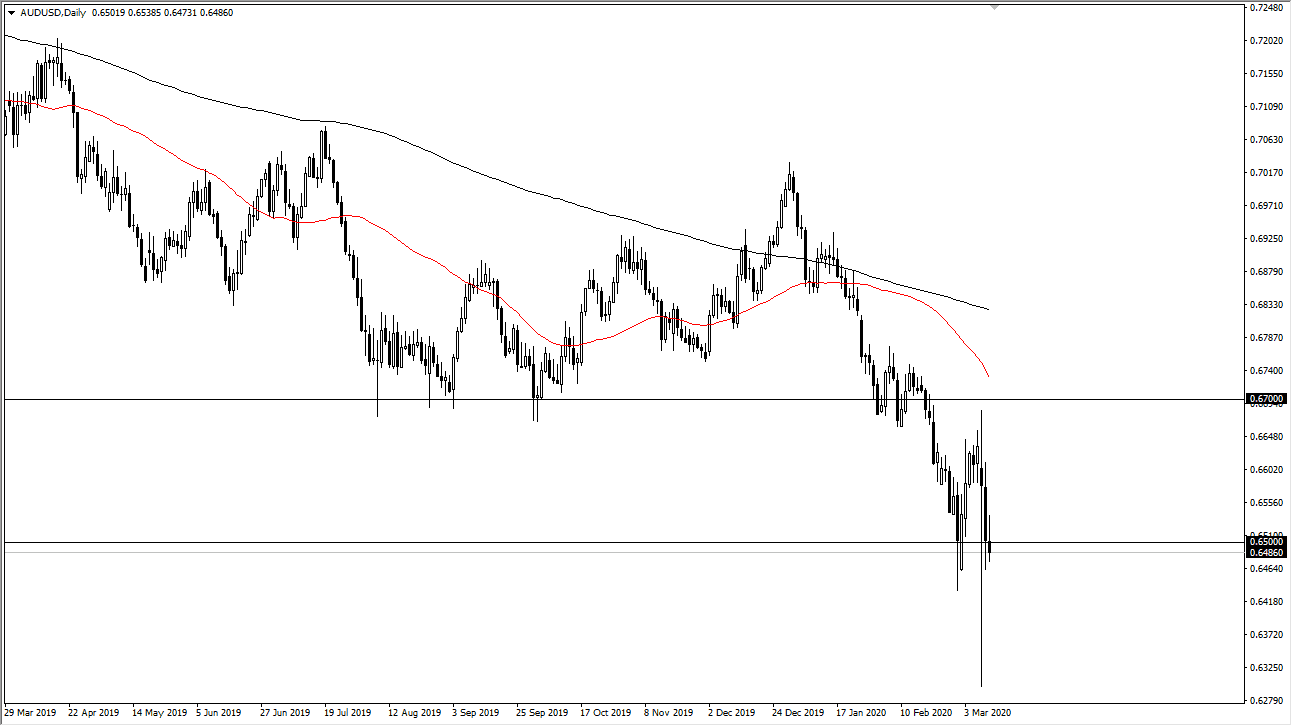

Looking at this chart, it does show a bit more weakness during the trading session, forming a bit of a shooting star like candlestick, so if we can break down below the lows of the day it’s likely that we could drop towards the 0.64 handle, maybe even the 0.63 level. I do expect the 0.63 level to offer plenty of support, as it was the bottom of the financial crisis and we did see a massive 300 PIP bounce just a couple of days ago from that region. To the upside, if we were to break above the highs from the trading session on Wednesday it could have this market looking towards the 0.67 level. A break above there would be rather bullish but at this point I don’t think it happens anytime soon. I believe that there are still far too many questions about the global growth situation which is getting more dire by the day. As long as it’s going to be the case the Australian dollar should be a bit soft. That’s not to say that we are trying to form a little bit of a base, but at this point in time it’s difficult to imagine a scenario where we get extraordinarily bullish. I suspect that rallies will continue to be sold into. Whether or not we can break down below the lows is a completely different question, but at this point I certainly believe that the Australian dollar will be a bit softer than the greenback unless of course the US embarks on some type of massive quantitative easing program.