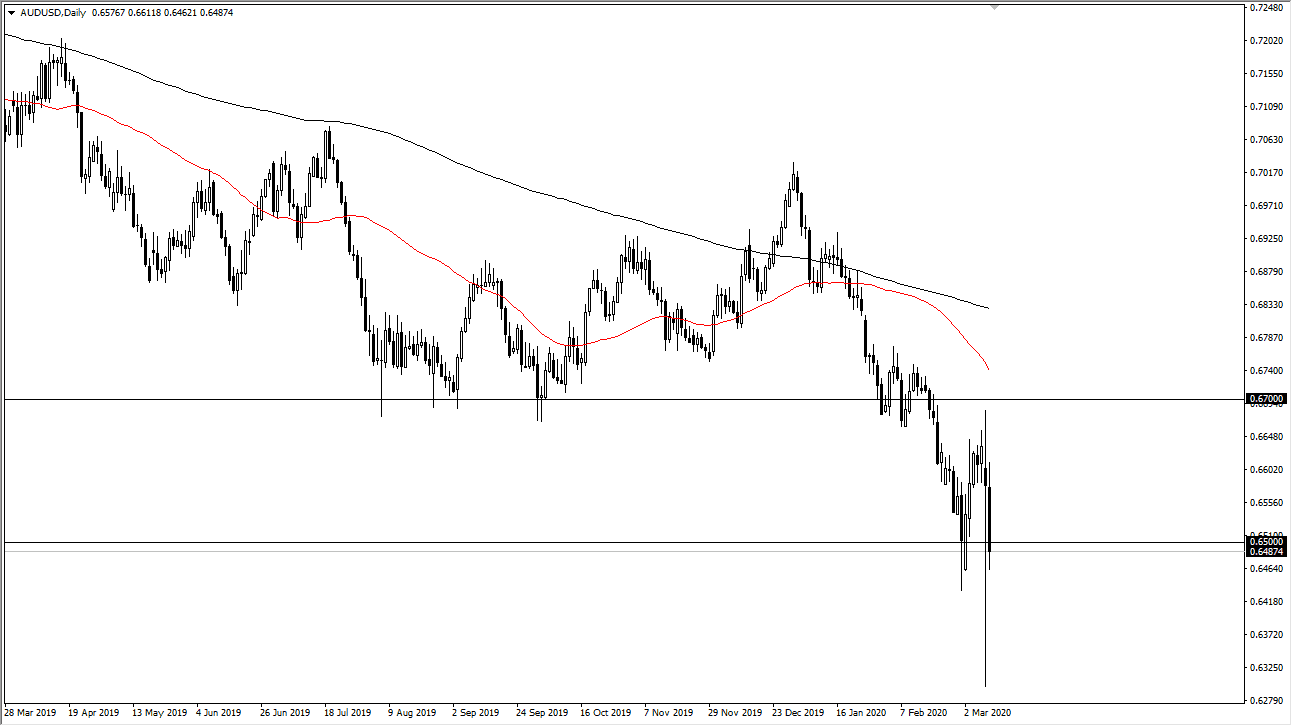

The Australian dollar broke down a bit during the trading session on Tuesday again to reach down below the 0.65 level. That’s an area that of course is a large, round, psychologically significant figure and it’s also possible that after the massive hammer that formed during the trading session on Monday, that could be plenty of support. Ultimately, this is a market that continues to see a lot of volatility, as the Australian dollar is a proxy for China and all things growth related. Ultimately, this is a market that is trying to build a bit of a base, but it may take some time to make that happen. The 0.63 level underneath has been massive support going back to the financial crisis, so it’s very unlikely to get broken without some type of major breakdown again in risk appetite.

That being said, it’s very difficult to buy the Australian dollar but the 0.65 level could be an area where buyer step in to pick up a bit of value if the US government comes in with enough fiscal stimulus to bring risk appetite back to bear. Ultimately, this is a market that I think you will see a lot of volatility and so pay attention to the absent flows of what’s going on when it comes to news and headlines.

The US dollar has been all over the place, and probably will continue to see a lot of issues. The Federal Reserve is expected to cut interest rates by another 50 basis points at the meeting later this month, but that then brings into question what the Australians will do. Keep in mind that the Australian dollar is a little bit different than many other currencies, as it is a proxy for a foreign government, in this case China. If the Chinese economy is growing, then typically the Australian dollar does fairly well. If the Chinese economy is getting better as people are starting to speculate, then we should be getting close to a bottom for the Aussie. Ultimately, you will have to pay attention to things like Chinese PMI and the like in order to get a read as to where the Aussie may go in the future. Keep your position size small, because if we do get a turnaround this is going to be a longer-term move, not something that you will look to trade in short increments.