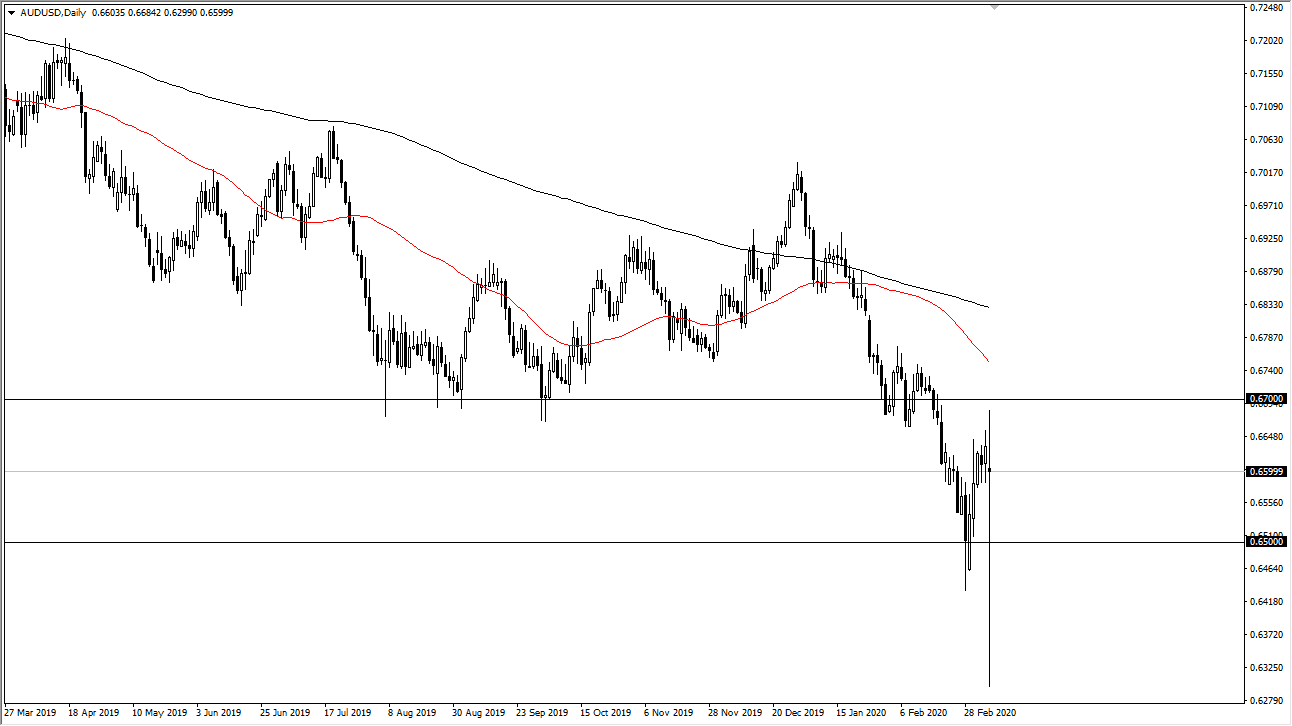

The Australian dollar has been all over the place during the trading session on Monday, breaking down towards the 0.63 level, an area that was the bottom of the financial crisis for the Aussie dollar. Consequently, the market turned around and bounced another 300 pips straight back up in the air to form a relatively neutral candlestick during the day, albeit one with a massive amount of range built into it. Because of this, the Australian dollar has shown just how all over the place it could be, and therefore it’s likely that it will continue to be difficult to trade. That being said though, I do think that the 0.63 level should end up being a major “floor” in the market, as it had been previously. However, the market breaking down below that level would signal a brand-new form of panic and could send the Aussie down to the 0.60 level. I don’t anticipate seeing that happen, but it is a possibility that we need to keep in the back of our minds.

To the upside, the 0.67 level has held as resistance as one would anticipate, so if we break the top of the 0.67 level, it would be breaking the top of a massive hammer, which is a bullish sign anyways. At this point in time, the market is likely to continue to see a lot of volatility but if we were to make that move it’s very likely that it could be the beginning of something rather big. If the market does do that, it could be yet another run on the US dollar, as it has been bashed quite significantly over the last couple of trading days.

Keep in mind that the Australian dollar is highly levered to China though, so it is important to pay attention to what’s going on over there. With that, it’s very likely that the market will continue to pay attention to the coronavirus and whether or not it is settling down in the mainland. If it is, that could be reason enough to get the Aussie going as there will be more demand for Australian commodities out of China. However, it should be noted that there are a lot of concerns out there right now it is difficult to imagine a scenario where market suddenly take off in a “risk on” type of situation.