Despite the record-breaking contraction in the Chinese manufacturing and non-manufacturing PMI’s February, resulting from Covid-19, financial markets started the new trading week in recovery mode. The Australian Dollar, the primary Chinese Yuan proxy currency, was able to reverse off of extreme oversold conditions. Economic data out of Australia came in above expectations, sparking a short-covering rally in the AUD/SGD. Rising bullish momentum is likely to extend the breakout farther to the upside.

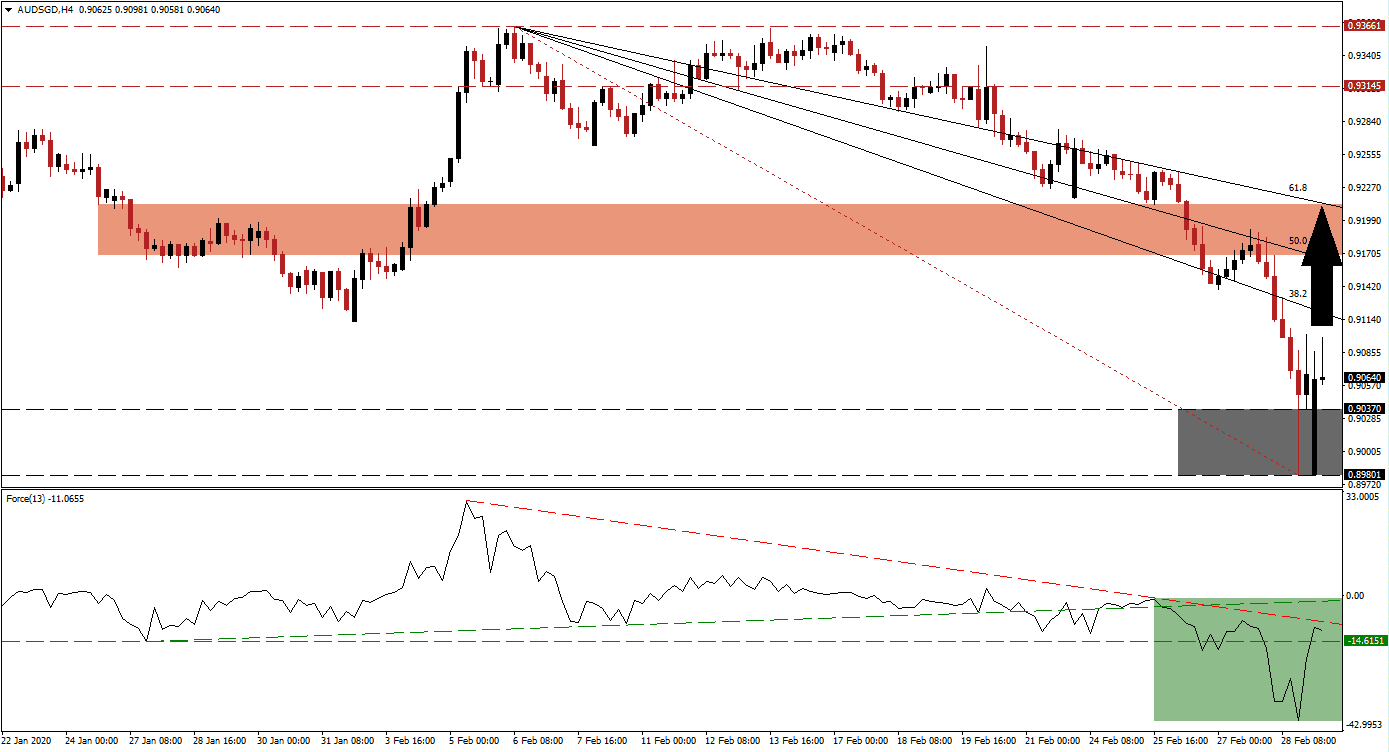

The Force Index, a next-generation technical indicator, plunged to a 2020 low before from where it was able to spike higher. It led to the conversion of its horizontal resistance level into support, as marked by the green rectangle. A breakout above its descending resistance level is awaited. The Force Index is then anticipated to retake its ascending support level, which currently acts as resistance. Bulls will be in charge of the AUD/SGD once this technical indicator moves into positive territory.

After this currency pair completed a breakout above its support zone located between 0.89801 and 0.90370, as marked by the grey rectangle, price action is on track to challenge its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to monitor the intra-day low of 0.91123, the low of a previous correction leading to an advance, from where the starting-point of the current Fibonacci Retracement Fan sequence emerged. A move above this level is favored to result in the addition of new net buy orders in the AUD/SGD. You can learn more about a breakout here.

Volatility is expected to remain elevated as markets price central bank actions into assets. A series of potentially coordinated interest rate cuts could be announced, but it remains premature to assume they are guaranteed. More economic data will be necessary to assess the potential damage from the virus. The AUD/SGD should be able to extend its breakout into its short-term resistance zone located between 0.91688 and 0.92131, as marked by the red rectangle. More upside will require a fresh catalyst.

AUD/SGD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.90650

Take Profit @ 0.92100

Stop Loss @ 0.90200

Upside Potential: 145 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 3.22

In case of a reversal in the Force Index, enforced by its descending resistance level, the AUD/SGD could attempt a second breakdown. Given the fundamental outlook for this currency pair, in conjunction with the extreme oversold nature of price action, the downside potential from the current level is limited. Forex traders are recommended to view a breakdown as a great long-term buying opportunity. The next support zone is located between 0.88716 and 0.89004.

AUD/SGD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.89750

Take Profit @ 0.89000

Stop Loss @ 0.90100

Downside Potential: 75 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.14