Australia reported a more significant trade surplus for January than forecast, but marginally lower than the one announced in December. Imports as well as exports contracted by 3.0% monthly. It failed to provide a boost to the Australian Dollar, forcing the advance in the AUD/NZD to pause inside of its resistance zone. Bullish momentum is fading, making price action vulnerable to a temporary profit-taking sell-off. The long-term uptrend is favored to remain intact.

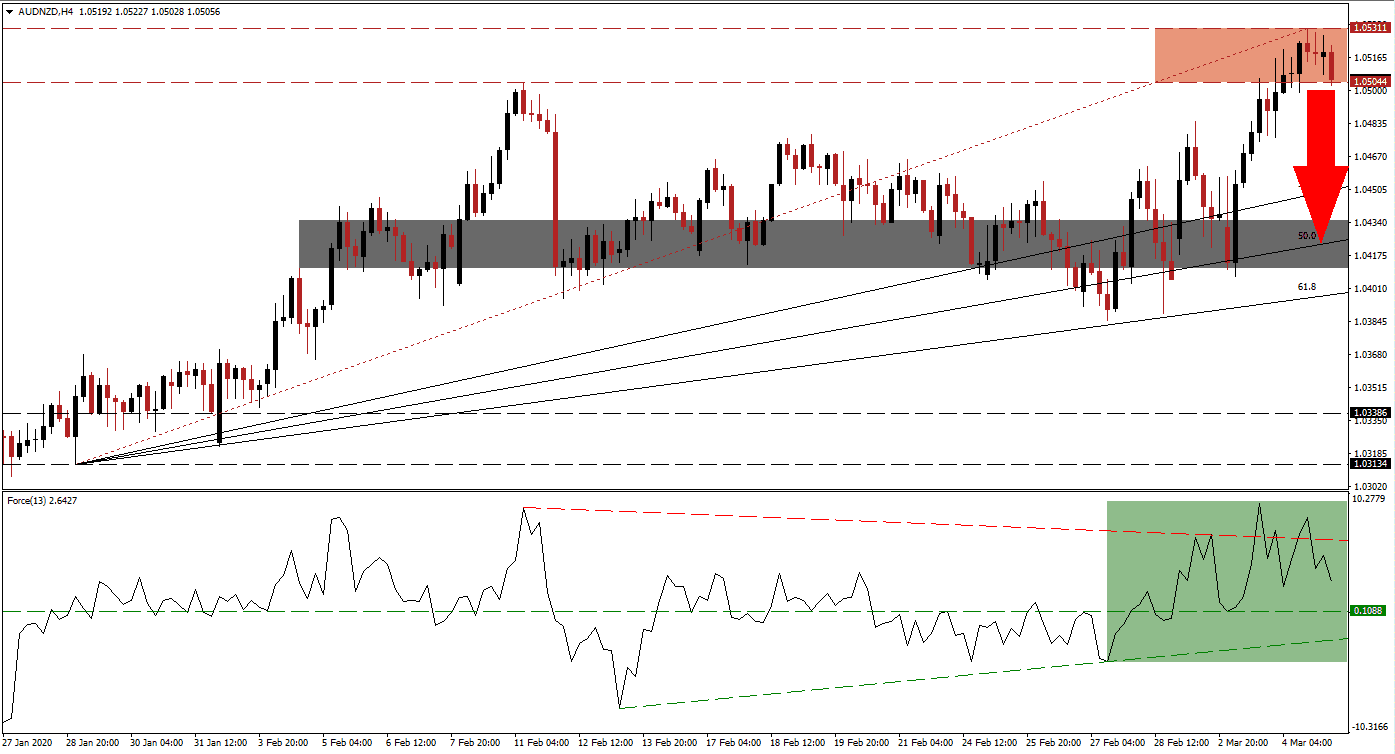

The Force Index, a next-generation technical indicator, confirmed the preceding advance in this currency pair with a fresh 2020 high. After the AUD/NZD recorded a new intra-day high for this year, the Force Index reversed below its shallow descending resistance level, as marked by the green rectangle. A contraction below its horizontal support level into negative conditions is expected to take it into its ascending support level. You can learn more about the Force Index here.

A breakdown below its resistance zone located between 1.05044 and 1.05311, as marked by the red rectangle, is likely to trigger a healthy sell-off. It will ensure the longevity of the dominant bullish trend in the AUD/NZD. Forex traders are recommended to monitor the intra-day high of 1.04845, the peak of a previous advance, which was reversed into its ascending 50.0 Fibonacci Retracement Fan Support Level. A push below it is anticipated to result in the addition of new net short positions.

Following a breakdown, this currency pair will be in track to close the gap to its 38.2 Fibonacci Retracement Fan Support Level. A slide into its next support zone located between 1.04112 and 1.04355, as marked by the grey rectangle, is favored to follow. The 50.0 Fibonacci Retracement Fan Support Level enforces this zone, likely to mark an end to the corrective phase in the AUD/NZD. Risks of an interest rate cut by the Reserve Bank of New Zealand, following the one by the Reserve Bank of Australia, ensures a long-term bullish bias for price action. You can learn more about a support zone here.

AUD/NZD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.05100

Take Profit @ 1.04250

Stop Loss @ 1.05350

Downside Potential: 85 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 3.40

In the event of a breakout in the Force Index above its descending resistance level to a new 2020 high, the AUD/NZD is expected to attempt a breakout and extend its advance. A short-term correction is necessary for continued healthy advance, delaying one now will position this currency pair for one at a later stage. The next resistance zone awaits price action between 1.06363 and 1.06690.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.05500

Take Profit @ 1.06350

Stop Loss @ 1.05200

Upside Potential: 85 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.83