Price action in the AUD/NZD stabilized inside of its support zone after the Reserve Bank of Australia (RBA) cut interest rates by 25 basis points to an all-time low of 0.25%. It was an unscheduled emergency cut, the second reduction in March. The Australian government is considering a second stimulus following the initial A$17.6 billion aid package while the central bank will start its quantitative easing program in the form of bond purchases. This currency pair found support at parity, and with bullish momentum rising, a breakout is anticipated to spark a short-term reversal.

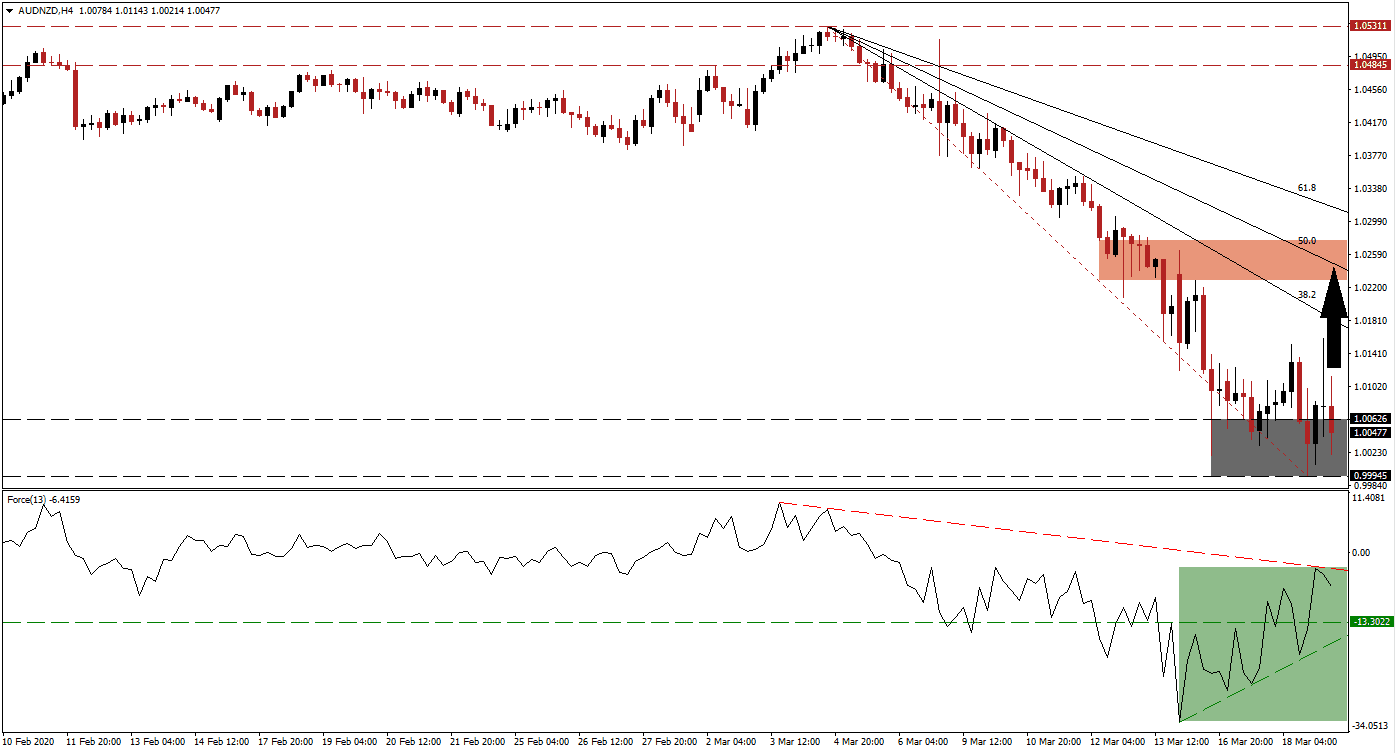

The Force Index, a next-generation technical indicator, offered an early sign that a recovery is forming with the emergence of a positive divergence. This currency pair extended its slide into its support zone, but the Force Index advanced off of a new 2020 low. It has since converted its horizontal resistance level into support, assisted by its ascending support level. After reaching its descending resistance level, the advance stalled, and this technical indicator drifted lower. Bears remain in control of the AUD/NZD until a breakout into positive territory materializes.

Following today’s RBA action, Australia and New Zealand both feature interest rates of 0.25%. Given the size and strength of the former’s economy, as compared to the latter, parity in the AUD/NZD does not reflect underlying fundamentals. A breakout in this currency pair above its support zone located between 0.99945 and 1.00626, as marked by the grey rectangle, is expected to spark a short-covering rally, closing the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. You can learn more about a support zone here.

One essential level to monitor is the intra-day high of 1.01590, the peak of the reversed breakout. A maintained push higher will clear the path for the AUD/NZD to recover into its short-term resistance zone. This zone is located between 1.02281 and 1.02761, as marked by the red rectangle. The 50.0 Fibonacci Retracement Fan Resistance Level is passing through it, enforcing the dominant bearish trend. A breakout is possible but will require a new fundamental catalyst to farther elevate price action out of extreme oversold conditions.

AUD/NZD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.00450

Take Profit @ 1.02250

Stop Loss @ 0.99900

Upside Potential: 180 pips

Downside Risk: 55 pips

Risk/Reward Ratio: 3.27

In case of a breakdown in the Force Index below its ascending support level, the AUD/NZD could be temporarily pressured to the downside. The fundamental outlook for this currency pair is developing a bullish bias, limiting the downside potential below parity. Forex traders are advised to consider a push below 1.00000 as an outstanding buying opportunity, with the next support zone identified between 0.98990 and 0.99240.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.99700

Take Profit @ 0.99250

Stop Loss @ 0.99900

Downside Potential: 45 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.25