Australia announced its first stimulus package since the 2008 global financial crisis in response to economic disruptions related to Covid-19. The A$17.6 billion aid package follows the 25 basis point interest rate cut to a historic low of 0.50%. Roughly 6.5 million Australians on government benefits will qualify for an A$750 cash payment. Business, apprentices, and the tourism sector will receive A$12 billion in aid over the next three months in an attempt to avert a potential recession. New Zealand appears behind the curve, positioning the AUD/NZD for recovery off of its support zone.

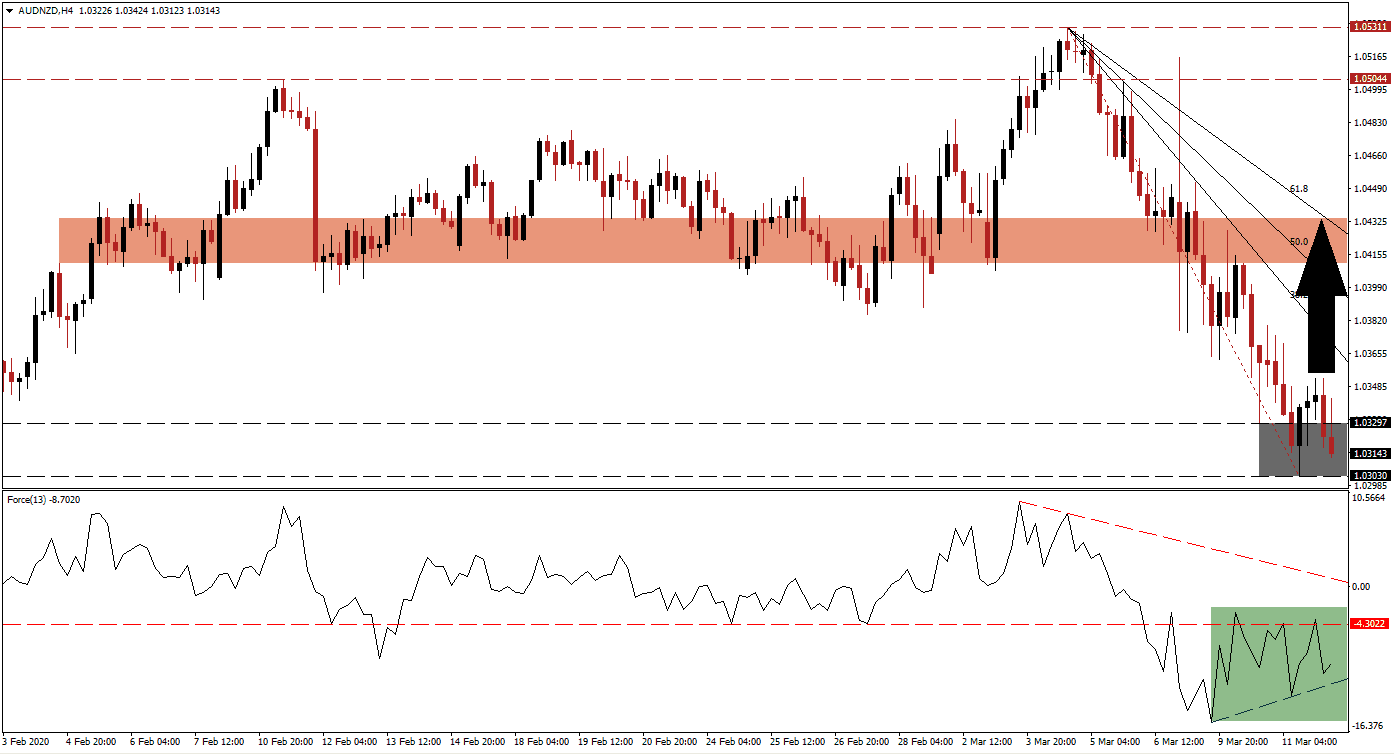

The Force Index, a next-generation technical indicator, contracted from a new 2020 high to a fresh 2020 low after the AUD/NZD recorded a new peak for the year. The Force Index now offers a reversal indicator with the formation of a positive divergence. Bullish momentum is on the rise, and the ascending support level is expected to pressure this technical indicator above its horizontal resistance level until it can challenge its descending resistance level, as marked by the green rectangle.

Price action is anticipated to stabilize inside of its support zone from where a short-covering rally is favored to materialize. This zone is located between 1.03030 and 1.03297, as marked by the grey rectangle. Forex traders are recommended to monitor the intra-day high of 1.03528, the peak of the previously reversed breakout attempt in the AUD/NZD. A push above this level is likely to result in the addition of new net buy orders in this currency pair, providing necessary upside pressure. You can learn more about a breakout here.

New Zealand finance minister Robertson admitted the economy has yet to face the impact of Covid-19, designated as a global pandemic yesterday by the World Health Organization. The delayed response could increase short-term pressures on the New Zealand Dollar, providing a fundamental catalyst for the AUD/NZD. A recovery into its short-term resistance zone located between 1.04112 and 1.04340, as marked by the red rectangle, and enforced by its descending 61.8 Fibonacci Retracement Fan Resistance Level is expected to unfold. More upside will require a new catalyst but remains a possibility.

AUD/NZD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.03150

Take Profit @ 1.04300

Stop Loss @ 1.02850

Upside Potential: 115 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.83

In case of a contraction in the Force Index below its ascending support level, the AUD/NZD may attempt a breakdown. Given the developing fundamental scenario, supported by technical developments, the downside potential appears extremely limited. The next support zone awaits price action between 1.01680 and 1.02140. Forex traders are advised to consider this an excellent buying opportunity.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.02600

Take Profit @ 1.02000

Stop Loss @ 1.02850

Downside Potential: 60 pips

Upside Risk: 25pips

Risk/Reward Ratio: 2.40