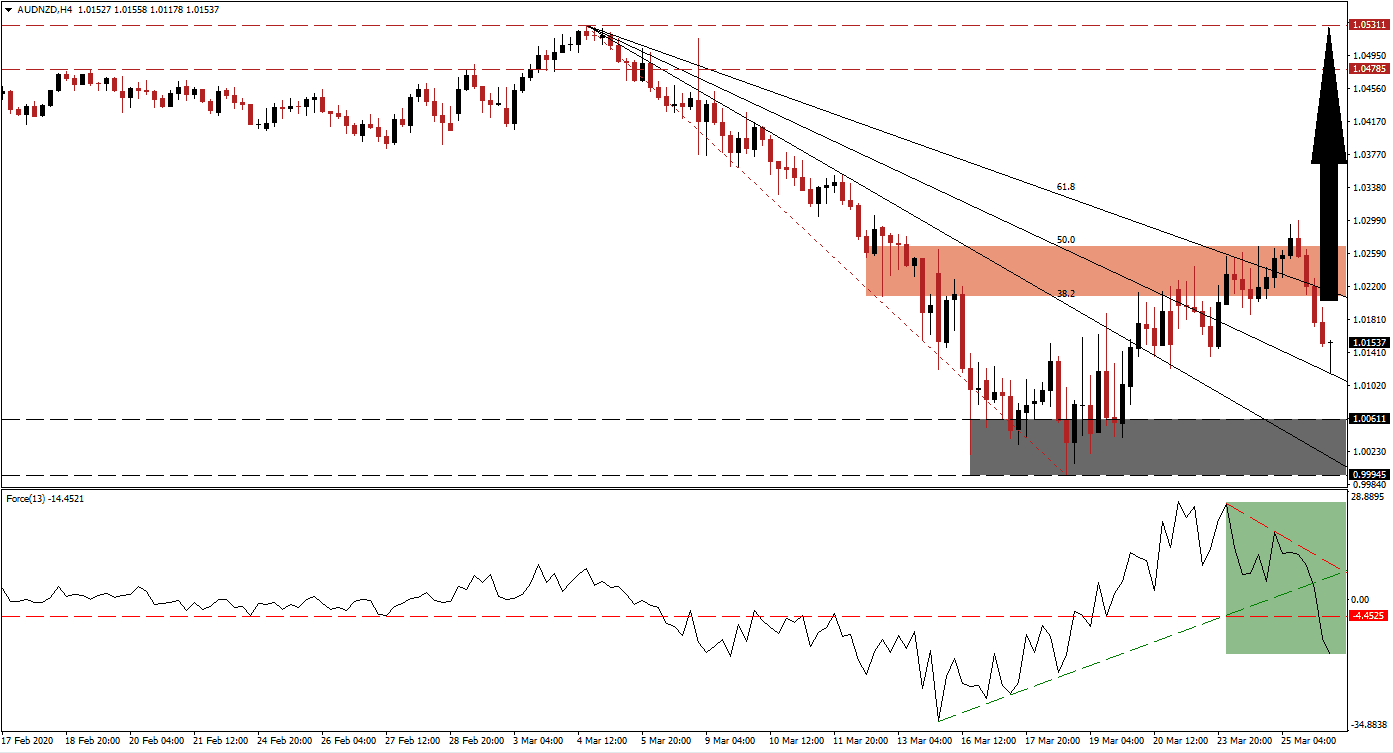

Australia and New Zealand have announced economic relive packages, while bot central banks announced quantitative easing measures after slashing interest rates to 0.25%. Covid-19 is anticipated to end Australia’s remarkable 28 years of growth and force the country into a recession. PMI data indicated the steepest drop on record, led by the services sector. The AUD/NZD briefly dipped below parity before staging a reversal, which took it above its short-term resistance zone. Price action reversed the breakout but bounced higher off of its descending 50.0 Fibonacci Retracement Fan Support Level.

The Force Index, a next-generation technical indicator, shows the retreat in bullish momentum, enforced by its descending resistance level, following two lower highs. It sufficed to pressure the Force Index below its ascending support level, and converted its horizontal support level into resistance, as marked by the green rectangle. This technical indicator additionally moved into negative territory, ceding control of the AUD/NZD to bears. A momentum recovery is anticipated with the Force Index well above its previous low.

Given the size of the Australian economy compared to New Zealand, the move towards parity is not based on fundamental conditions. While the Australian Dollar remains the primary Chinese Yuan proxy currency, the New Zealand Dollar is heavily exposed to China’s economy. The breakout in the AUD/NZD above its support zone located between 0.99945 and 1.00611, as marked by the grey rectangle, is well-positioned to result in a more massive advance. You can learn more about a support zone here.

Forex traders are advised to monitor price action as it drifts into its 61.8 Fibonacci Retracement Fan Support Level, which just crossed below the short-term resistance zone located between 1.02080 and 1.02679, as identified by the red rectangle. A sustained breakout is favored to attract new net buy orders. It will provide a catalyst, allowing the AUD/NZD to accelerate into its long-term resistance zone, which awaits between 1.04785 and 1.05311. The current reversal in this currency pair represents a healthy pause, ensuring the longevity of the developing bullish trend.

AUD/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.01550

Take Profit @ 1.04850

Stop Loss @ 1.00800

Upside Potential: 330 pips

Downside Risk: 75 pips

Risk/Reward Ratio: 4.40

In case of a continued contraction in the Force Index, further away from its descending resistance level, the AUD/NZD may challenge its support zone and parity once again. A breakdown is unlikely, due to developing fundamental conditions. Forex traders are highly recommended to consider any drop to parity as an excellent long-term buying opportunity in this currency pair.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.00550

Take Profit @ 1.00000

Stop Loss @ 1.00800

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20