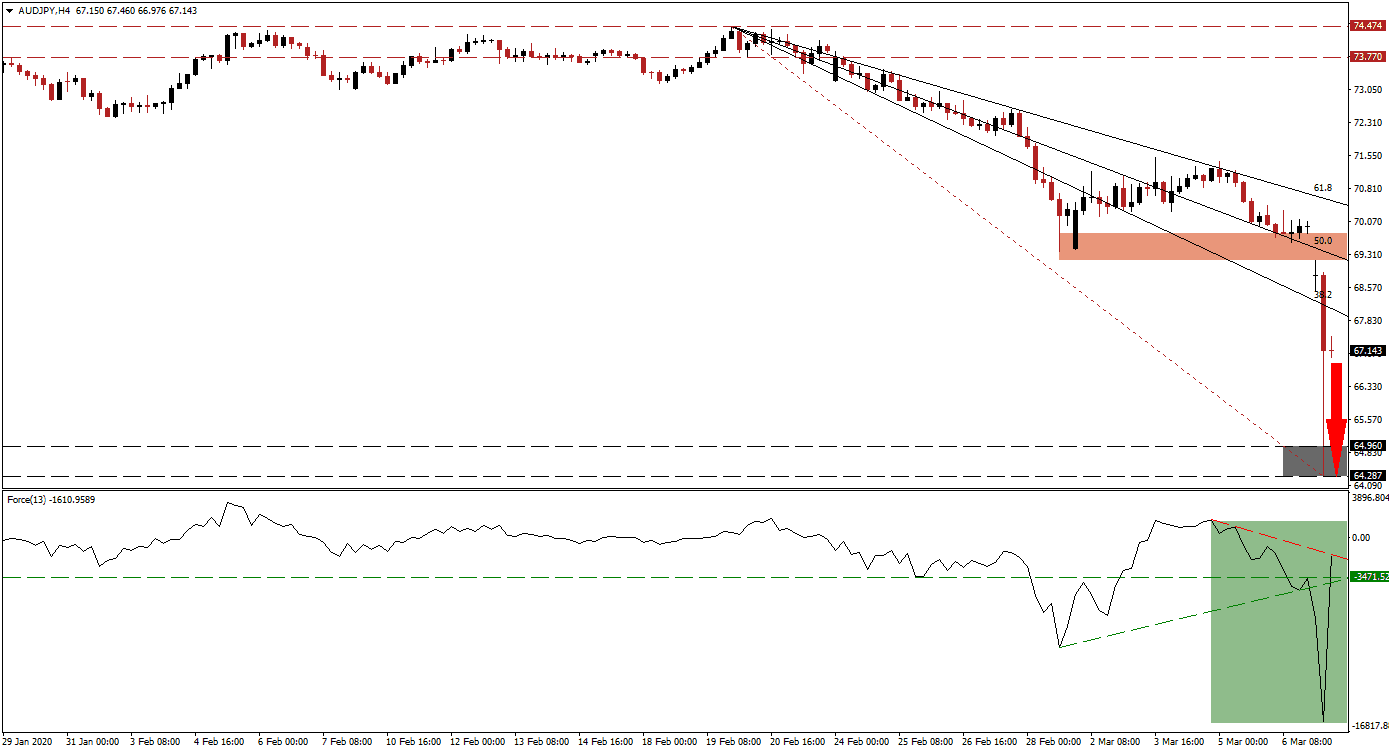

Friday’s OPEC+ deal collapse sent oil prices tumbling, creating more massive concerns for financial markets than Covid-19 related economic disruptions. The current deal between OPEC members and Russia to limit supply will expire at the end of March. Saudi Arabia vowed to spike production as the strategy is shifting from price stability to increasing market share. Oil prices collapsed, and the Japanese Yen experienced a flash crash. After the AUD/JPY plunged to a support zone dating back to March 2009, a quick retracement spanning roughly 50% of the crash emerged.

The Force Index, a next-generation technical indicator, collapsed to a fresh 2020 low in unison with the flash crash in the Japanese Yen. An equally violent recovery took it back above its ascending support level and converted its horizontal resistance level into support. More downside is favored with the Force Index at its descending resistance level, as marked by the green rectangle. This technical indicator maintains its position in negative territory, granting bears control of the AUD/JPY. You can learn more about the Force Index here.

After this currency pair plunged into its support zone located between 64.287 and 64.960, as marked by the grey rectangle, a short-covering rally materialized. It is typical price action behavior, and more downside in the AUD/JPY is anticipated to follow the flash crash. The Australian Dollar is a commodity currency, exposed to the price war in oil. Forex traders should expect a retest of the support zone from where an extension of the breakdown sequence cannot be excluded.

While a spike in price action into its descending 38.2 Fibonacci Retracement Fan Resistance Level may unfold, it will represent a selling opportunity before the resumption of the sell-off. The short-term resistance zone will be lowered after rejection in the AUD/JPY by its 38.2 Fibonacci Retracement Fan Resistance Level. This zone is currently located between 69.171 and 69.803, as marked by the red rectangle, including a price gap to the downside. Dismal Japanese economic data failed to prevent the crash, and the Bank of Japan may intervene. You can learn more about a price gap here.

AUD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 67.150

Take Profit @ 64.300

Stop Loss @ 68.000

Downside Potential: 285 pips

Upside Risk: 85 pips

Risk/Reward Ratio: 3.35

In case of a sustained breakout in the Force Index above its descending resistance level, the AUD/JPY may attempt a push to the upside. Given developing fundamental conditions, supported by the dominant technical scenario, any breakout appears limited to its 50.0 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to consider any price spike as an improved short-entry level.

AUD/JPY Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 68.550

Take Profit @ 69.150

Stop Loss @ 68.250

Upside Potential: 60 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.00