Australia announced its initial A$17.6 stimulus, an A$90 billion three-year funding facility created by the Reserve Bank of Australia on top of a reduction in interest rates to 0.25%, and up to A$15 billion in loans for small businesses. Conditions materially worsened and prompted the government to issue an additional A$66 billion package, labeled an economic lifeline. Prime Minister Morrison did stress the government cannot fix all of the pending hardship, urging Australian’s not to allow Covid-19 to break their spirits. The AUD/JPY partially reversed its breakout, but bullish momentum continues to rise.

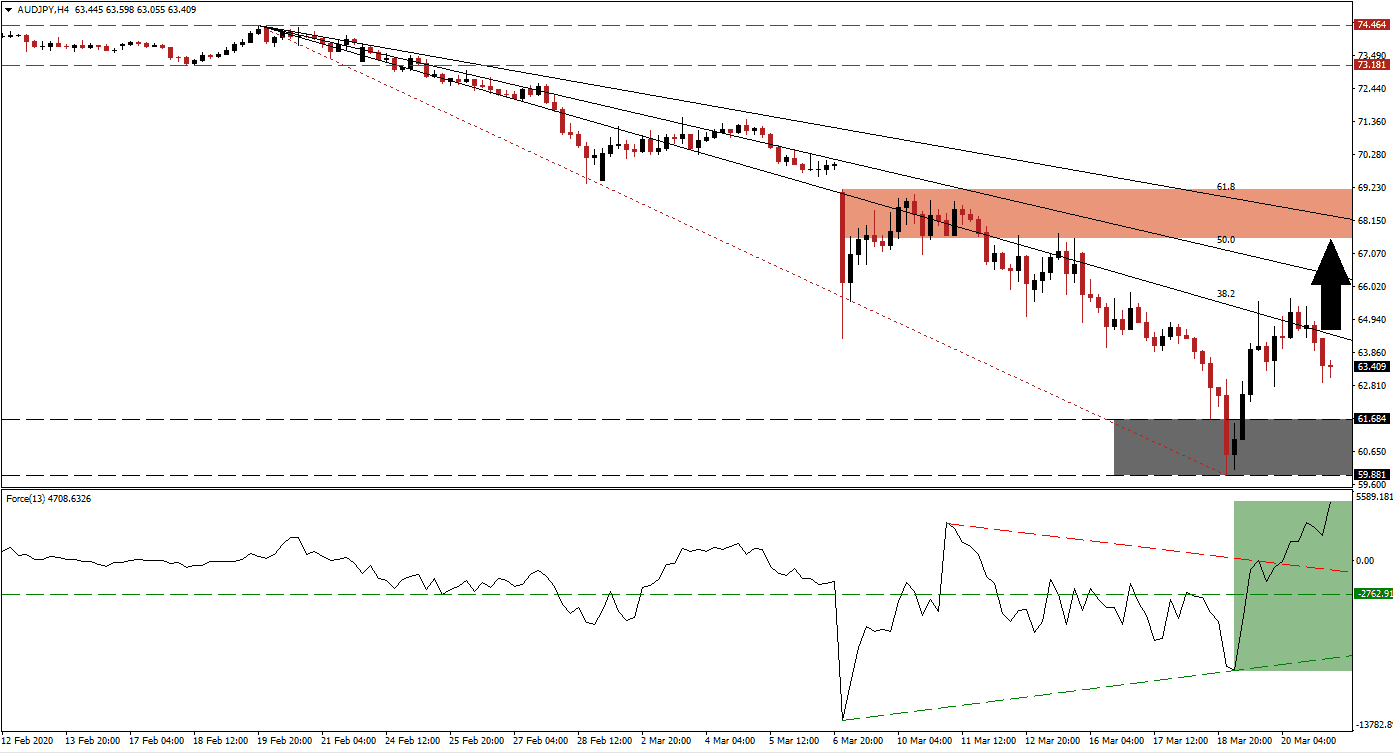

The Force Index, a next-generation technical indicator, formed a positive divergence before this currency pushed out of its support zone. Following the bounce off of its ascending support level, the horizontal resistance level was converted into support, as marked by the green rectangle. This technical indicator then accelerated through its descending resistance level and into positive territory, ceding control of the AUD/JPY to bulls. A renewed push higher is favored to emerge. You can learn more about the Force Index here.

After price action completed a breakout above its support zone located between 59.881 and 61.684, as marked by the grey rectangle, it was rejected by its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are now advised to monitor the intra-day low of 64.329, the low of a price gap to the downside, which initiated the current section of the sell-off in the AUD/JPY. A sustained move higher is anticipated to invite the addition of new net long positions, adding to upside pressures.

This currency pair is well-positioned to recover into its short-term resistance zone, enforced by its 61.8 Fibonacci Retracement Fan Resistance Level, which maintains the bearish chart pattern. This zone is located between 67.556 and 69.154, as identified by the red rectangle, and the top range forms the bottom of the previously noted price gap to the downside. Volatility in the AUD/JPY is likely to remain elevated. Further upside is possible, but a new fundamental catalyst is necessary. You can learn more about a resistance zone here.

AUD/JPY Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 63.400

Take Profit @ 67.900

Stop Loss @ 62.300

Upside Potential: 450 pips

Downside Risk: 110 pips

Risk/Reward Ratio: 4.09

In case of a reversal in the Force Index below its ascending support level, the AUD/JPY is expected to challenge the low of its current support zone. Given the extreme oversold nature of this currency pair, coupled with developing fundamental conditions, the downside potential remains depressed. A minor support zone awaits price action between 58.080 and 58.520, dating back to January 2009. Forex traders are recommended to consider any breakdown from current levels as a buying opportunity.

AUD/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 61.300

Take Profit @ 58.500

Stop Loss @ 62.300

Downside Potential: 280 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 2.80