Fourth-quarter Australian GDP surprised to the upside, eliminating fears of a technical recession in the first quarter. China reported its biggest slump in service sector activity for February, following a similar contraction in manufacturing. The Hong Kong and Australian service sectors posted PMI readings below 50.0, confirming contraction in February. After the Reserve Bank of Australia cute interest rates yesterday by 25 basis points to an all-time low of 0.50%, the AUD/CHF was able to maintain its breakout. More upside is favored to follow backed by a recovery in bullish momentum.

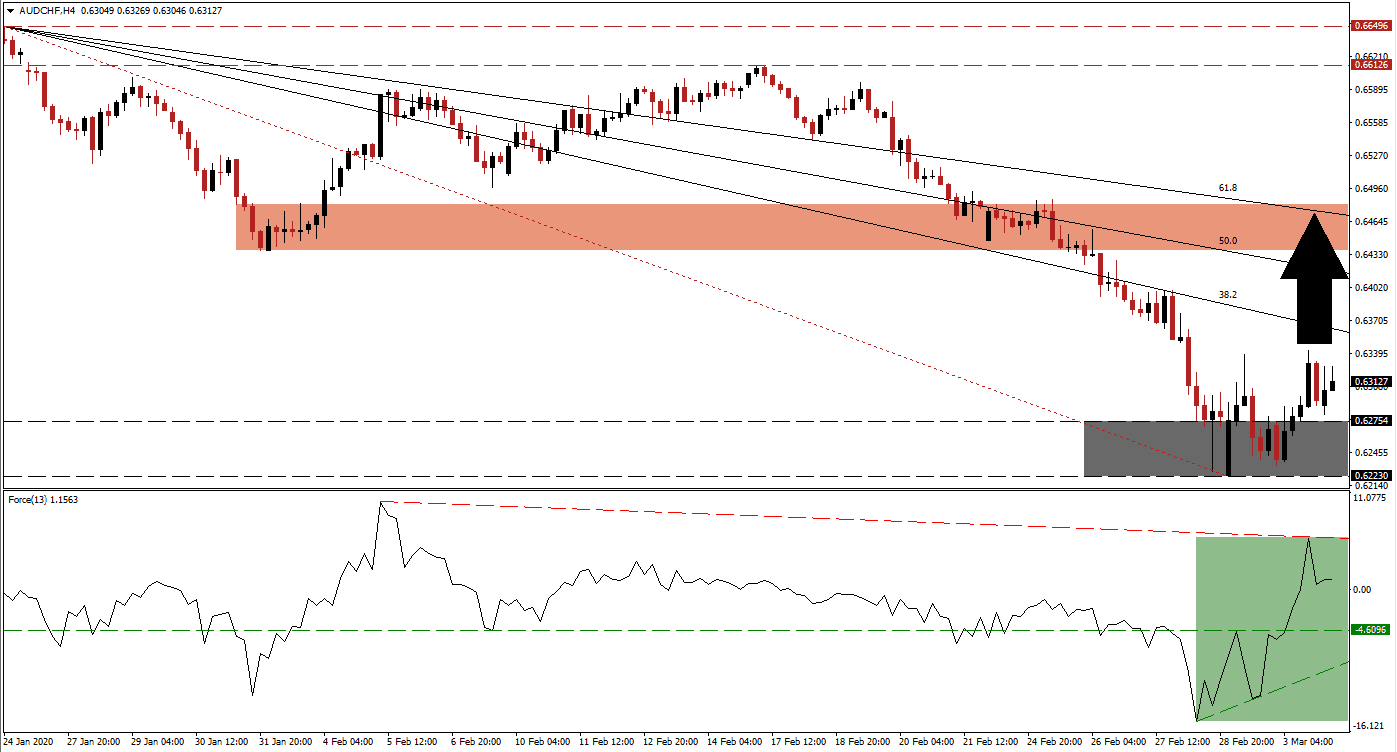

The Force Index, a next-generation technical indicator, confirmed the breakout in price action. An ascending support level allowed for an acceleration to the upside. It resulted in a conversion of the horizontal resistance level into support, as marked by the green rectangle. This technical indicator additionally crossed into positive territory, placing bulls in control of the AUD/CHF. An extension of the advance is expected until it can challenge its descending resistance level.

Safe-haven demand for the Swiss Franc has eased despite the continued spread of Covid-19, adding to bullish pressures in this currency pair. Following the breakout above its support zone located between 0.62230 and 0.62754, as marked by the grey rectangle, the AUD/CHF will test its descending 38.2 Fibonacci Retracement Fan Resistance Level. The Swiss National Bank remains active via direct market manipulation, supporting its export-oriented economy through a weaker currency. A change in the dominant bearish downtrend, therefore, is unlikely. You can learn more about the Fibonacci Retracement Fan here.

A push into its short-term resistance zone located between 0.64376 and 0.64813, as marked by the red rectangle, is anticipated to follow the sustained breakout in the AUD/CHF. The 61.8 Fibonacci Retracement Fan Resistance Level has entered this zone, marking a potential end to the counter-trend advance. It will keep the long-term downtrend intact. Swiss GDP data for the fourth-quarter surprised to the upside yesterday, but the focus is shifting towards first-quarter data. The severity of virus-related economic disruptions is mispriced, positioning financial markets for more volatility.

AUD/CHF Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.63100

Take Profit @ 0.64750

Stop Loss @ 0.62600

Upside Potential: 165 pips

Downside Risk: 50 pips

Risk/Reward Ratio: 3.30

In the event of a contraction in the Force Index below its ascending support level, the AUD/CHF is likely to attempt a breakdown. This currency pair is trading near all-time lows. Failure to correct farther to the downside after yesterday’s interest rate cut suggests resilience. The next support zone awaits price action between 0.61645 and 0.61830. Forex traders may cautiously consider this as a long-term buying opportunity.

AUD/CHF Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 0.62100

Take Profit @ 0.61650

Stop Loss @ 0.62300

Downside Potential: 45 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.25