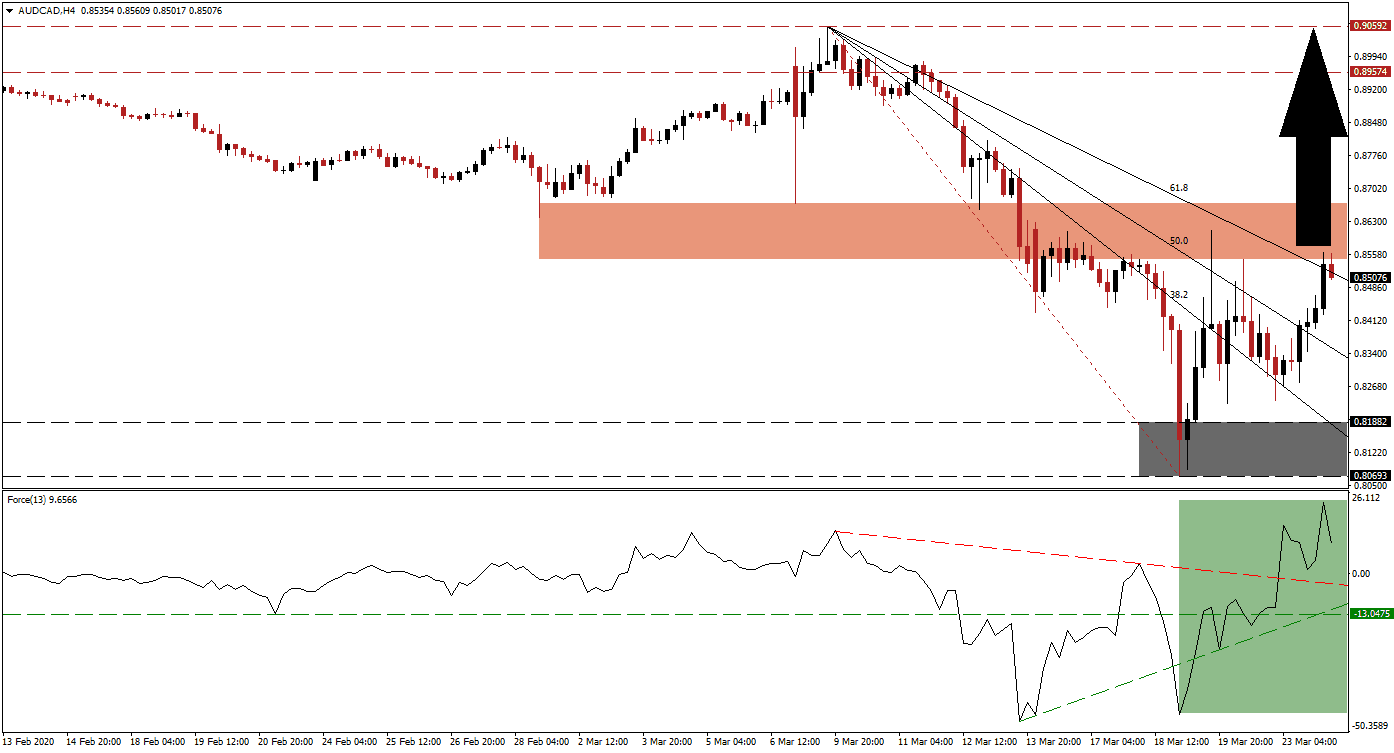

While the Australian government rushed through to economic stimulus packages worth A$83.6 billion, it will now enter a five-month recess. The first direct payment is not scheduled to be sent until April 27th, indicating a lack of urgency and stoking fears that assistance to businesses will arrive too late. Despite concerns, Canada is facing more severe problems. It allowed the AUD/CAD to use the momentum from its breakout above its support zone to push trough its entire Fibonacci Retracement Fan sequence.

The Force Index, a next-generation technical indicator, recovered from a brief drop below its ascending support level. Bullish momentum converted its horizontal resistance level and its descending resistance level into support, as marked by the green rectangle. The Force Index retreated from its peak and is expected to challenge its descending support level before spiking higher. After completing a crossover above the 0 center-line, bulls took control of the AUD/CAD. You can learn more about the Force Index here.

A short-covering rally in the AUD/CAD materialized following the collapse in price action into its support zone located between 0.80693 and 0.81882, as identified by the grey rectangle and levels not reached since March 2009. The Australian finance minister was granted A$40 billion to utilize without parliament approval, adding a minimal safety net under the deteriorating economy. Major Canadian banks have issued second-quarter GDP contraction estimates between 10% and 24%, placing the country on track for the worst collapse since the 1960s. All believe the second-half will see a massive rebound in consumer activity.

This currency pair is now faced with its short-term resistance zone located between 0.85468 and 0.86711, as marked by the red rectangle. Price action is likely to struggle temporarily before using it’s converted descending 61.8 Fibonacci Retracement Fan Support Level to push through its short-term resistance zone. It will clear the path for an extension of the breakout sequence in the AUD/CAD into its long-term resistance zone identified between 0.89574 and 0.90592, baring unforeseen fundamental shocks.

AUD/CAD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.85150

Take Profit @ 0.90000

Stop Loss @ 0.83650

Upside Potential: 485 pips

Downside Risk: 150 pips

Risk/Reward Ratio: 3.23

In case the Force Index drops below its ascending support level, the AUD/CAD is anticipated to correct into its support zone. Given the developing fundamental scenario, enhanced by dominant technical conditions, more downside is questionable. The 0.80000 provides a significant psychological support level, further reducing downside risk. Forex traders are advised to consider any sell-off from current levels as an excellent buying opportunity.

AUD/CAD Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 0.82700

Take Profit @ 0.81200

Stop Loss @ 0.83400

Downside Potential: 150 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 2.14