Australian economic data showed a further contraction in consumer as well as business confidence. It sufficed to prompt a minor profit-taking sell-off in the AUD/CAD following a massive advance yesterday, fueled by the worst collapse in oil prices in almost three decades. Canada’s exposure to the oil market crushed its currency as its economy is dealing with disruptions from rail strikes and a strained budget amid wasteful spending. Covid-19 remains a critical concern, but China, the epicenter of the outbreak, is reporting significant improvements. It provides a catalyst for the Australian Dollar, the primary Chinese Yuan proxy currency.

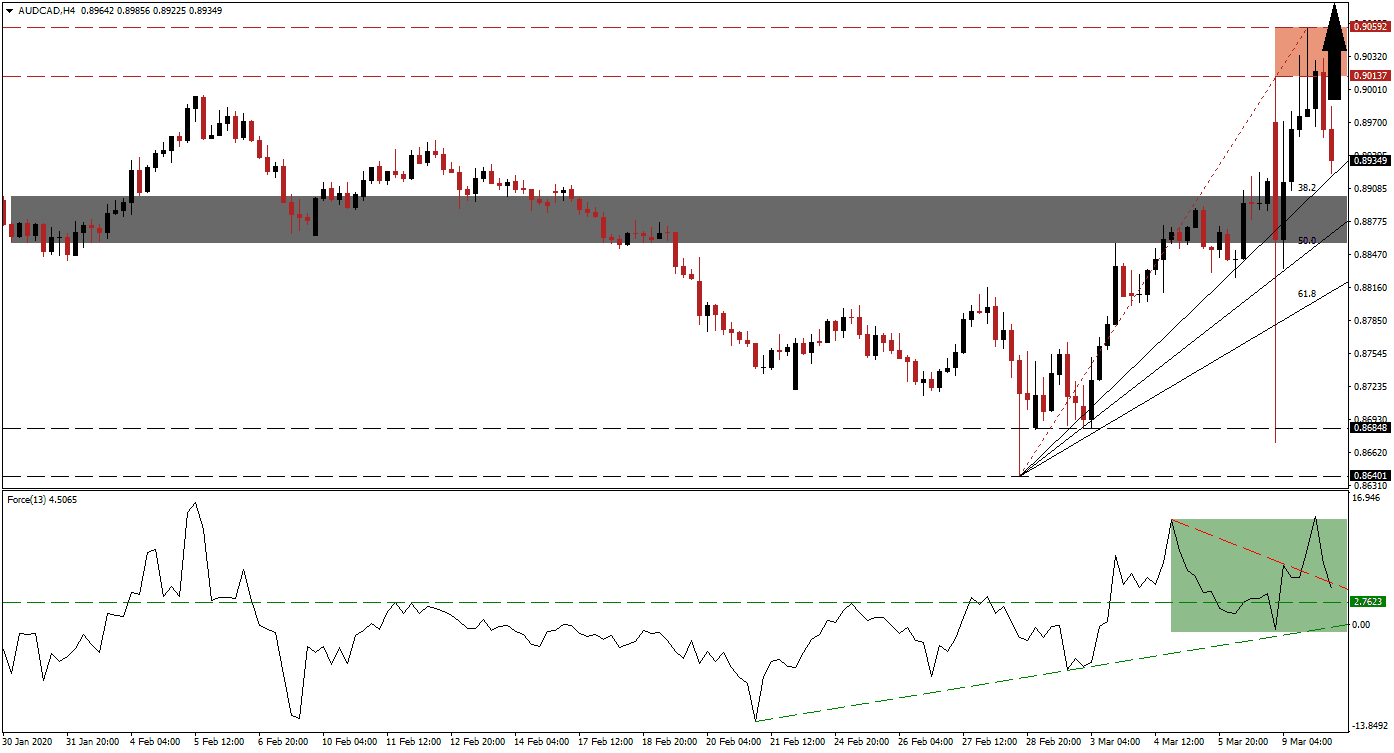

The Force Index, a next-generation technical indicator, confirmed the fresh 2020 high in this currency pair with a new peak of its own. It has now retreated below its descending resistance level, which acted as temporary support, as marked by the green rectangle. Bulls remain in charge of the AUD/CAD with the Force Index above its horizontal support level in positive territory. Adding bullish pressures is the ascending support level, and this technical indicator is expected to bounce off of its horizontal support level, leading to more gains in price action. You can learn more about the Force Index here.

Volatility in commodity currencies, like the Australian and Canadian Dollars, is anticipated to remain elevated. Markets are now awaiting significant stimulus measures by central banks and governments, especially out of the US. The Australian economy is positioned to bridge economic uncertainty more effectively than Canada, adding an extra fundamental boost to the AUD/CAD. Price action is currently testing the ascending 38.2 Fibonacci Retracement Fan Support Level. A drop into the 50.0 Fibonacci Retracement Fan Resistance Level is possible, which is passing through the short-term support zone located between 0.88577 and 0.89012, as marked by the grey rectangle.

With bullish momentum elevated even after the breakdown in price action below its resistance zone located between 0.90137 and 0.90592, as marked by the red rectangle, a renewed push higher is favored. Recession fears for the global economy are on the rise. Australia may face its first one since 1991, but Canada’s weak fiscal position creates a bullish bias in the AUD/CAD on the back of a firm second-half outlook. The next resistance zone is located between 0.92011 and 0.92466 from where a breakout will require a new catalyst.

AUD/CAD Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 0.89250

- Take Profit @ 0.92250

- Stop Loss @ 0.88500

- Upside Potential: 300 pips

- Downside Risk: 75 pips

- Risk/Reward Ratio: 4.00

In case the Force Index corrects below its ascending support level, the AUD/CAD is likely to extend its breakdown. Given the dominant fundamental outlook for this currency pair, the downside potential remains limited to its long-term support zone located between 0.86401 and 0.86848. Forex traders are recommended to consider and push to the downside as an excellent buying opportunity.

AUD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 0.88000

- Take Profit @ 0.86850

- Stop Loss @ 0.88500

- Downside Potential: 115 pips

- Upside Risk: 50 pips

- Risk/Reward Ratio: 2.30