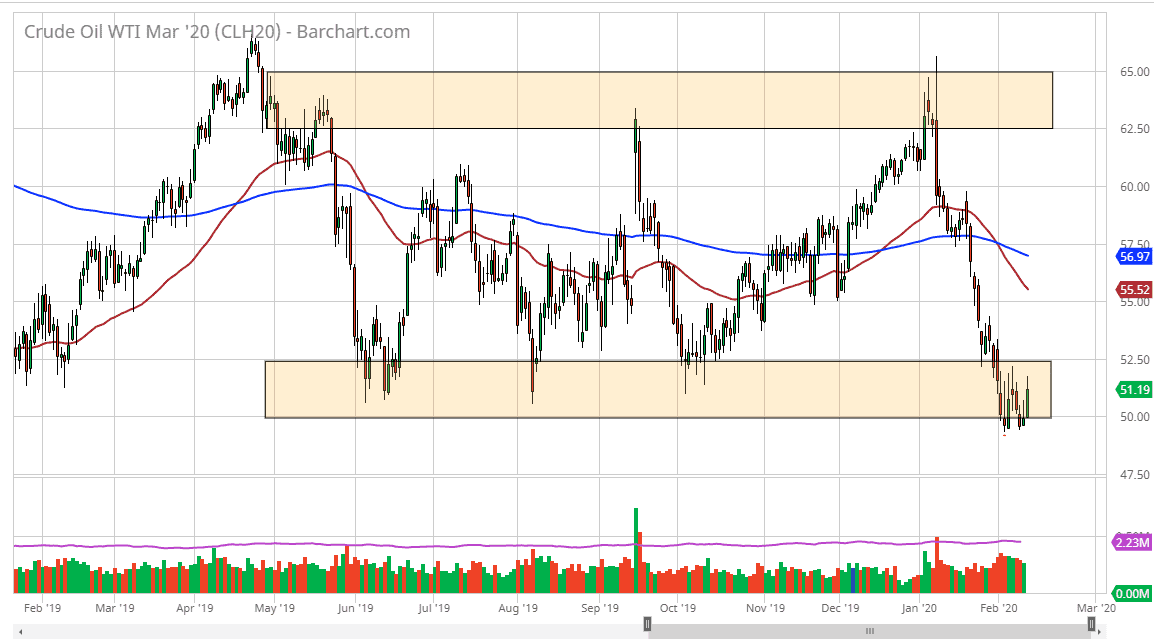

The West Texas Intermediate Crude Oil market has rallied significantly during the trading session on Wednesday, as we continue to see a lot of noise in general. The $50 level attract a lot of attention, and therefore it seems as if larger traders are stepping in and trying to support this area. Quite frankly, if we make a fresh, new low then the market could very well drop down to the $47.50 low, and then perhaps even the $45 level. That would of course be a very negative turn of events, and would more than likely see a flash of panic selling. At this point though, it looks as if the market is trying to stay within the consolidation area that is defined by $50 on the bottom and $65 on the top. If the market does in fact turn around a break above the $52.50 level, then I think the buyers come in and pick it up, trying to send this market back towards the middle of the range. Granted, if you were to take that trade, you will need to be very patient as the move won’t necessarily be quick. After all, the market has just been decimated so most people will be a bit hesitant to get involved. What you will more than likely need to see is a bit of short covering.

If the US dollar continues to lose a little bit of value like it has against some currencies, it could help crude oil as well, but I think at this point it’s very unlikely to count on that hell. We need to see signs of Chinese economic strength coming back after the coronavirus outbreak, which is one of the biggest drivers of crude oil to the downside recently. The candlestick is relatively encouraging for the day on Wednesday though, so one would have to think there are some value hunters down here, as the reaction to the coronavirus may have been a bit overdone. All things being equal, a break above the $52.50 level should send a lot of short covering into the market and perhaps even a lot of added buying.