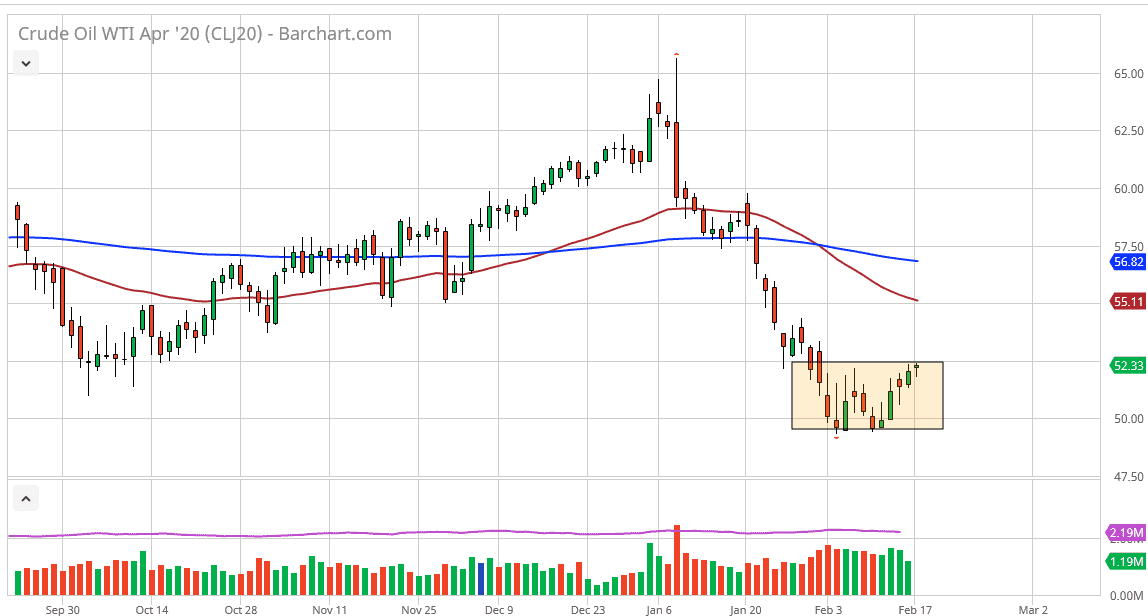

The West Texas Intermediate Crude Oil market initially pulled back a bit during the trading session on Monday, but then turned around to show signs of strength. By doing so, it looks as if the market is trying to break above the $52.50 level, an area that should offer plenty of resistance due to the fact that it is the top of a bit of consolidation or perhaps even a basing pattern. That being said, the market would have had a very thin volume during the trading session on Monday as it was Presidents’ Day in the United States, and therefore this would have been partial Globex trading more than anything else. However, the move started before the session, so one has to look at it as a simple continuation of what was already going on.

If the market can break above the $52.50 level, at that point I think we will continue to try to chew to the upside, but it won’t necessarily be easy to accomplish, as the market will go looking towards the $55 level above as that is a large, round, psychologically significant figure. The 50 day EMA is sitting right there, but we are a long way from there so it’s going to take some time to get there. Ultimately, this is a market that is trading on fears coming out of China, which are starting to abate a bit.

The recent selloff in the market was due mainly to China dropping 20% of its demands for supply. In a market that is already oversupplied, that of course is going to continue to be a major issue. All things being equal, this is a market that is oversold, and I think that some type of short-term rally is quite likely. I also think that it makes quite a bit of sense that the $50 level has offered support as it is a large, round, psychologically significant figure. There will be a lot of attention paid to that level, and the combination of all of these things tells me that we are more likely to go higher than lower. Having said that, if we made a fresh, new low then crude oil could drop to the $47.50 level, possibly the $45 level after that. Even if we do pull back from here, there should be plenty of support underneath anyway, so I don’t think that’s likely to happen anytime soon.