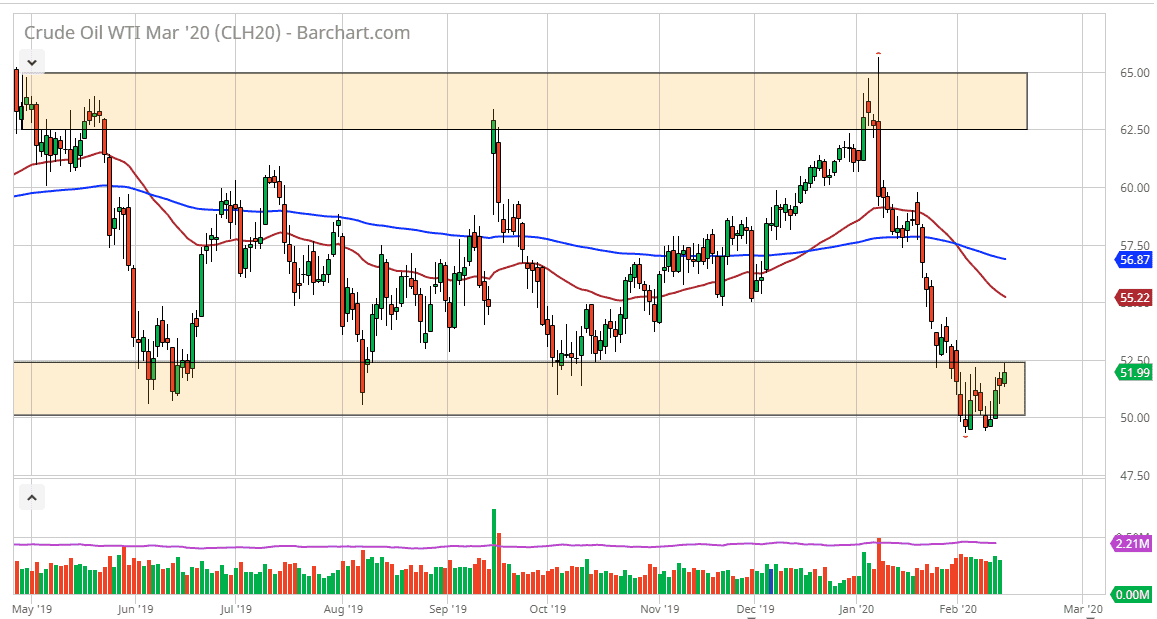

The West Texas Intermediate Crude Oil market has rallied during the day on Friday to test the $52.50 level, an area that I think is crucial. If we can break above that area, then a lot of short sellers will suddenly find themselves in trouble. There is a lot of noise between there and the $54 level, so I don’t necessarily think that it is going to be an explosive move to the upside but it certainly is a market that is technically oversold so we could get a bit of a short covering rally, nonetheless.

Furthermore, keep an eye on the headlines coming out of China because the oil market has sold off in basically has priced in Armageddon when it comes to demand coming out of the mainland. If the coronavirus gets contained somewhat, oil will be thought of as cheap, and it should bounce at least a few dollars. Ultimately, the $54 level should be rather resistive, but breaking above there will probably accelerate the move higher. That being said, there does come a point where the Chinese getting back to work will drive oil higher and should make it an explosive market. The GDP contraction due to the coronavirus will be somewhat damaging, but at the end of the day when China gets back to work full force, it’s going to be a sudden jolt to the marketplace.

To the downside, I believe that the $49 level is now offering a very hard floor the market, so breaking down to a fresh new low would be extraordinarily negative and could open up the move to the $47.50 level, possibly even the $45 level. The market is most certainly negative as of the last couple of weeks, but we are still basically in the consolidation area from the longer-term standpoint. Note that most of the selling has been due to the coronavirus situation but was preceded by the idea of the Iranians not reacting to the killing of Soleimani. Having said that, the market was at roughly $60 before all of this started. To imagine a bounce back to the $55 level if the coronavirus gets to be somewhat under control really is in a stretch of the imagination at all. Nonetheless, you will need to be very cautious about your positioning, but if you are trying to sell crude oil now, you are most certainly chasing the trade.