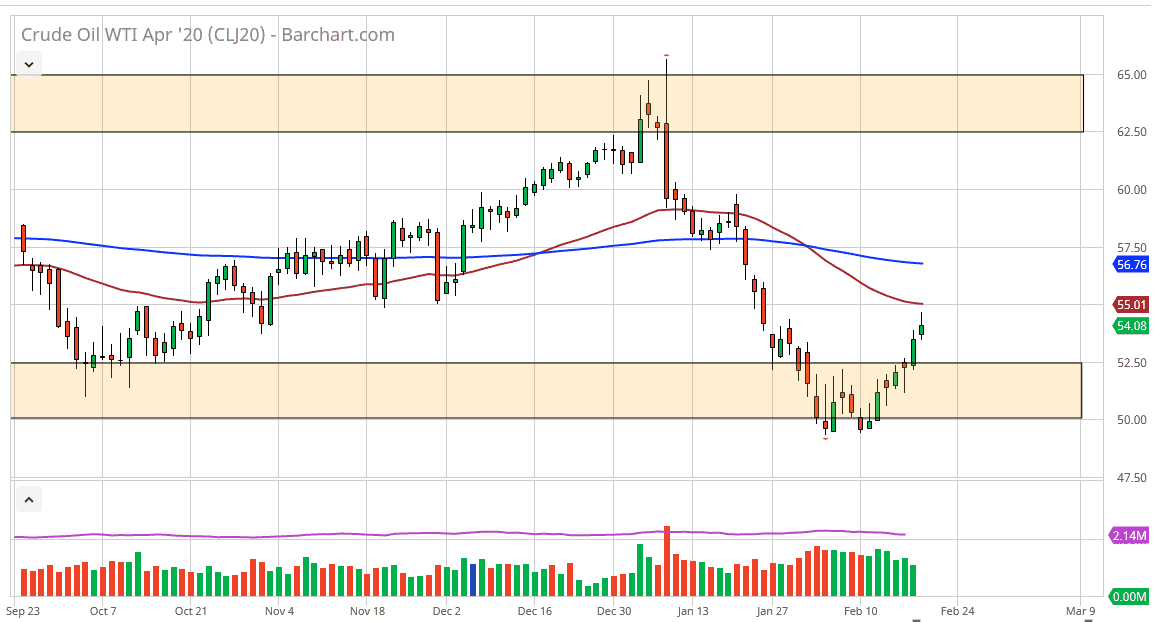

The West Texas Intermediate Crude Oil market has gone back and forth during the trading session, even though we had a very strong inventory figure coming out of the United States. As the market reached towards the 50 day EMA, the market then sold off to form a bit of a shooting star. The $55 level is an area that will attract a certain amount of attention, and therefore it’s likely that the market will reach back to lower levels heading into the weekend. After all, the lesson traders want to do is carry a lot of risk over the weekend only to see a massive gap against their position. The daily candlestick forming a shooting star is of course a very negative sign, and therefore break down below the bottom of it probably sends this market down towards the $52.50 level which is previous resistance.

Don’t be wrong, I don’t necessarily think that the oil markets are going to collapse from here, just that they are probably a little bit stretched going into the weekend. However, the market does break above the $55 level, it’s likely that it goes looking towards the 200 day EMA above. The $57.50 level above would also be an area that I would be paying attention to, as it is the middle of the larger consolidation area. The market has bounced significantly from the absolute bottom, so it shows that that is an area that is massive support from a longer-term standpoint.

This is a market that should continue to go back and forth but I think that this moves basically on the coronavirus situation as China was going to drop a significant amount of demand for petroleum, with a lot of figures talking about a total of a 20% decline from the Chinese. This would be a major issue for markets, as we are already oversupplied. That being the case, this is a market that is going to continue to struggle so don’t be surprised at all if this is a bit of choppiness trying to form some type of base at this extreme low. If we did make a fresh, new low, this market would probably unravel quite rapidly. I think taking a look at this market after the Friday close will be crucial, so a new position can probably wait until Monday.