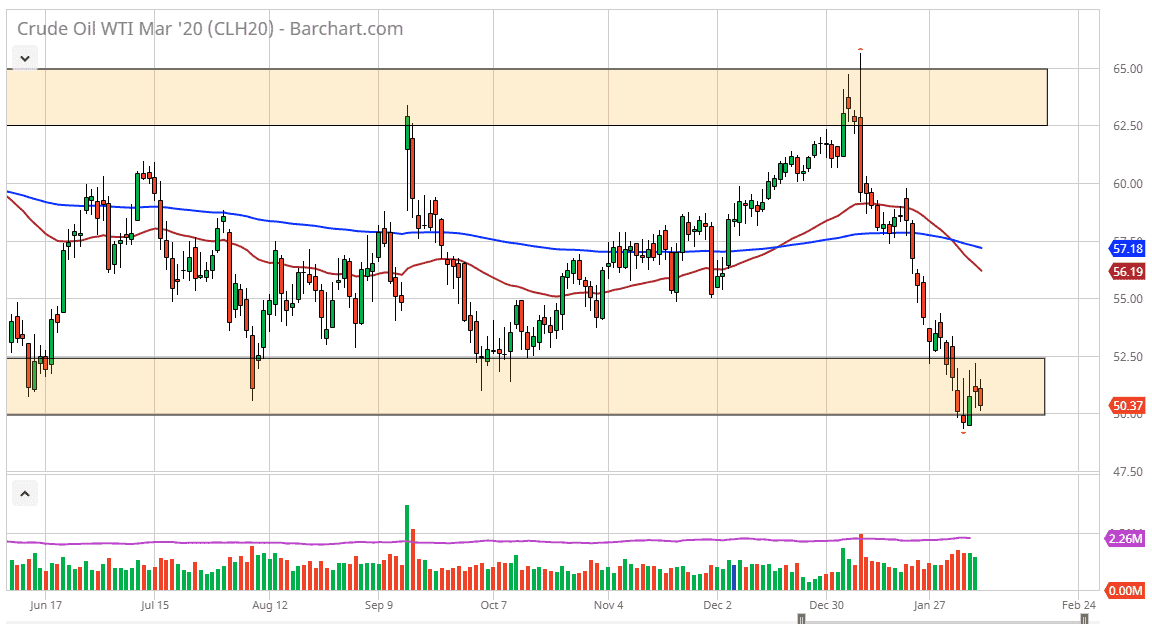

The crude oil markets have taken it on the chin over the last several weeks, falling from $65 after the killing of Gen. Soleimani in Iraq. Since then, the market has dropped $15 which is a huge move in just a few weeks. That being said, there are a multitude of reasons why the markets continue to sell crude oil, not the least of which would be the issues in China. Chinese demand is expected to be down at least 20% if not more, and that of course is going to have an influence on pricing crude oil as China is the largest consumer of the commodity in the world.

If the market was to turn around though, the $52.50 level could be a significant barrier. If the market breaks above there, then it’s possible that we could go looking towards the $55 level. Somewhere near that area you should see the 50 day EMA coming into play and causing resistance. However, this would need some type of news such as OPEC and Russia decided to further production cuts in order to happen. Even then, I think it would be a short-term move based upon what we have seen as of late.

To the downside, breaking below the lows on Wednesday would open up the door down to the $47.50 level initially, followed quickly by the $45 level which is a major level on the longer-term charts. Crude oil is going to continue to suffer at the hands of the Chinese situation involving the coronavirus, as it has brought down demand drastically. Furthermore, the United States has been producing a ton of oil, and therefore the markets are oversupplied anyway. With that, the market is more than likely going to sell rallies and possibly even eventually break through the support. Crude oil is on its back foot and I suspect it probably will be going forward until the fundamental change, and the most important fundamental right now will be the health of the Chinese economy. It has clearly taken it on the chin due to the coronavirus, as entire cities are shut down in order to fight the infection. As long as that’s the case, demand for crude oil will be much less than typical. Overall, this is a market that looks as if it is trying to break down through the larger consolidation area given enough time. The question is whether or not it can do it now, or if it needs to rally and then slam back down in order to do it.