The West Texas Intermediate Crude Oil market fell rather hard after initially trying to climb on Monday. There were reports that the Saudi Arabian government was considering production cuts, which of course could drive up the value of crude oil, but at the end of the day people are focusing more on a Bloomberg report that Chinese demand for crude oil could fall as much is 20% due to the coronavirus shutting down so many factories.

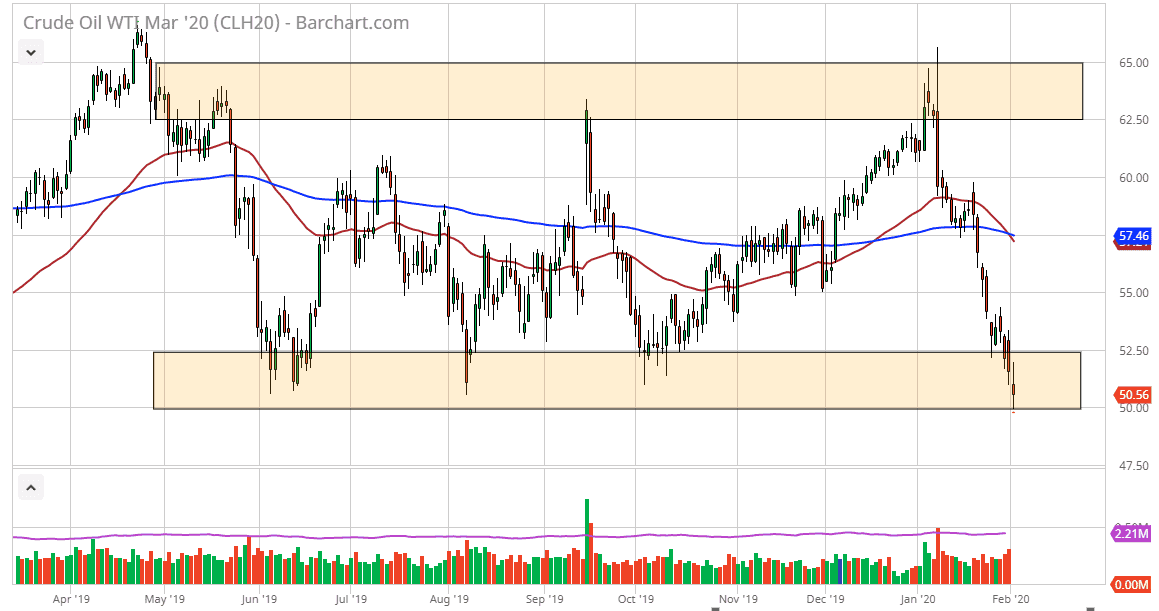

Furthermore, there are concerns about global growth in this environment and that of course will have a direct influence on what happens with crude oil markets as well. With that in mind, it makes quite a bit of sense that the crude oil markets get battered. The market is currently sitting right in the midst of a major support zone, that extends down to the $50.00 level. It’s at this level that the market will then try to make a decision as to whether or not it is going to bounce and save itself. If it can retake the $52.50 level, then it’s likely that the market could recover towards the $55 level, possibly even the $57.50 level. However, that looks less likely with the price action that we have seen during the trading session on Monday.

The alternate scenario is a breakdown below the $50 level, opening up the door down to the $47.50 level. After that, the next major support level is the $45 level, as it has been important in the past. The market has just formed the so-called “death cross” when the 50 day EMA crosses below the 200 day EMA. That being said, I would not read too much into it as the market has been beaten down so hard lately that it’s difficult to imagine a scenario where that holds like most longer-term technicians trying to use it for. I anticipate that the easiest trade is probably going to be fading the crude oil market every time it rallies on short-term chart, but really at this point I think that it’s likely we see a bit of back and forth with a slightly downward proclivity than anything else. I have no interest in buying crude oil, at least not until we are above the $52.50 level, which is something that would take quite a bit of effort down at these low prices. Clearly, the market is very skittish at this point.