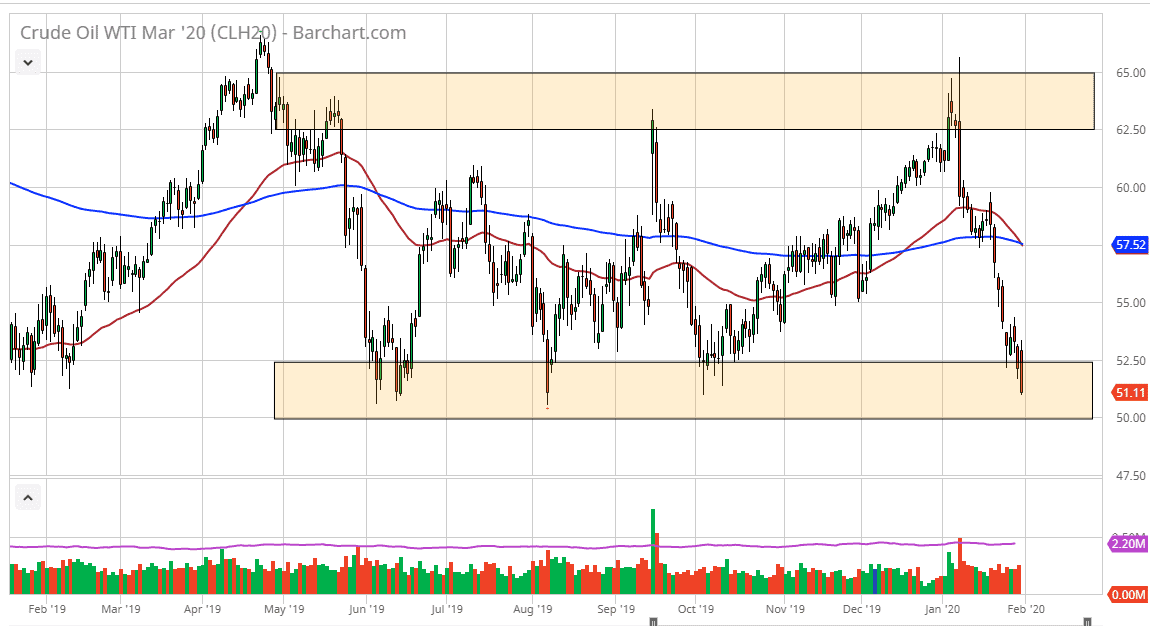

The West Texas Intermediate Crude Oil market has broken down significantly during the trading session on Friday, slicing through the $52.50 level again, despite the fact that the market deed gapped higher to kick off the Friday session. Ultimately, the market has to deal with the idea that the coronavirus and China will bring down demand and will the world’s largest consumer of petroleum. However, the reality is that the Americans are supplying more crude oil than ever, so that is another reason to think that the market is going to continue to struggle.

Looking at this chart, we are obviously at the bottom of the larger consolidation area, so having said that it’s obvious that there will be a certain amount of value hunters in this area. However, after the Friday candlestick printing so negatively, you are better off waiting for some type of bounce in order to get involved. That being said, the market was to break down below the $50 level, then it’s likely that the market breaks down significantly, perhaps down to the $47.50 level and then eventually the $45 level.

If we do get some type of bounce, it’s not until we get a daily close above the $54 level that I would be comfortable considering buying this market. Simply put, there are a lot of concerns about demand coming out of China, and the global economy on the hold. Furthermore, the supply is extraordinarily loose, as crude oil is overly abundant. With that in mind, the supply/demand ratio simply isn’t working in the favor of buyers. However, some type of geopolitical situation coming out of the Middle East could change things rather quickly, like we have seen as of late. That being said, this is a market that simply seems to be falling apart and although we have crashed into this area, I don’t expect it to be easy to simply break down unless of course we get bigger negativity coming out of China. This of course is a possible scenario, so on a daily close below the $50 level I would then initiate a short position. Selling at this level is more than likely going to be dangerous until we break down below that psychologically important $50 level so I’m going to be very patient as to putting any money to work, because the last thing I want to do is chase the trade.