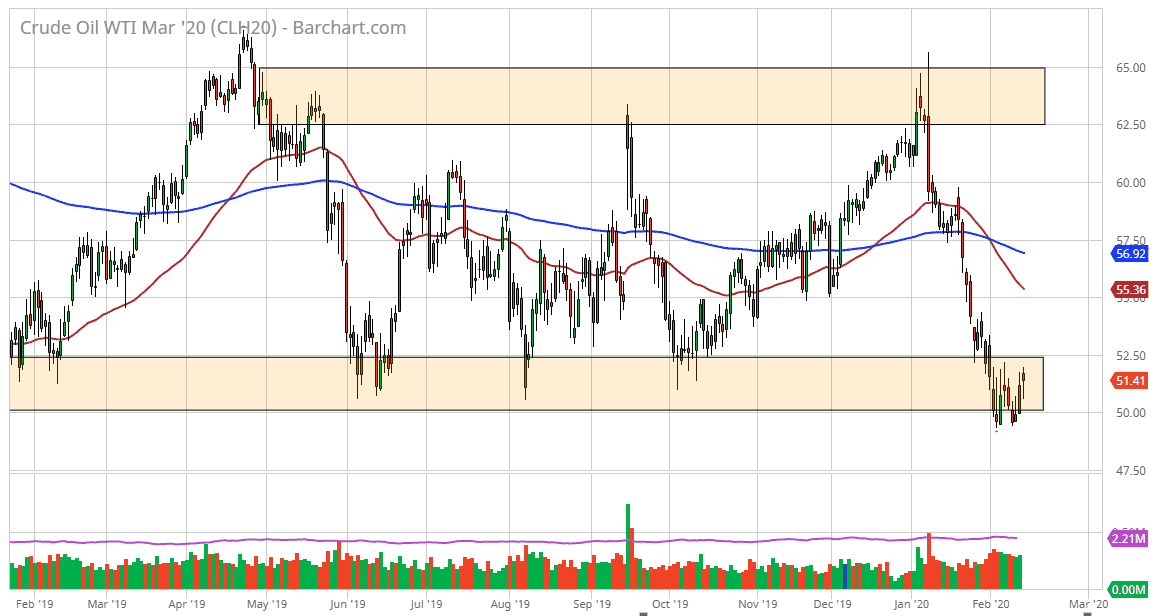

The West Texas Intermediate Crude Oil market has pulled back a bit during the trading session on Thursday but has also found buyers underneath to show signs of life. The crude oil markets are at a very low level, and as a result it makes sense that there are a certain amount of value hunters out there. Keep in mind that the $50 level of course is a psychologically important level, and it is also the bottom of an overall range that the market has been trading in between that level and the $65 level to the upside.

The candlestick for the day suggests that it is trying to form some type of a hammer, so that’s bullish as well, and I believe that a move above the $52.50 level should send crude oil higher. The market looks very likely to continue to find buyers on dips, especially as people are believing now that the Chinese are starting to peak as far as the amount of coronavirus infections. When you look at the chart, you can see a direct correlation between the rise of the coronavirus outbreak and the fall of crude oil. In other words, it is far too oversold at this point if you take the virus out of the equation. Remember, markets are forward-looking, so it looks towards what is likely to happen down the road.

With the trade war cooling-off a bit and the coronavirus perhaps getting under control, oil demand should start to pick up as China gets back to work. If that’s going to be the case then it’s very likely that the market goes looking towards the $52.50 level, and then breaks higher towards the $55 level. However, if the market was to turn around a break down below the recent lows, then it’s likely that the market breaks down to the $47.50 level and then eventually the $45 level. Ultimately, this is a market that is very choppy and at the very least oversold, so keep in mind that it’s likely that we see a bounce more than anything else. With that being said, I think there’s more value to the upside but there is no guarantee in trading, but the one thing I can promise is that there is more room to the upside than down at the moment. However, if the virus situation gets under control, that’s going to be difficult for oil.