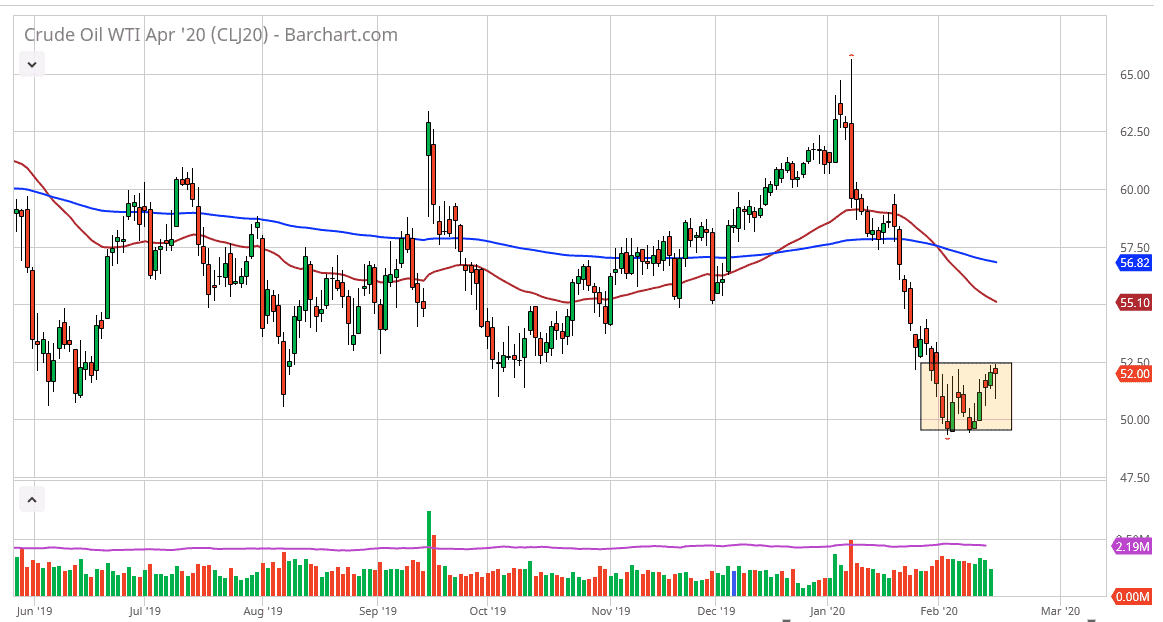

The West Texas Intermediate Crude Oil market has fallen rather significantly during the trading session on Tuesday, only to find buyers again. This shows resiliency in this market, and it looks as if the crude oil market is trying to break above the $52.50 level. Break above that level then opens up the door to the $54 level, and then towards the $55 level. It should be noted that the 50 day EMA is currently hanging around that area, so would not be surprising at all to see some resistance in that area.

To the downside, I believe that there is plenty of support underneath extending all the way down to the $50 level, so I’m looking at short-term pullbacks as potential buying opportunity as the market has shown itself to be so resilient in this area. If we can break above the 50 day EMA, then it’s likely that the market goes looking towards the 200 day EMA. This is a market that has reacted to the Chinese situation and the lack of demand coming out of that country. However, the question now is whether or not there has been enough destruction to pricing in order to stabilize the market.

The market breaking down below the $49 level would be extraordinarily negative, but right now it looks as if we are in fact finding enough buyers underneath on dips to lift this market and the massive selloff that we have seen needs to be recovered. This bounce gives us an opportunity to take advantage of bit of value, as the coronavirus seems to be slowing down and therefore the idea is that traders are trying to get ahead of the increase in demand that will almost certainly be coming. The market will eventually find its rhythm, but right now we are at the bottom of the larger consolidation area, so it does make quite a bit of sense that the market rallies from here. Over the longer term, value hunters will come in and take advantage of this. The market continues to move on global growth fears and of course the coronavirus, so pay attention to the headlines but I do think that the market is trying to get past all of that and look forward which should continue to show a pickup in overall demand for energy. When the Chinese get back to work full-time, use is going to shoot through the roof.