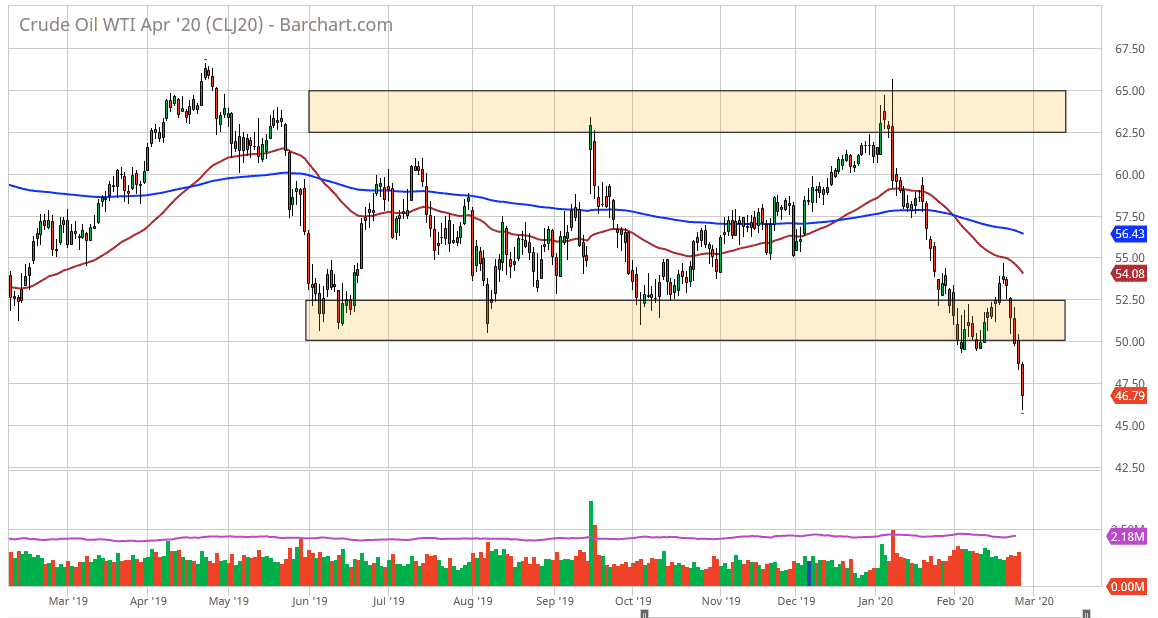

The West Texas Intermediate Crude Oil market has broken down significantly during the trading session on Thursday but has bounced from the extreme lows. The market dropped all the way down to the $46 level, but then bounced late in the day to form a hammer like candle. At this point in time, the market looks very broken and it seems as if the trend is most certainly to the downside even further. At this point, the market bouncing does make some sense because it is overextended to the downside, but I think that the $50 level above is a significant resistance barrier as it was once a significant support level.

There is a lot of noise just above there, so I think it would take something rather spectacular to break through that area. If we did, it would obviously be a huge change in sentiment, but I don’t think that happens in the near term. Any rally at this point would have to be looked at with suspicion as clearly sellers are in control. Don’t be wrong, I do think that we bounce a bit because we have gotten so oversold, but one would have to say that there are still going to be a lot of concerns when it comes to demand in the markets. Furthermore, the oversupply of crude oil is still a major issue as well. We have more crude oil out there than we know what to do with.

The 50 day EMA is starting to race towards the $52.50 level, an area that marks the top of the overall support range. The support range should be rather difficult to break so I think it keeps a bit of a lid on the market. Ultimately, the market break down has been rather impressive. If we were to break down below the bottom of the candlestick for the trading session, the market then goes looking towards the $45 level, and then eventually the $40 level. There is nothing good about this chart, so I would not be looking to find any value here. As long as computers continue to sell off on every headline, crude oil will continue to be on its back foot. However, if we can get some type of longer-term reversal signal, then of course you have to entertain the possibility of buying. We are nowhere near that right now.