The West Texas Intermediate Crude Oil market initially rallied during the trading session on Tuesday but gave back the gains as it rolled over to show signs of exhaustion again. There was an initial attempt to rally based upon the fact that the Saudi Arabian oil minister had a conversation with the Russian oil Mr. about doing emergency cuts. The market is focusing more on China and the lack of demand coming out of that country. With the Chinese demand for petroleum dropping at least 20%, that continues to weigh upon what has already been a very soft market to begin with.

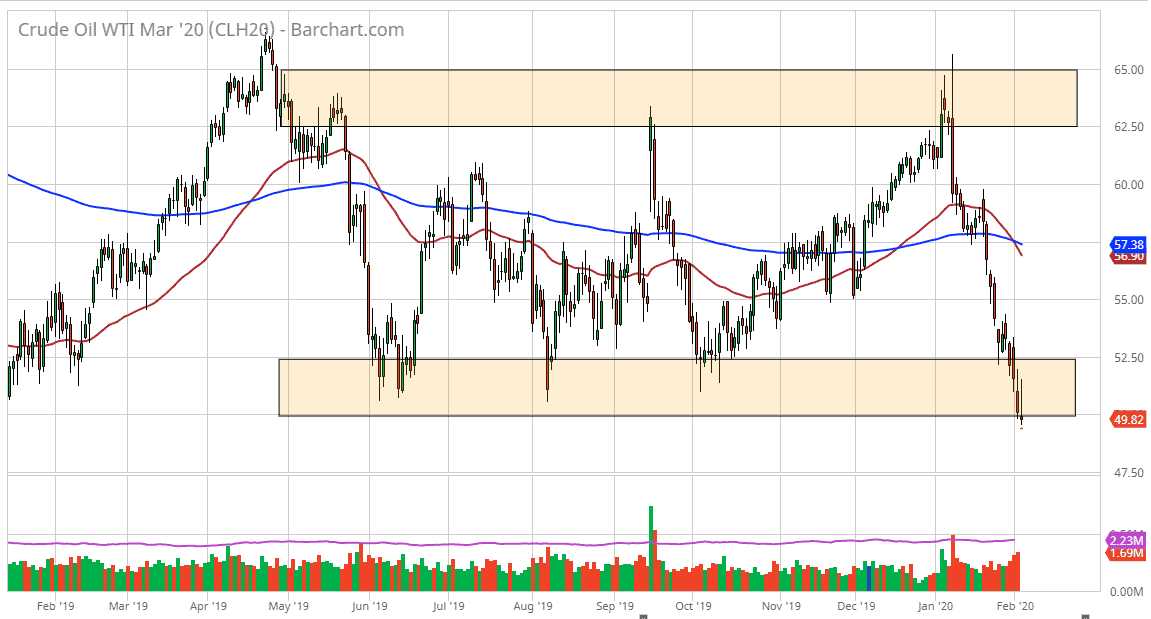

While the general vicinity that the market is and right now look to be a value area that buyers would continue to come in and try to contain the market within the consolidation area that I have marked on the chart, it’s obvious that we are in fact going to lose this battle and see this market more than likely go lower. A breakdown below the bottom of the candlestick for the trading session on Tuesday would be a continuation of the downtrend down towards the $47.50 low, and then eventually the $45 level. However, breaking above the top of the candlestick constitutes an “inverted hammer”, which would be a very bullish sign as it would not only break above action from the last 24 hours, but then it would solidify the idea of the $50 level offering support. At this point, the next daily candlestick should give us quite a few clues as to where we’re going. We are oversold, and there’s no real way around that. However, markets can remain irrational much longer than you can remain solvent, so the saying goes.

That being said, it is difficult to imagine a scenario where the oil markets take off significantly without some type of Chinese recovery, which of course is going to take some time due to the fact that the coronavirus is still finding new victims. With that, it’s more than likely going to be a scenario where rallies are sold into, but we do have technical levels that we should be watching. Furthermore, it should also be noted that oil was already starting to fall, mainly based upon the fact that the Americans and Iranians didn’t escalate tensions. While that seems like an entire lifetime ago, it was just last month.