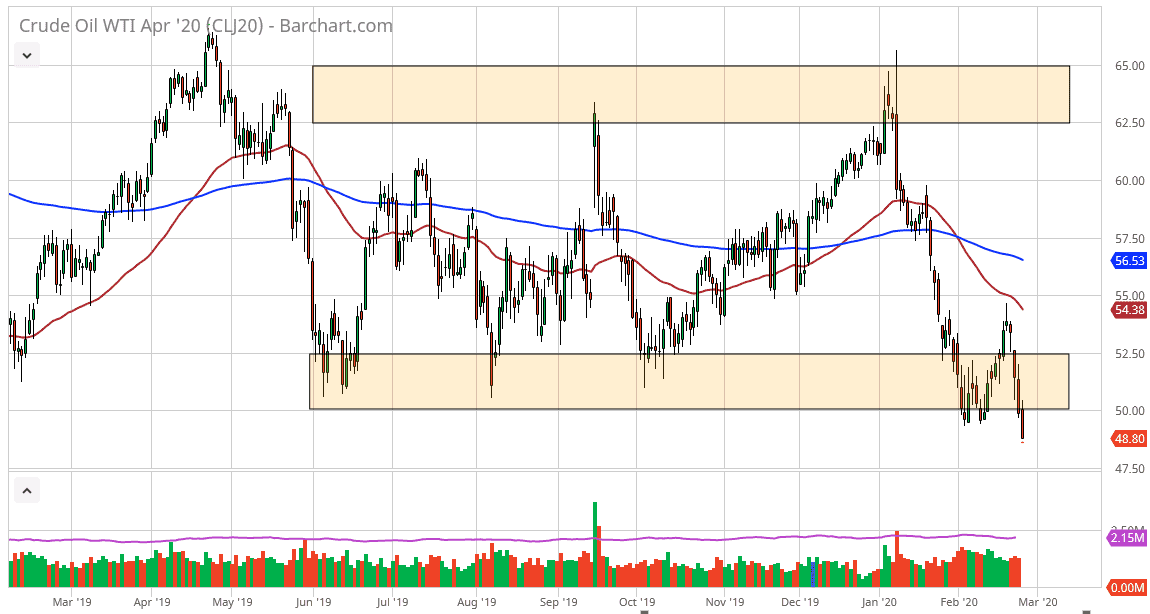

The West Texas Intermediate Crude Oil market broke down rather significantly during the trading session on Wednesday, finally slicing through the $49 level and crushing all hope of support. The coronavirus continues to be a major driver of fear in the world, and as people continue to worry about the industrial production of Asia, and thereby the need for the crude oil itself. As demand continues to drop and people worry about global growth, it makes sense that crude oil takes it on the chin. Further exacerbating the issue is the fact that the US dollar has strengthened, so therefore it puts wait upon the oil market as well.

Now that we are below the $50 level and looking very likely to continue going lower based upon the close, it’s likely that rallies will be sold into on short-term charts, and it’s very likely that the $47.50 level will be the next target but I believe that is a minor support level at the end of the day. Ultimately, the market could go down to the $45 level after that, where it has much more support based upon a historical look back.

Rallies at this point should continue to see resistance between the $50 level and the $52.50 level above there. That is a thick area of noise, so I think it’s very likely that the sellers will be sitting there. The 50 day EMA is starting to break towards the $52.50 level, so beyond that it’s also resistance. This is a market that has certainly made its statement during the day on Wednesday, even though the inventory number came out better than anticipated. All things being equal, this is a market that looks like it’s ready to go much lower and has broken through the bottom of what could be thought of as a bearish flag. If that’s the case, then it’s very likely that the market could go as low as $35, based upon the measurement. I’m not necessarily calling for that, but it is something that you need to keep in the back of your mind. Regardless, this is a market that cannot be bought at this point, and not until the coronavirus situation gets under control. As we are nowhere near that, it remains very bearish looking to say the least and therefore it’s a scenario where trying to catch a falling knife can get you hurt rather quickly.