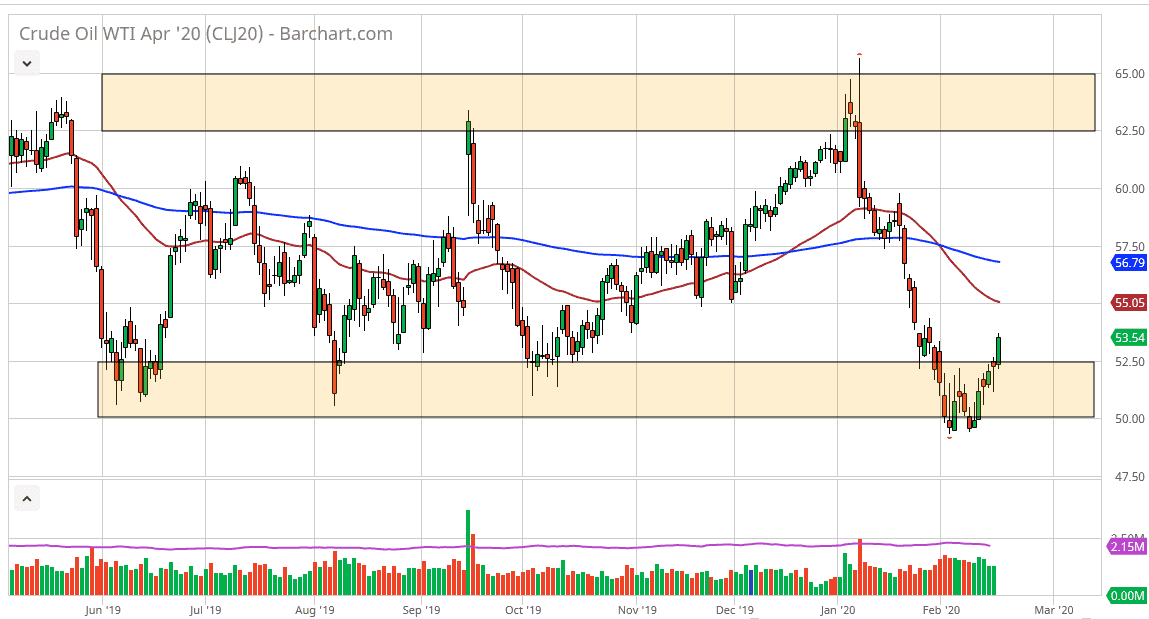

The West Texas Intermediate Crude Oil market broke out during the trading session on Wednesday, breaking above the $52.50 level, an area that I thought was very crucial. At this point, it’s likely that we are going to continue to reach towards the $54 level, and then eventually the 50 day EMA. I think at this point it’s very likely that you will continue to see buyers jump in and on pullbacks, because quite frankly this is a market that has been oversold for some time.

Beyond that, the Chinese coronavirus numbers are starting to slow down a bit, and that suggests that there should be a bit of a relief rally due to the fact that we are not only oversold, but Chinese demand should start to pick up yet again. Ultimately, I believe that the market should eventually test that 50 day EMA and possibly even sliced through it. When you look at the longer-term chart, it’s obvious that we have been bouncing around between the $50 level on the bottom on the longer-term charts, and the $65 level on the top.

Looking at the chart, it makes sense that we would go towards the middle of the overall consolidation, so therefore I think that longer term we may be looking at a move towards the $57.50 level. I believe at this point it is likely that the market will find a bit of balance, assuming that we can get that far. The Chinese demand picking up of course is going to be a major driver of the market going higher, and of course there are also murmurs about OPEC perhaps trying to come together with some type of agree bit to cut back production. If that is in fact what happens, then it’s likely that crude oil could rally significantly.

At this point, it’s not until we break down below the recent lows that I would be a seller, and quite frankly I think that the double bottom that has formed at that level shows just how supportive the overall area around $50 will be. Ultimately, pullbacks should offer buying opportunities in the short term. Given enough time, the market will more than likely try to find a reason towards the top of the overall range, but that’s a longer-term call more than anything else. I have no interest in selling crude oil at this level.