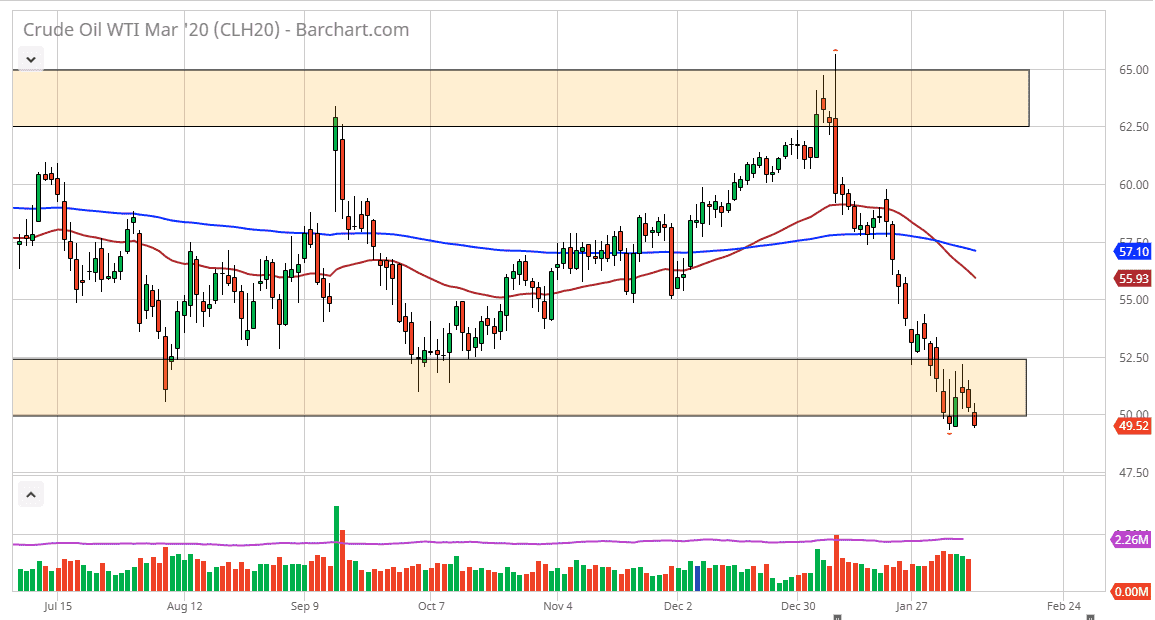

The West Texas Crude Oil market fell during the trading session on Monday to kick off the week, as we have broken below the $50 level yet again. The crude oil markets continue to suffer at the hands of lack of demand, and now course the entire situation in China.

WTI Crude Oil

The West Texas Intermediate Crude Oil market gapped lower, turned around to fill that gap, and then fell again on Monday. The market is now below the $50 level and looking to find some type of support underneath. On a break down below the lows of the Monday trading session it’s very likely that WTI will go looking towards the $47.50 level underneath which of course has a certain amount of psychological importance to it but at the end of the day I think we go even further, perhaps down to the $45 level, in congruence with the Brent Crude Oil market dropping down to the $50 level.

I see a lot of resistance above, and that makes quite a bit of sense as there are concerns about Chinese demand as the coronavirus seems to be getting worse, not better. If industry in China is going to be shut down for a while, that will put a massive dent in global demand when it comes to crude oil. Furthermore, the OPEC and Russian oil ministers did not have an agreement to further cut production over the weekend like some people had speculated, as the Russians are willing to see what type of effect coronavirus has on global markets and demand before cutting production even further.

With all of that and of course a stronger US dollar, it makes quite a bit of sense that crude oil would continue to struggle. I think at this point we are looking at a scenario where market participants continue to fade rallies, and I don’t think that this is a market that’s going to turn around very quickly. That of course would be unless there was some type of shock headline out of the Middle East which is always a wildcard in this marketplace. At this point, I think short-term rallies will probably continue to offer plenty of opportunities to sell crude oil, because quite frankly it has no fundamental drivers to make it go higher at this point in time. Short-term selling continues to be the way forward.