Gold markets rallied significantly heading into the weekend, as Friday had seen the market test the $1650 level. Furthermore, the market has closed towards the top of the range though that is obviously a bullish sign as well. Gold is being used as a safe haven currency, but keep in mind that there are a whole host of reasons to think that gold should continue to go higher.

To start with though, the US dollar has been rallying overall and that tells you just how much fear there is in the market. Typically, a strengthening US dollar works against the value of gold, so the fact that the yellow metal can rally in this type of environment is quite impressive. With that in mind, I believe that the market will eventually break much higher, especially if the US dollar starts to get a bit soft, something that we did see during the day on Friday at least.

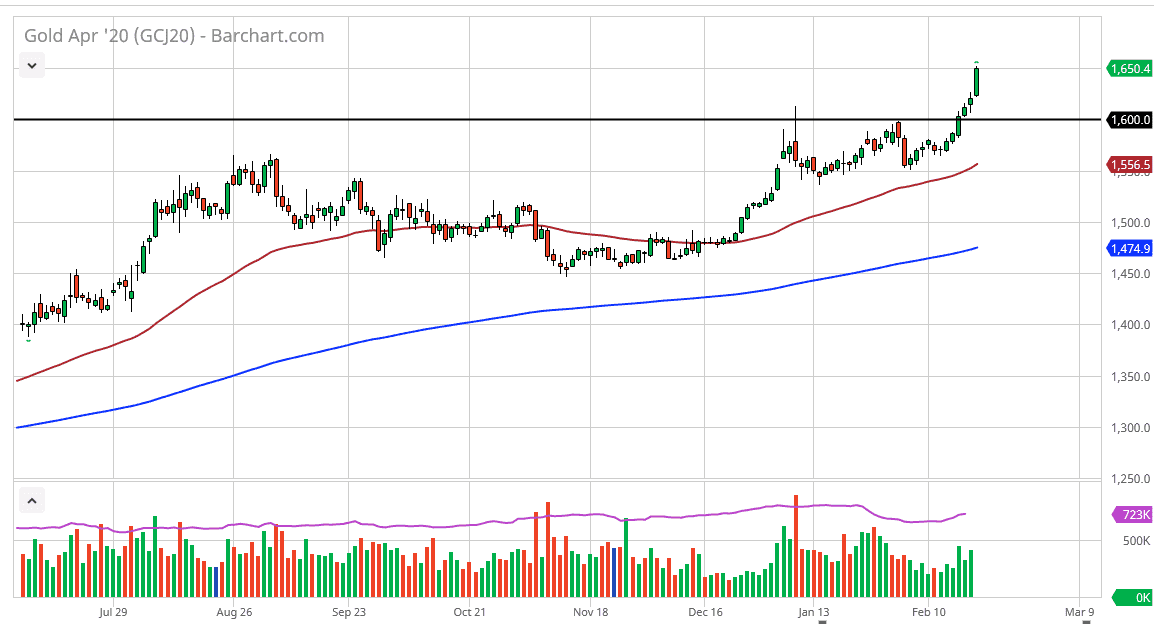

Breaking above the $1600 level has been a shot across the bow of those who would short the market, as it seems like the fear trade is still very much intact. The ascending triangle underneath should continue to cause technical traders to look for buying opportunities and I think that pullbacks towards the $1600 level will be attractive for value hunters as well. Furthermore, the central banks around the world continue with a very loose monetary policy, so that of course will attract a certain amount of inflows into the gold market also.

The trend has been higher for quite some time, and now that we have gotten done consolidating just below the $1600 level and have rallied quite rapidly to make a statement, I believe that a lot of traders out there will be looking to pick up any bits of value on pullbacks as a lot of them will have probably missed the opportunity. Furthermore, for those who were short of the market, they will be more than willing to cover their short trades if we get closer to the $1600 level. After all, gold is a somewhat thin market and therefore can make extreme moves rather quickly in times of turbulence. I also anticipate that part of the gains on Friday was probably people trying to take out a little bit of safety in their portfolio ahead of the weekend that could have quite a few negative headlines, given the right circumstances.